When you open new accounts with your banks, you’ll see a “New Accounts Available” indicator next to those institutions. You can connect them and start syncing data to Balance. There’s also a new “Reconnect” option to reinitialize which accounts you want to sync.

Updates

Product updates and improvements to Balance.

-

New Accounts Detection

Jul 03, 2025

-

Recaps

Jun 28, 2025

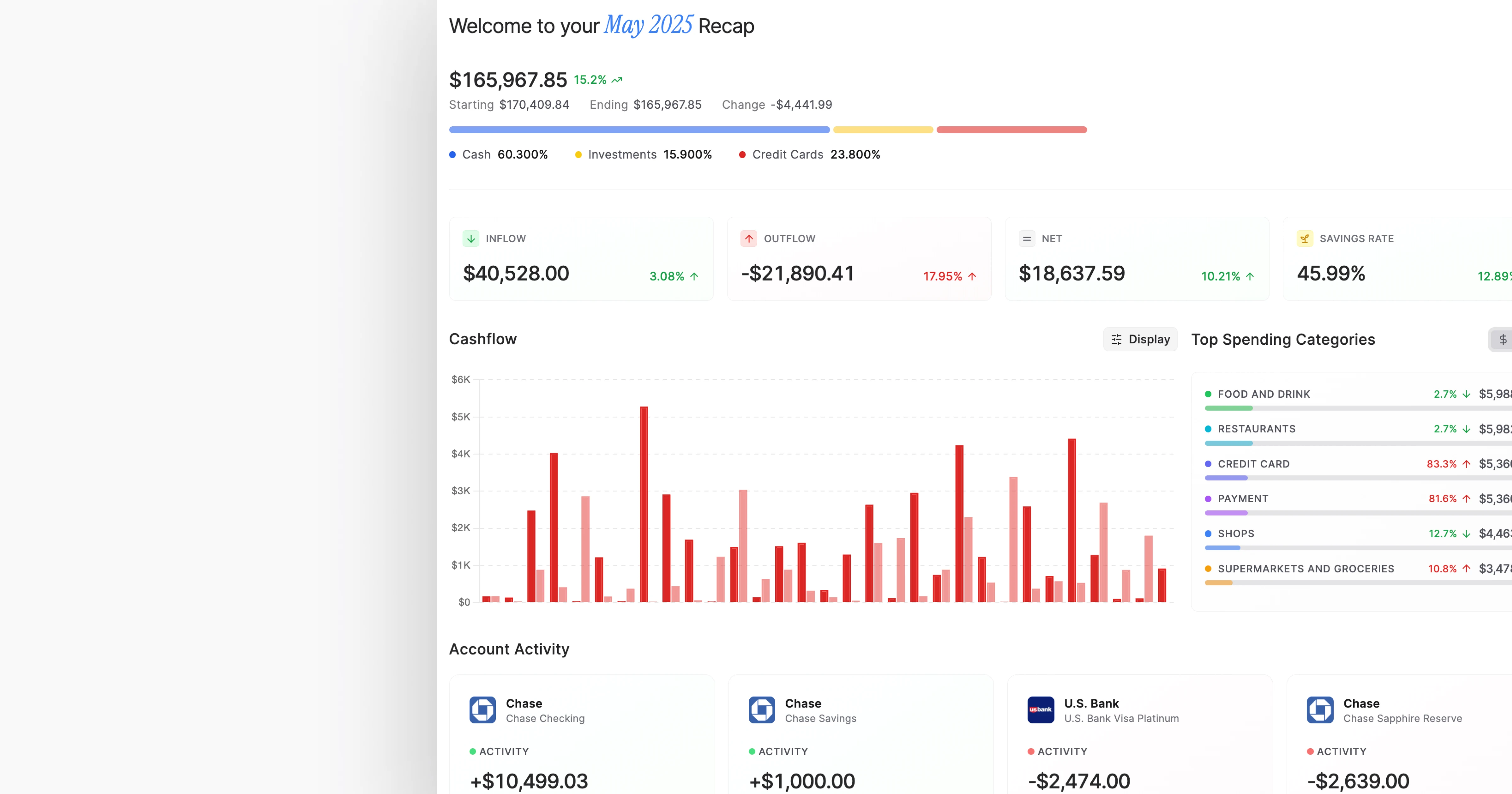

Today, I’m excited to launch Recaps — a comprehensive monthly financial summary that helps you step back and understand your financial patterns over time. While Balance’s daily insights provide tactical awareness, Recaps gives you the strategic perspective needed to make informed financial decisions.

Monthly Financial Overview

Get a complete picture of your financial health with automatically generated monthly summaries. Each recap includes your net worth progression, spending breakdowns, account activity, and transaction highlights — all in one comprehensive view.

Interactive Cashflow Analysis

Visualize your income and expenses with customizable charts. Switch between line and bar graphs, toggle between inflow and outflow views, and compare current month performance against previous periods. Choose between daily transactions or cumulative trends to see your money movement exactly how you want.

Smart Category Insights

Understand your spending patterns with visual category breakdowns and trend analysis. Each category displays month-over-month changes with toggles to view percentage or dollar amounts, plus click-through access to detailed transaction histories for deeper insights.

Account Activity Summary

Track money movement in all your accounts. See which accounts had the most activity during the month, with starting and ending balances plus change percentages. Perfect for tracking investment performance and understanding how money flows through your accounts.

Transaction Highlights

Review your largest transactions to identify the major financial events that shaped your month. Spot outliers and unexpected expenses at a quick glance without digging through your entire transaction history.

Transfer Summaries

See account transfers and credit card payments in one unified view. Compare changes from previous months to understand credit card usage or saving patterns.

Recaps are available for the past 6 months, with new monthly summaries generated automatically going forward.

Available to Plus subscribers.

-

Summer Release '25

Jun 07, 2025

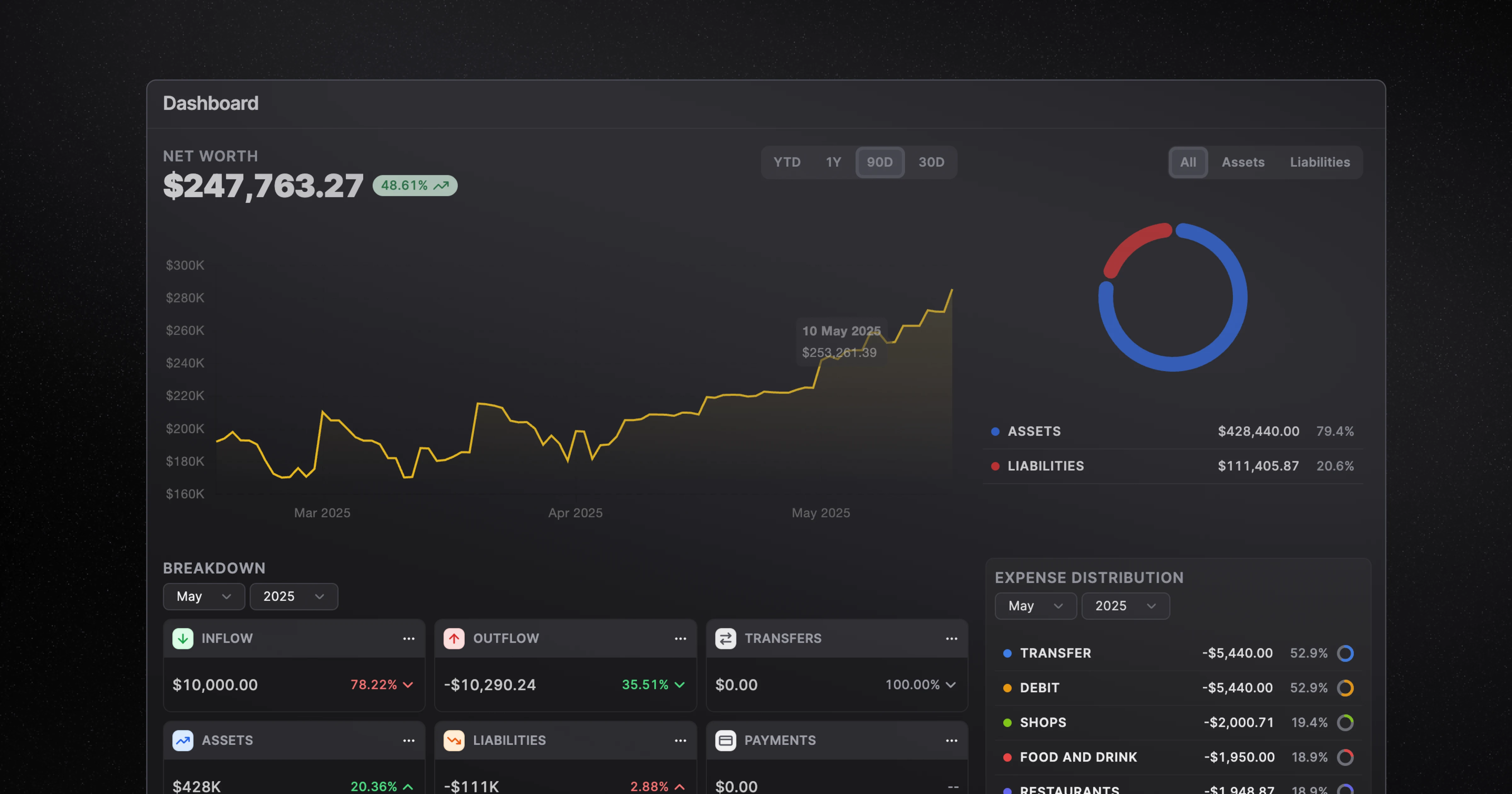

Introducing Balance Summer ‘25 launch, a release packed with AI-powered features and enhanced analytics to help you understand and manage your finances. Query your financial data with natural language, get smarter transaction categorization, and visualize your financial health with new charts and breakdowns.

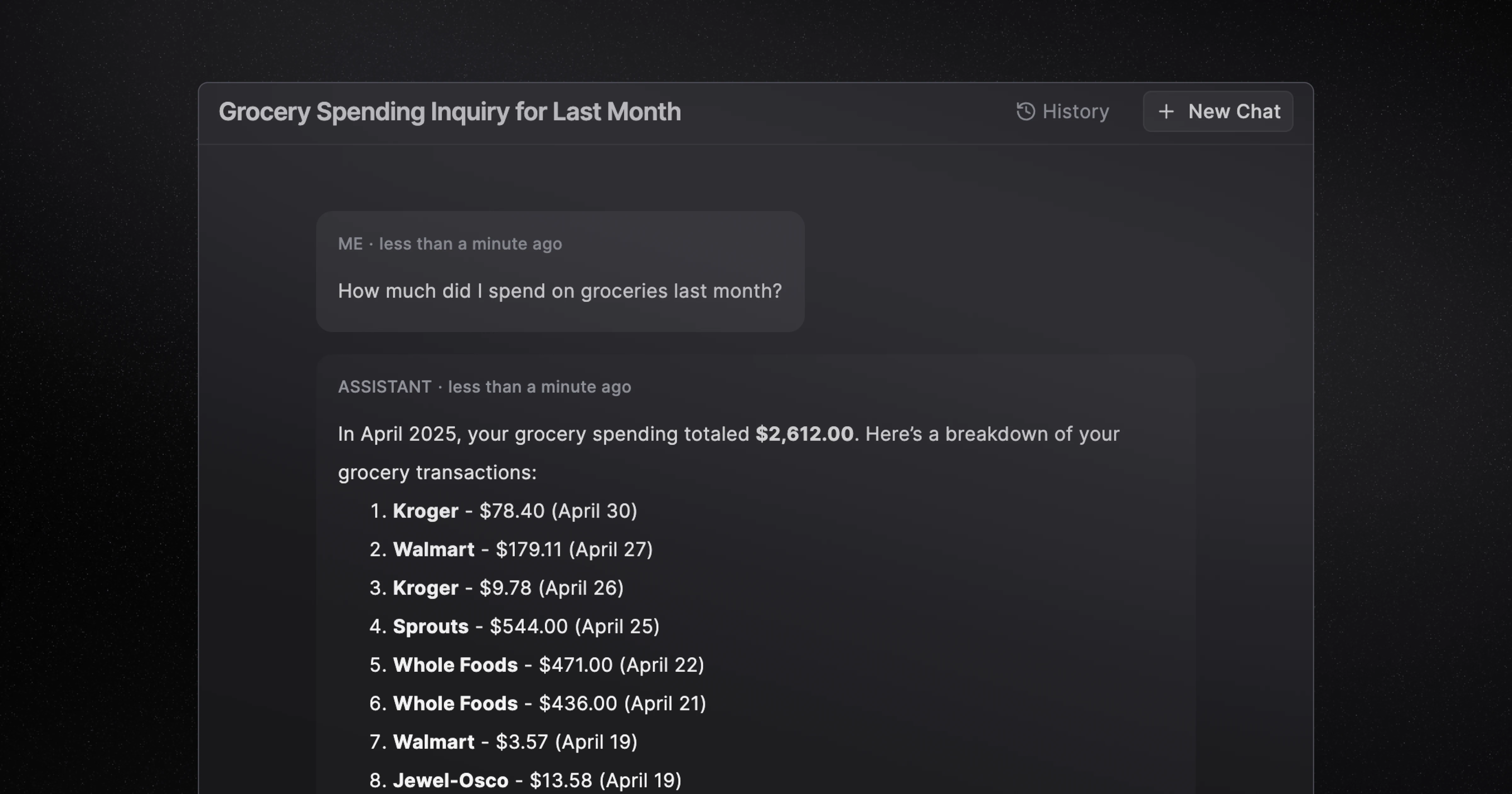

AI Chat

Query your financial data using natural language. Ask questions about spending patterns, account balances, and financial trends to get instant insights from your transaction history. Get explanations for unusual transactions, receive personalized budgeting recommendations, and analyze spending across specific categories or time periods.

Available to all Plus subscribers.

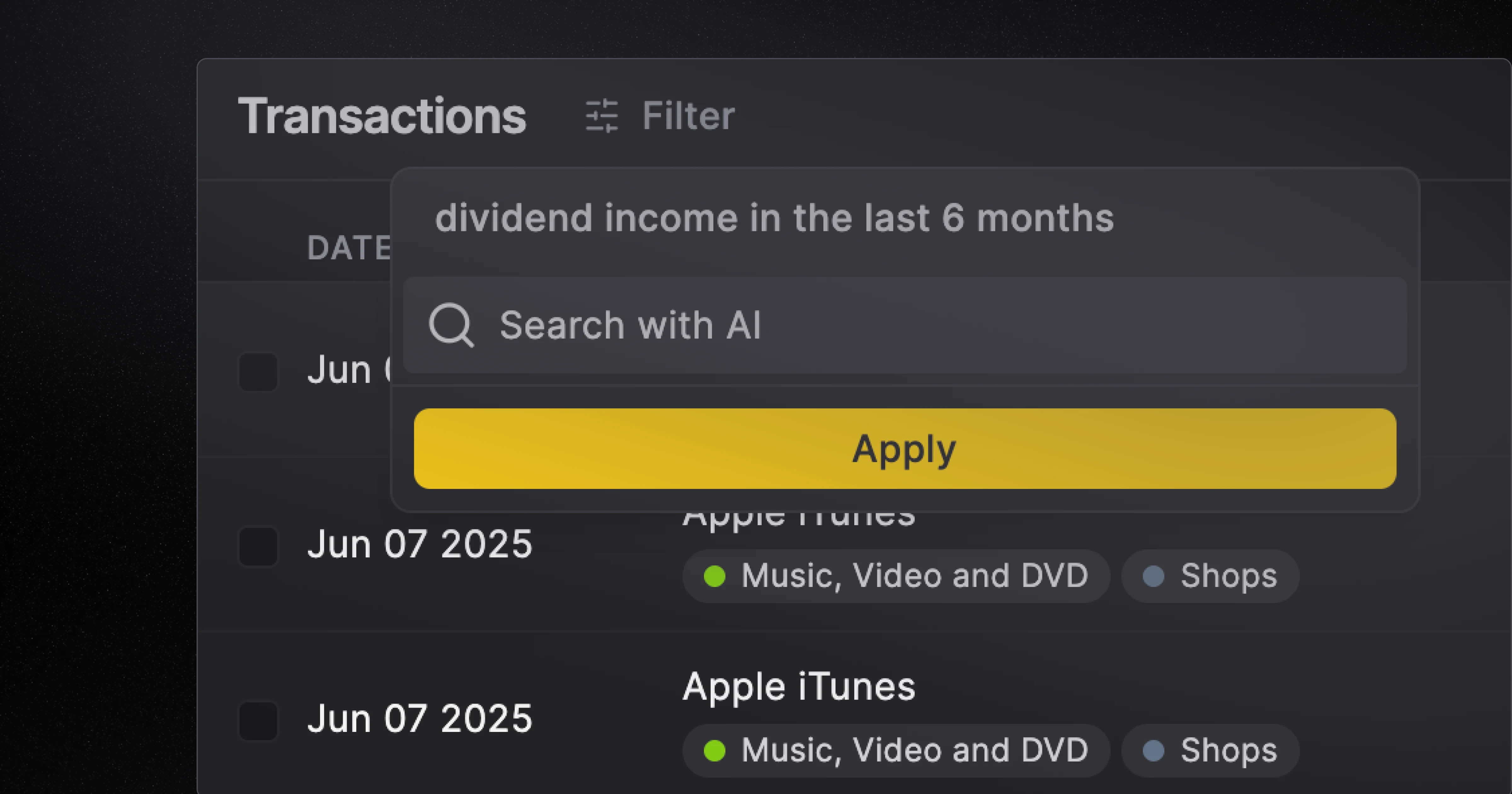

AI Filters

Search and filter transactions using plain English. Instead of manually configuring complex filter combinations, simply describe what you’re looking for and AI will automatically identify relevant transactions. Search for anything from “coffee purchases last month” to “large transactions over $500” or “business expenses from my trip to New York.”

Available to all Plus subscribers.

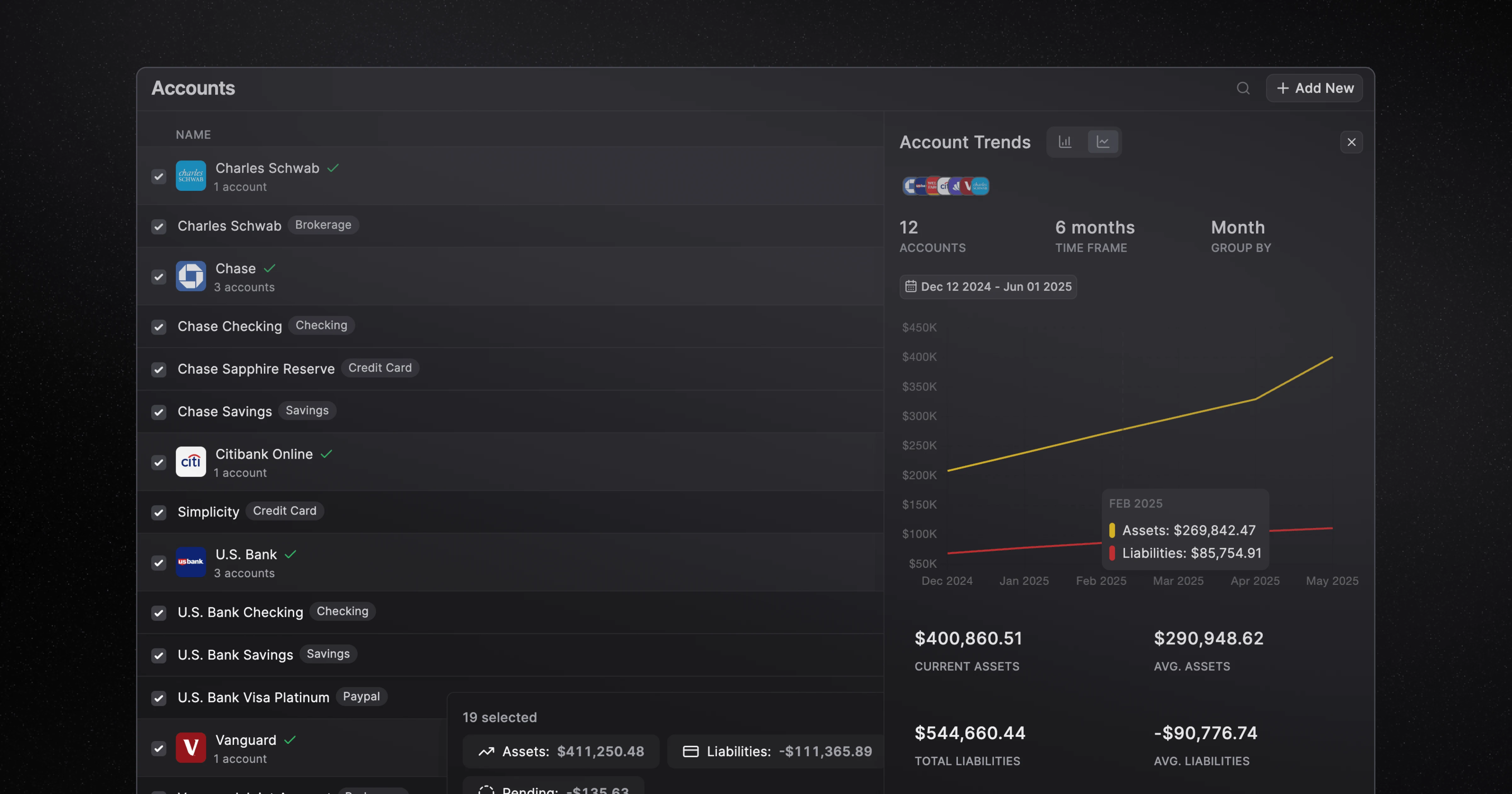

Account Balance Trends

Visualize account balance changes over time with interactive charts. Track financial health across different time periods and identify spending patterns with customizable date ranges and multi-account analysis.

Other enhancements:

- Net worth breakdown pie chart: New dashboard visualization shows how your net worth is distributed across assets and liabilities. Switch between All, Assets, and Liabilities views to see different breakdowns of your financial position.

- Account activity in Daily digest: A new section has been added to the daily digest email that shows money movement in your accounts. Keep an eye on transactions, expenses, and account activity throughout the day.

- Switch chart types: Switch between bar and line charts in any trends view. Choose the visualization that works best for your data.

- Smarter transaction categorization: Balance automatically categorizes similar transactions based on your previous category assignments.

- Institution search: Search and filter institutions and accounts on the institutions page.

-

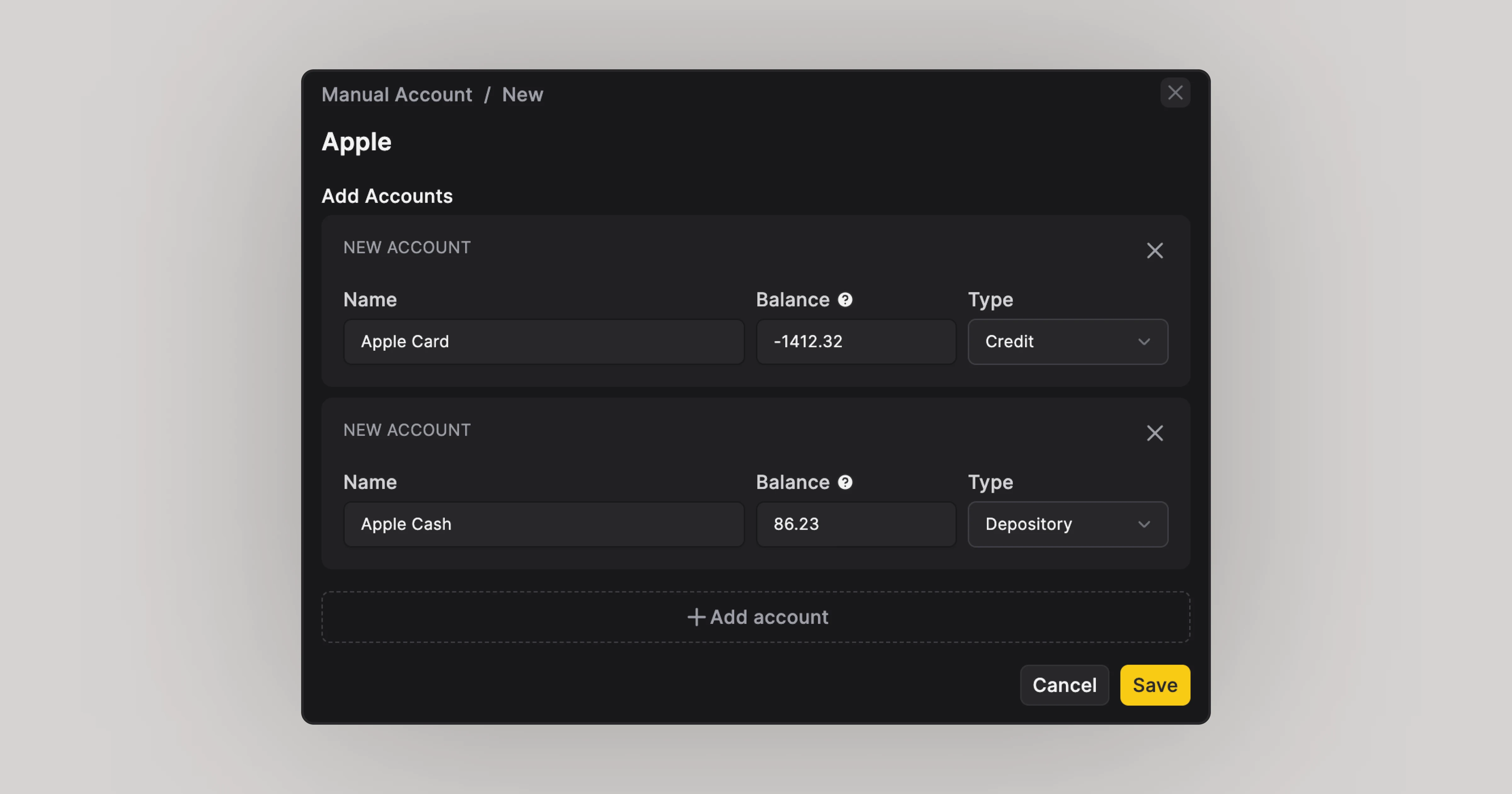

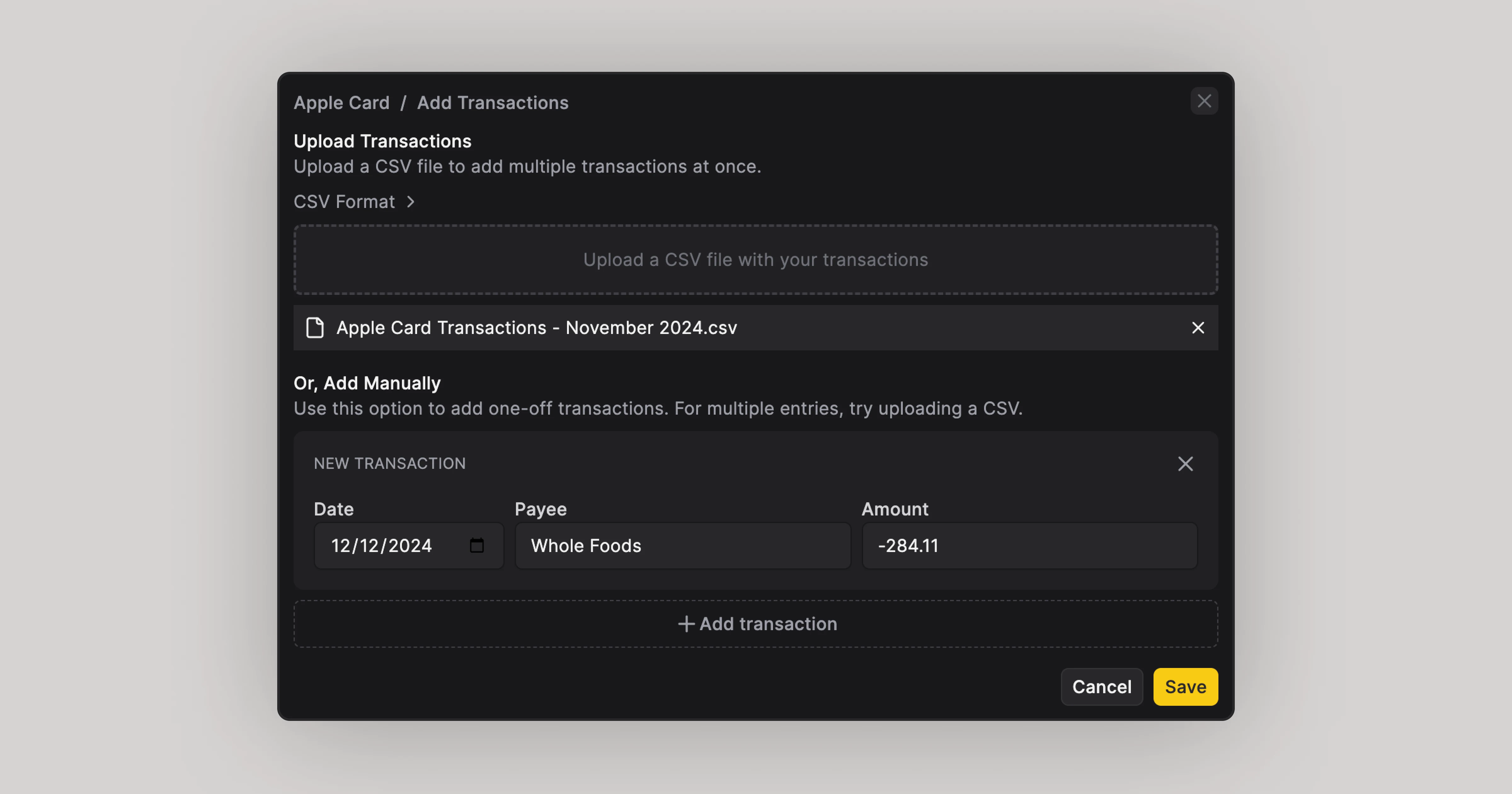

Manual Connections

Dec 26, 2024

Today, I’m excited to launch Manual Connections. While Balance has exclusively supported connecting accounts via Plaid, you’ll now be able to add and manage accounts on your own. Manual connections are ideal for accounts not supported by Plaid or accounts that you prefer to track manually.

For manual accounts, you’ll have full control over your transactional data. You can import transactions in bulk by uploading a CSV or add them individually as you go—right in the app. Manual accounts and transactions seamlessly integrate with your existing financial data, including net worth calculations and financial analytics, giving you a more holistic view of your finances.

For manual accounts, you’ll have full control over your transactional data. You can import transactions in bulk by uploading a CSV or add them individually as you go—right in the app. Manual accounts and transactions seamlessly integrate with your existing financial data, including net worth calculations and financial analytics, giving you a more holistic view of your finances. -

Canada (Beta)

Dec 08, 2024

Balance is now available in Canada! 🇨🇦

You can now connect to leading Canadian financial institutions, including Royal Bank of Canada, Scotiabank, TD Canada Trust, Bank of Montreal, CIBC, and more. Canada is the first country outside the U.S. where Balance supports financial institution connections.

If you have any feedback or questions, feel free to reach out—I’d love to hear from you!

-

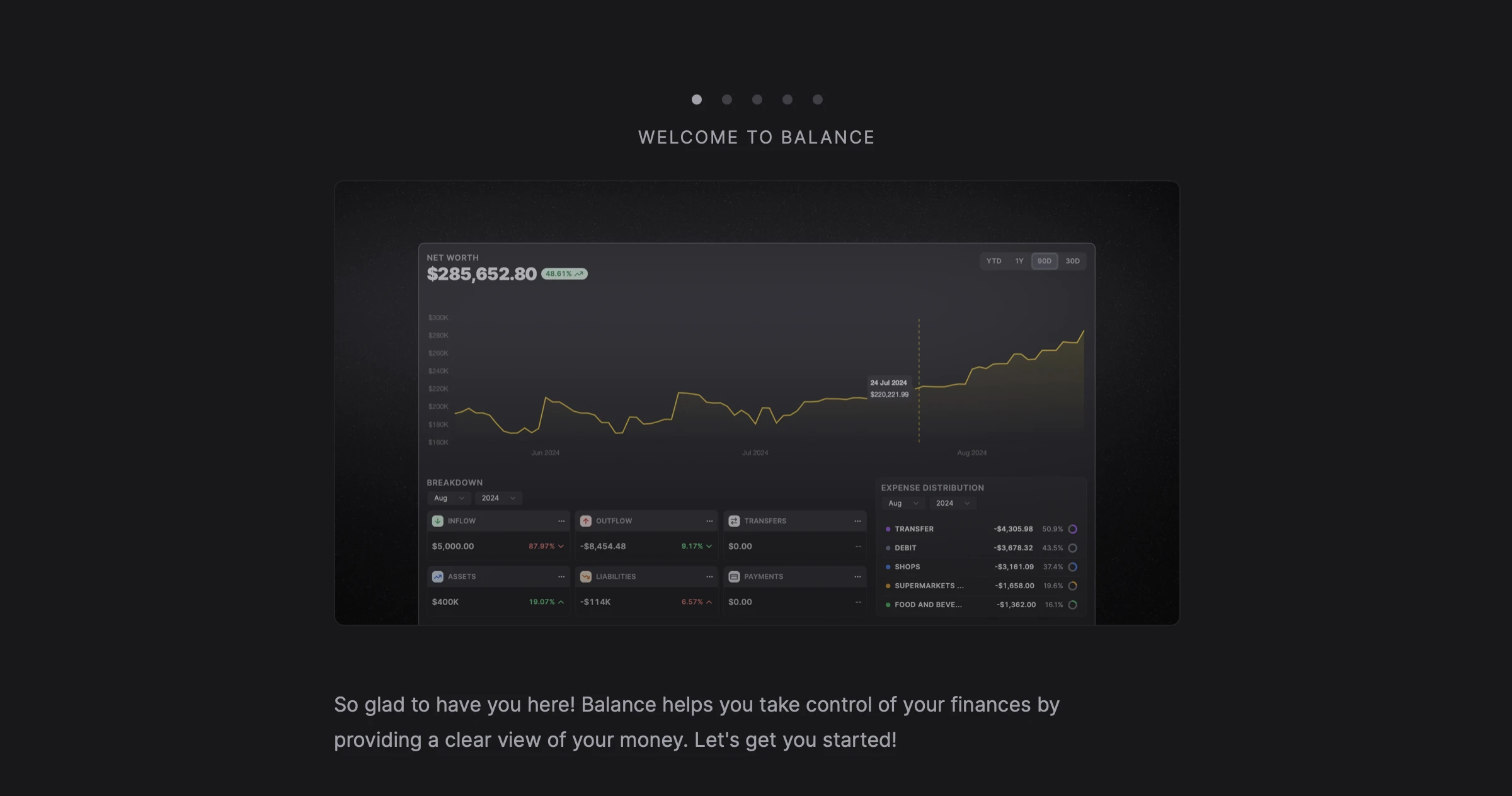

User Onboarding

Nov 30, 2024

Introducing a new and improved onboarding experience. The onboarding flow provides a guided tour to help you get started and explore the app.

-

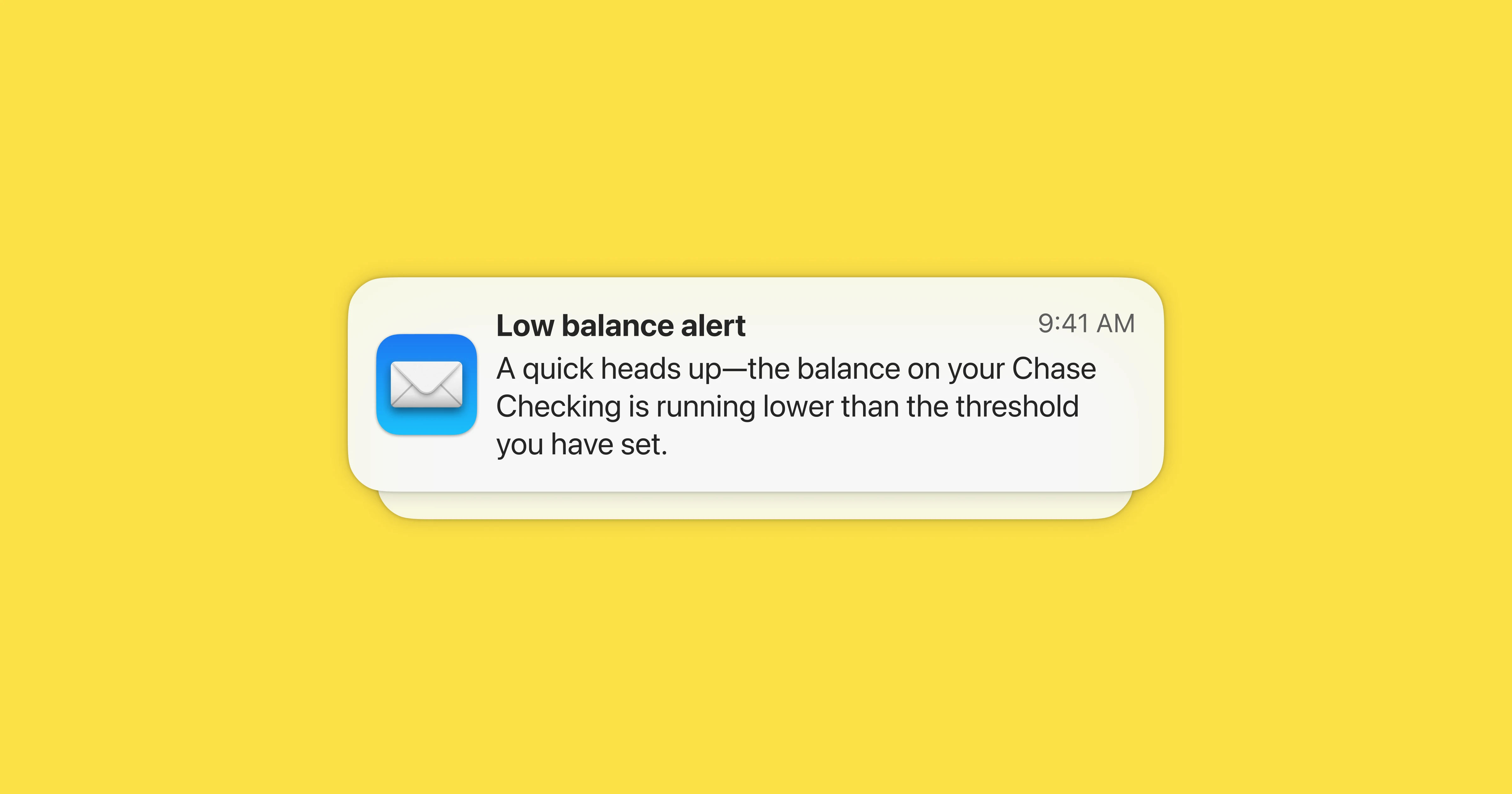

Low Balance Alerts

Nov 15, 2024

Receive alerts when your account balance is running low. Avoid surprise charges or overdraft fees by setting up alerts for your accounts. Configure the amount by setting up the alert on your Accounts page. Select a depository account, click “Set Up Alert”, and set an amount. If your account balance drops below this amount, Balance will notify you via email.

-

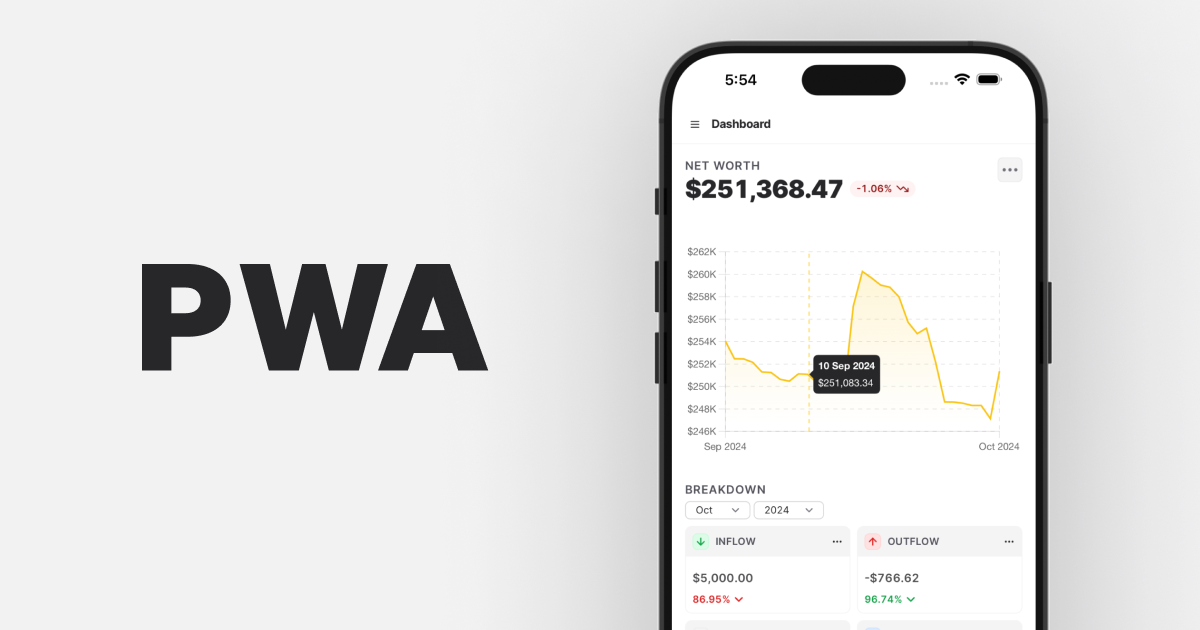

PWA

Sep 30, 2024

Introducing the Balance PWA (Progressive Web App) for a better mobile experience. Follow the installation instructions below to add the Balance on your home screen. Introducing the Balance App for a Better Mobile Experience

iOS

- Open Safari and navigate to https://app.balance.day.

- Tap the Share button at the bottom of the screen.

- Tap the Add to Home Screen button.

- Tap Add in the top right corner.

Android

- Open Chrome and navigate to https://app.balance.day.

- Tap the three dots in the top right corner.

- Tap Add to Home Screen.

- Tap Add in the bottom right corner.

- Open the app from your home screen.

Enjoy the new Balance PWA experience!

-

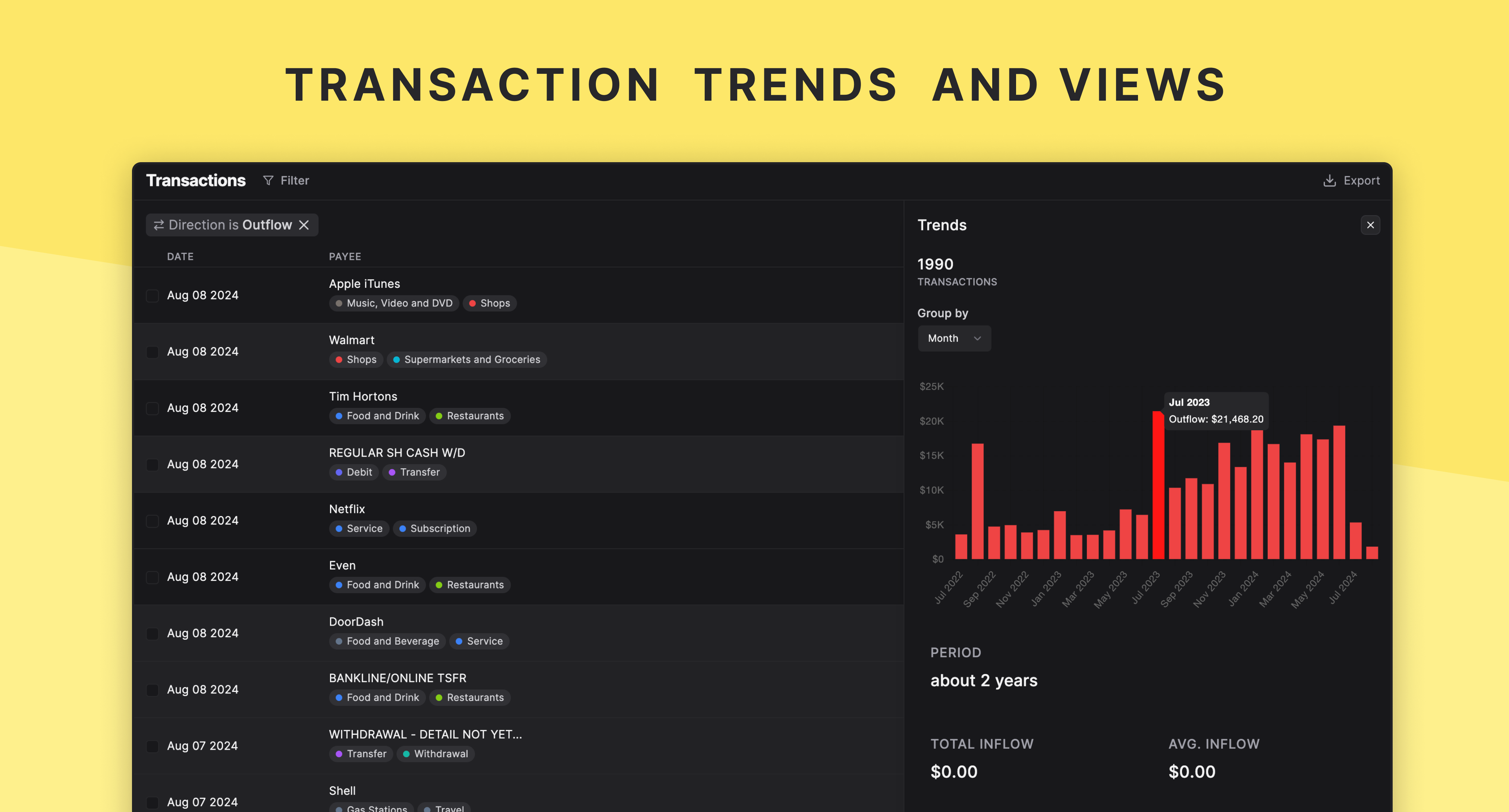

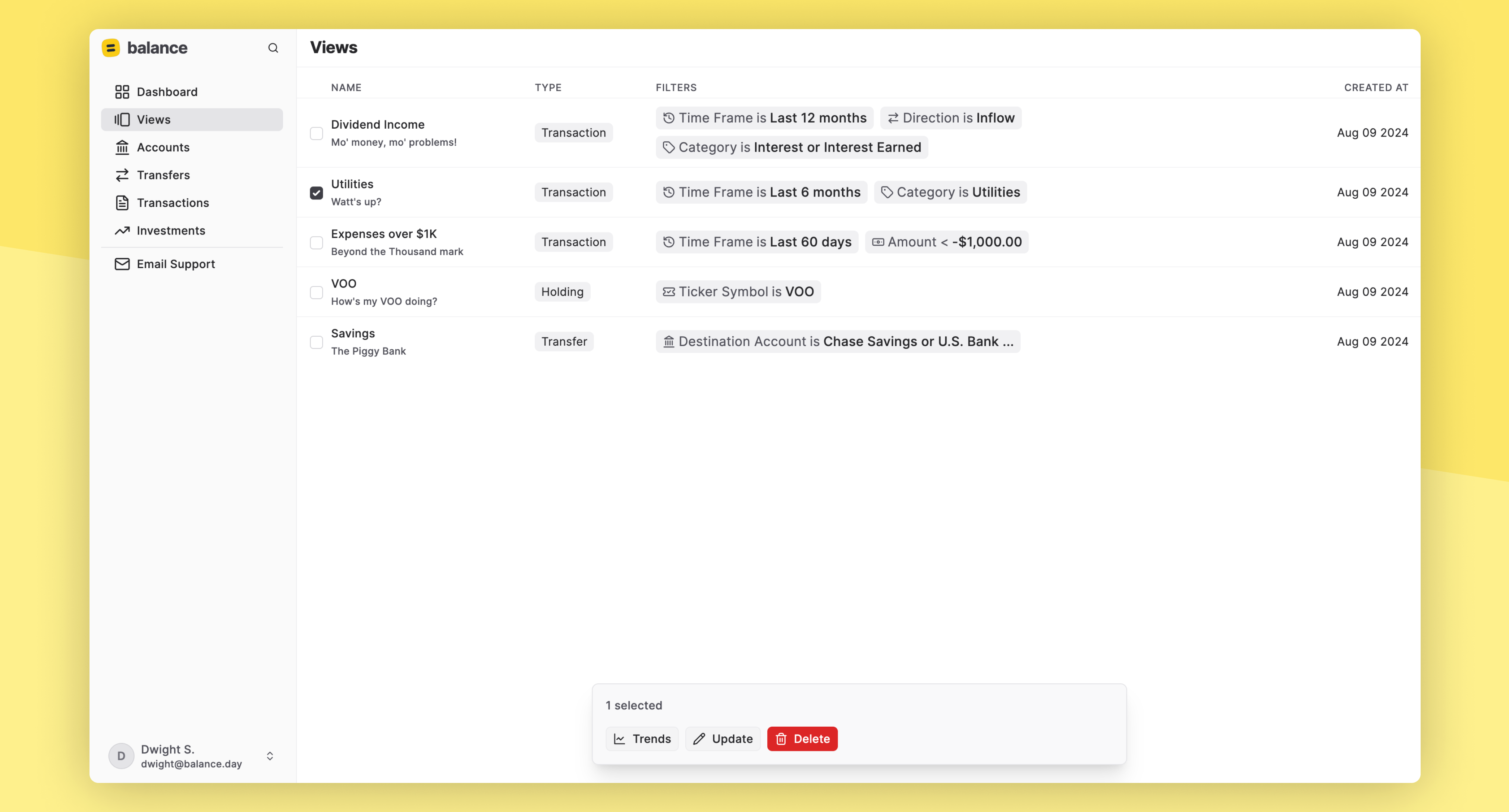

Transaction Trends and Views

Aug 11, 2024

Today, I’m thrilled to introduce one of the most impactful features in Balance. Transaction Trends and Views.

With Transaction Trends, you can now track trends over time to uncover spending patterns and gain valuable insights into your finances. Apply filters to dive deeper into your data, and link life events to financial changes to see how they impact your financial health. Trends empower you to make informed decisions and stay in control of your finances.

Next up are Views. You can save custom filters as Views, allowing you to access your most important financial data quickly. A new link on your sidebar lets you easily navigate to your saved Views. Create Views for Transactions, Transfers, and Investments to streamline your finances.

-

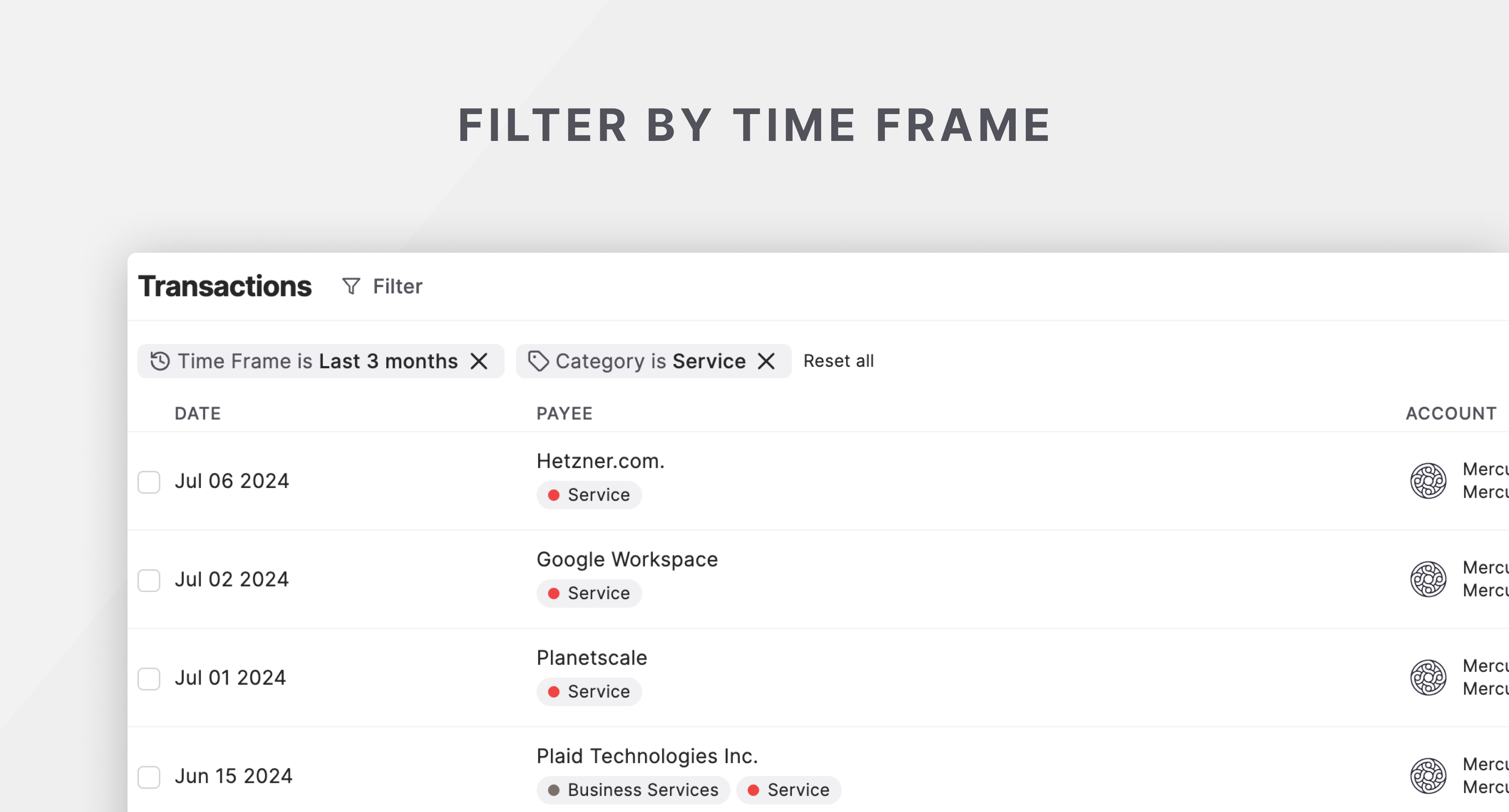

Filter by Time Frame

Jul 26, 2024

Filter transactions, transfers, and investment activities by a time frame. Previously, you could filter your financial data using static dates, but using time frames, you can filter data dynamically. Use time frame filters like “Last 30 days”, or “Last 3 months”, or “Last 1 year”, to filter data in a more flexible way.

-

Authenticate with Google

Jun 22, 2024

Introducing authentication with Google. You can now use your Google account to sign in to Balance. If you have previously logged in with email and password, link your Google account by simply signing in with Google.

-

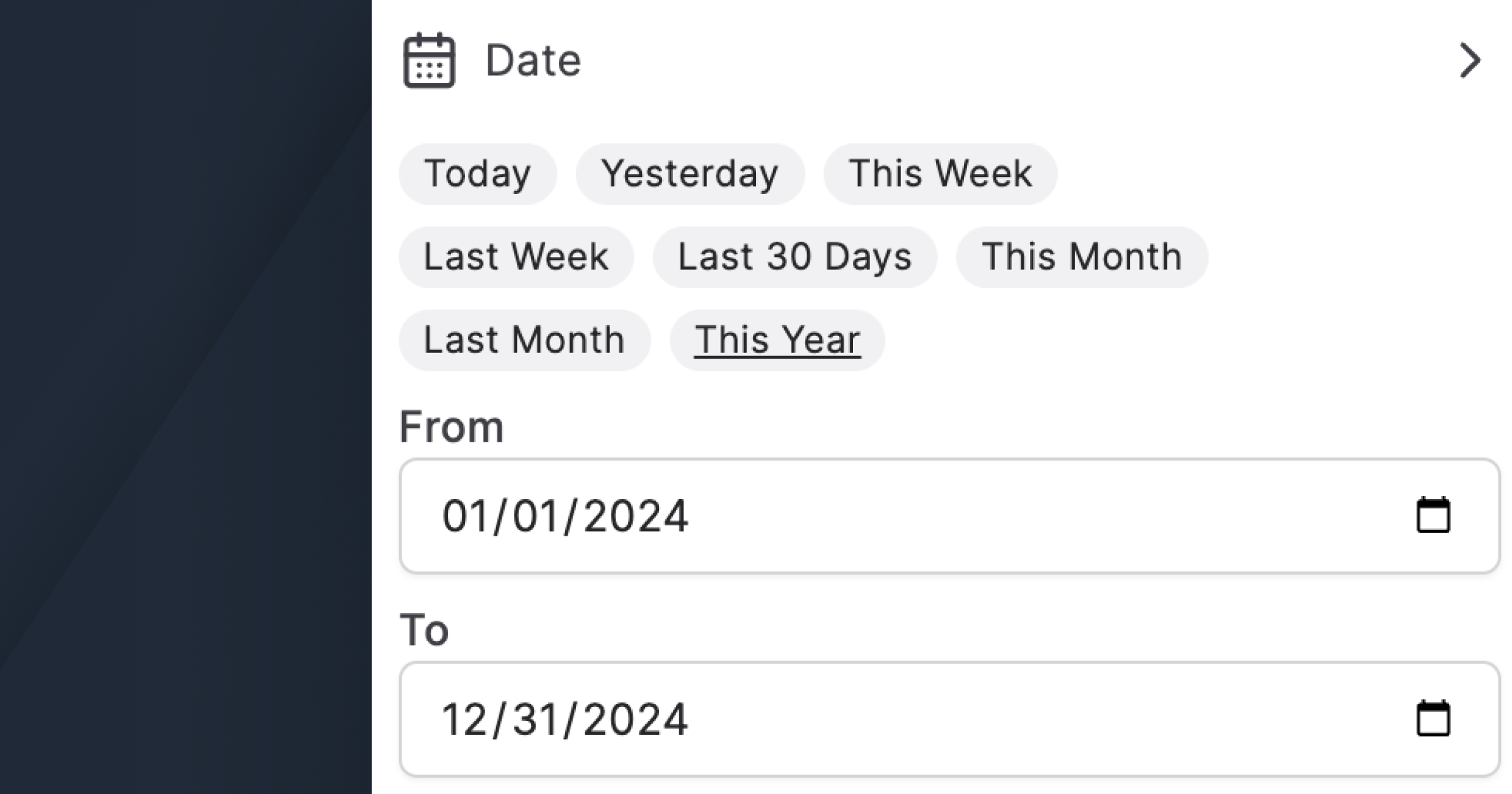

Quick Dates for Filtering

Jun 20, 2024

A small change that makes filtering easier. Filter your transactions, transfers, and investments with the new date helpers.

-

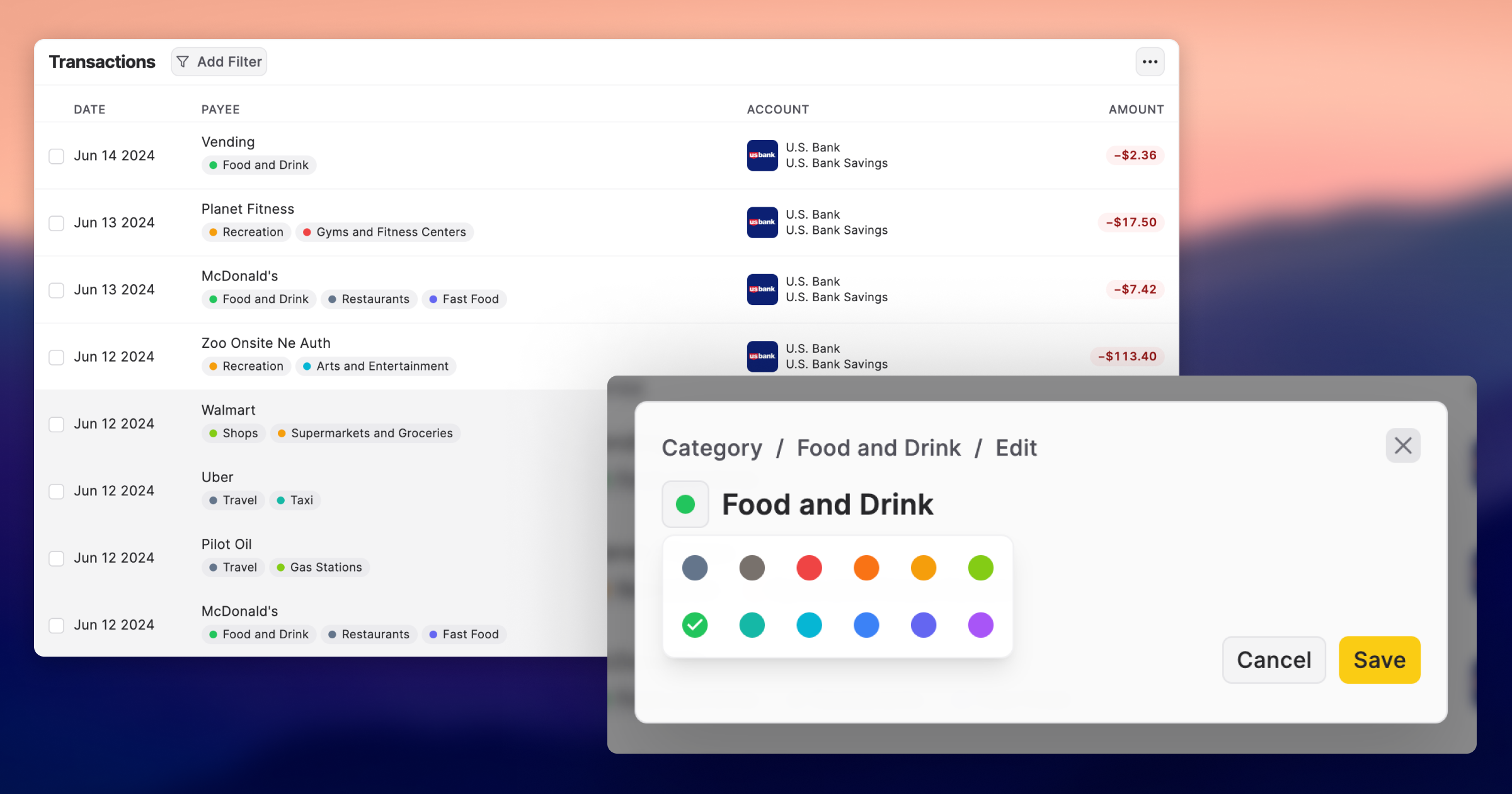

Color me intrigued

Jun 13, 2024

This release brings improvements to category management.

- Assign colors to your categories: Personalize categories by assigning colors to them.

- Editing and Deleting categories: Edit or delete categories from the category options by clicking on the category name.

Other improvements and fixes

- Add filtering capabilities to Transfers and Investments.

- Fixed link to Transfers in the Daily Digest email.

-

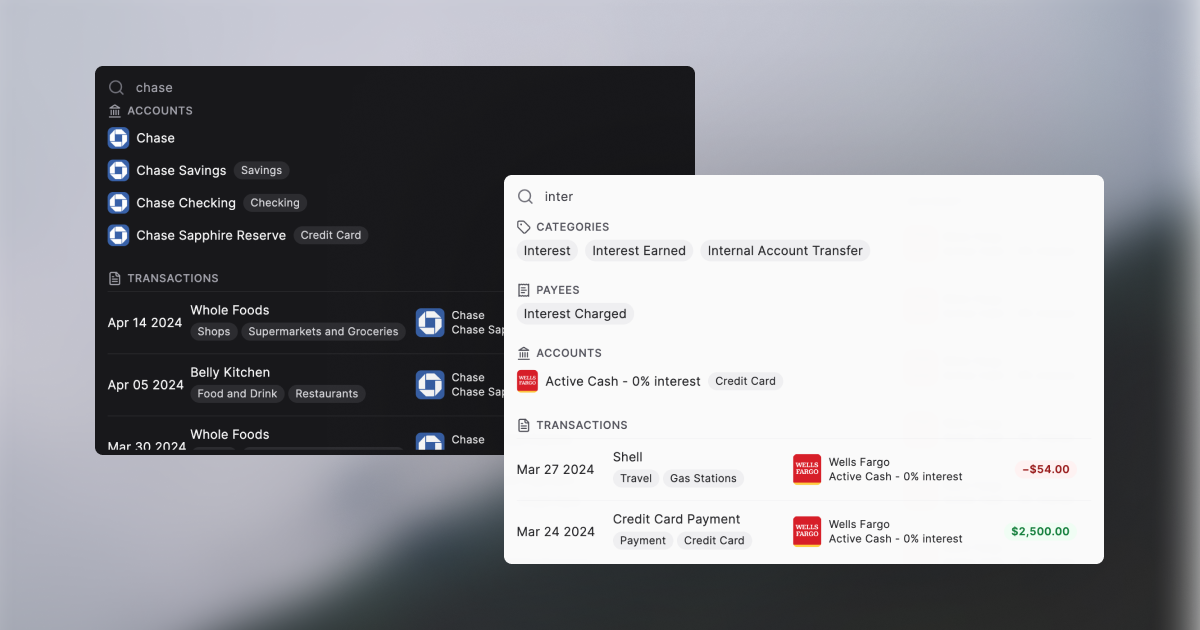

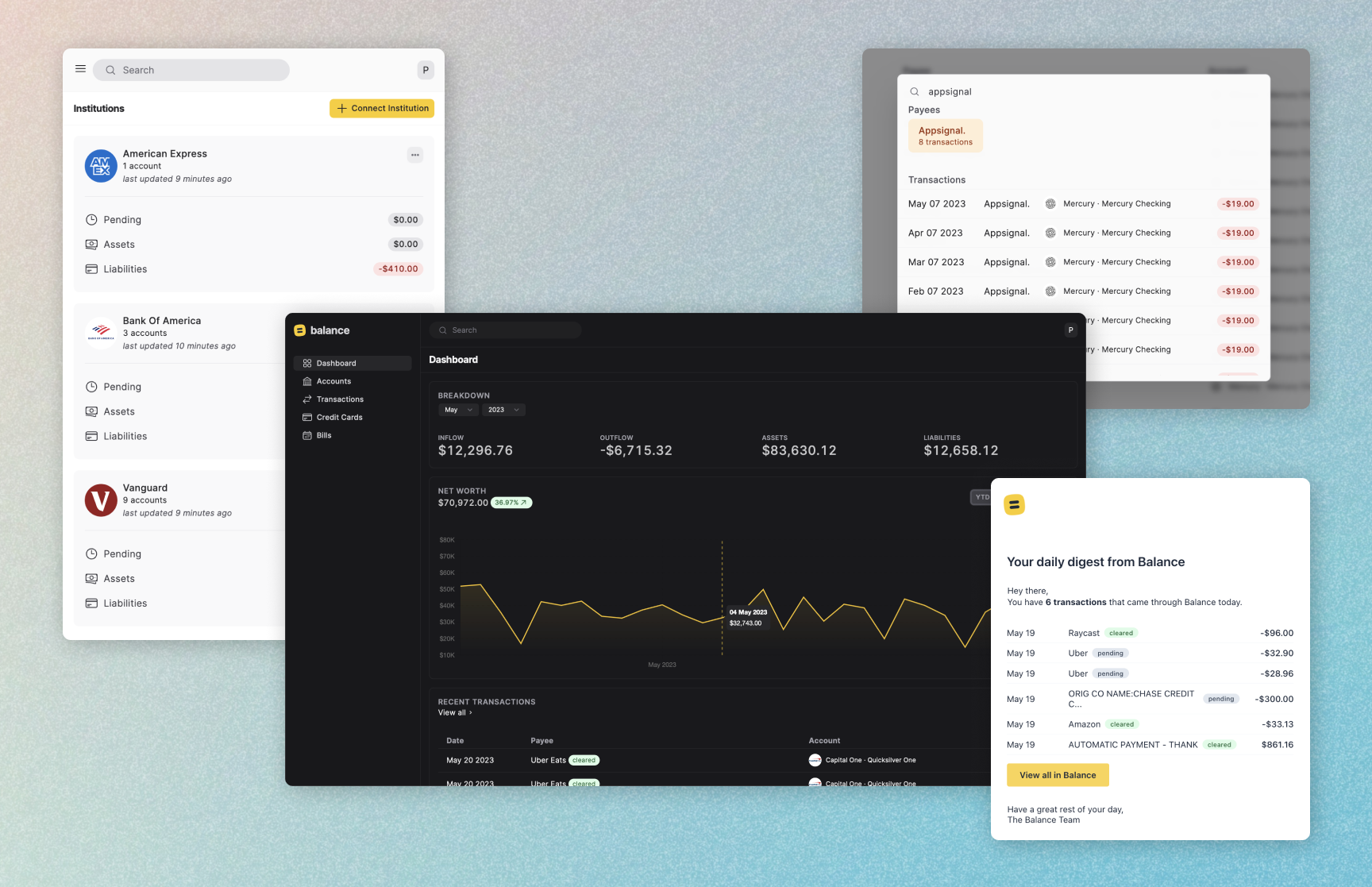

Improved Search

Apr 27, 2024

Introducing the all new, improved search in Balance. You can now conveniently search for transactions, payees, bank accounts, and categories — all in one place. And, the search is typo-tolerant, so the occasional slip-up is not a problem.

Having the ability to quickly search across all your financial data is key to understanding your money. With the improved search, you no longer need to sift through bank statements and browser tabs looking for answers — you can find them right here inside Balance.

-

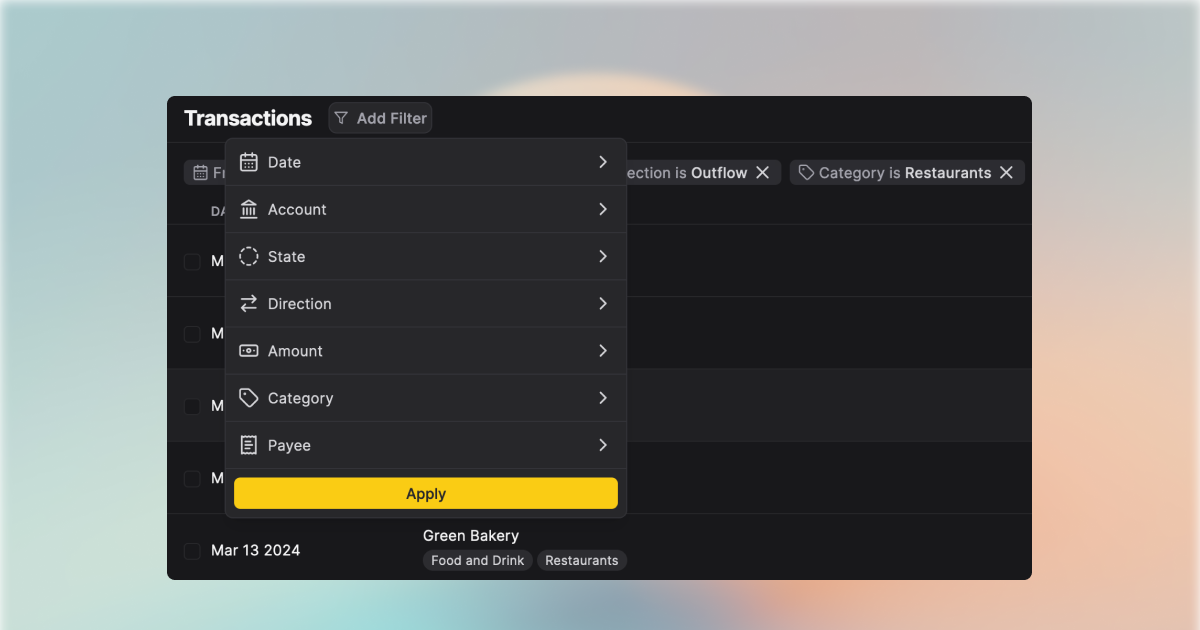

Filters

Mar 20, 2024

Today, I’m super excited to launch Filters. Filtering your financial data is an underrated yet extremely powerful mechanism for finding the data you are looking for. It helps you narrow down the results and gain a deeper insight into your finances.

With Filters, you can easily answer questions such as, “What’s my total spending on dining out in the last 3 months?” or “Have I been setting aside sufficient funds for emergencies lately?” Whether you’re seeking broad insights or delving into deeper specifics, Filters empowers you to sift through your finances with ease and clarity.

Balance currently supports the following filters:

- Date: Filter by a start and end date

- Account: Filter by your bank accounts

- State: Filter by Pending or Cleared

- Direction: Filter by Inflow or Outflow

- Amount: Filter by amount using various operators

- Payee: Filter by payee names

-

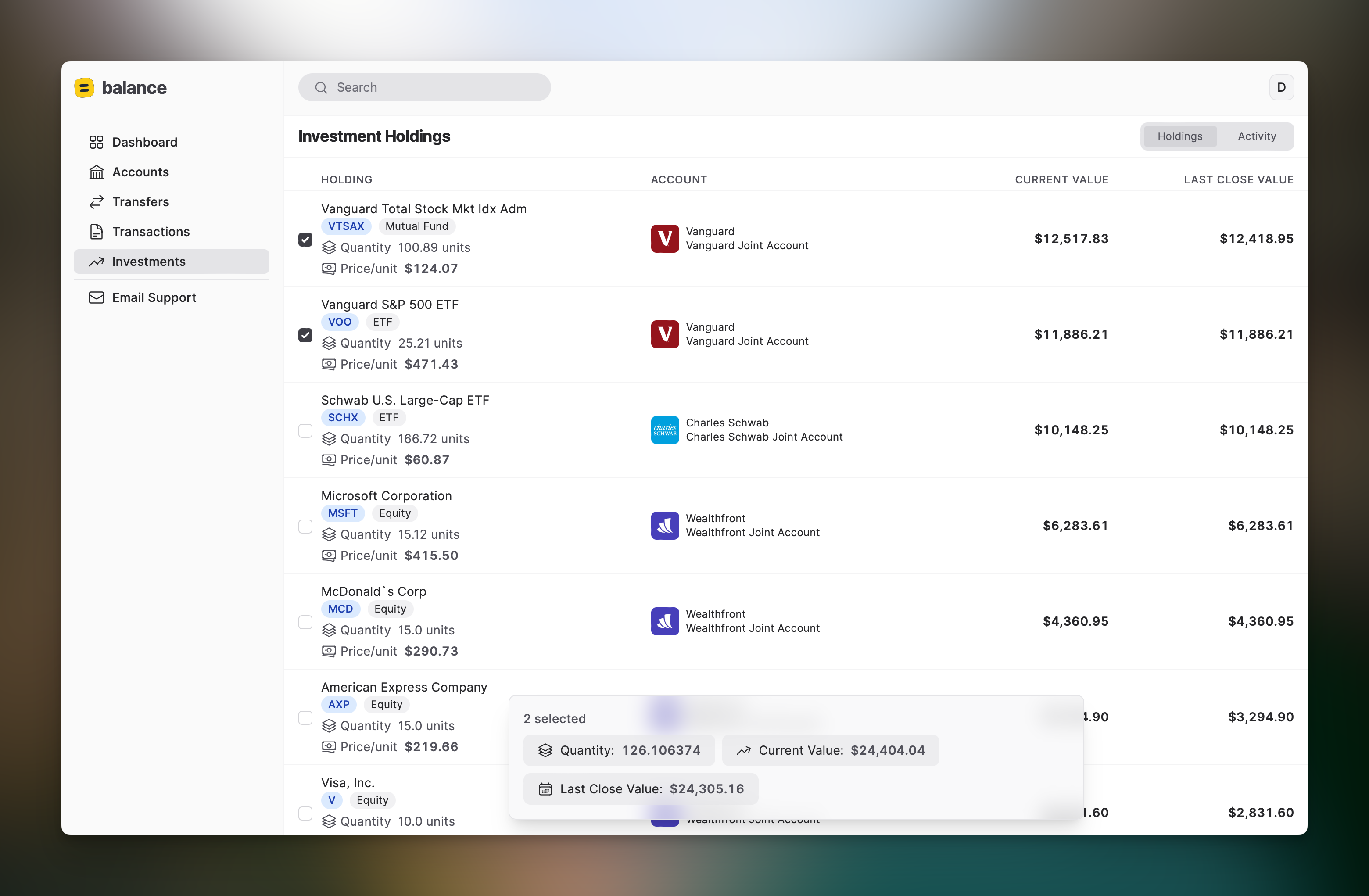

Investments (Beta)

Mar 02, 2024

I’m thrilled to announce the first release of Investments.

You can now connect your investment accounts such as brokerage, 401K, IRA, and more. Balance will sync your holdings along with any investment transactions.

You can also track current market prices for your investments to see the real-time value of your assets. Lastly, your net worth will factor in your portfolio value, allowing you to track your investment performance over time.

A couple of things to note:

- Unfortunately, Plaid does not support Fidelity accounts anymore. I’m exploring other ways to allow connecting Fidelity accounts in the meantime.

- Investments is a beta release, so some things need to be polished. If you encounter any bugs or data discrepancies, please let me know.

-

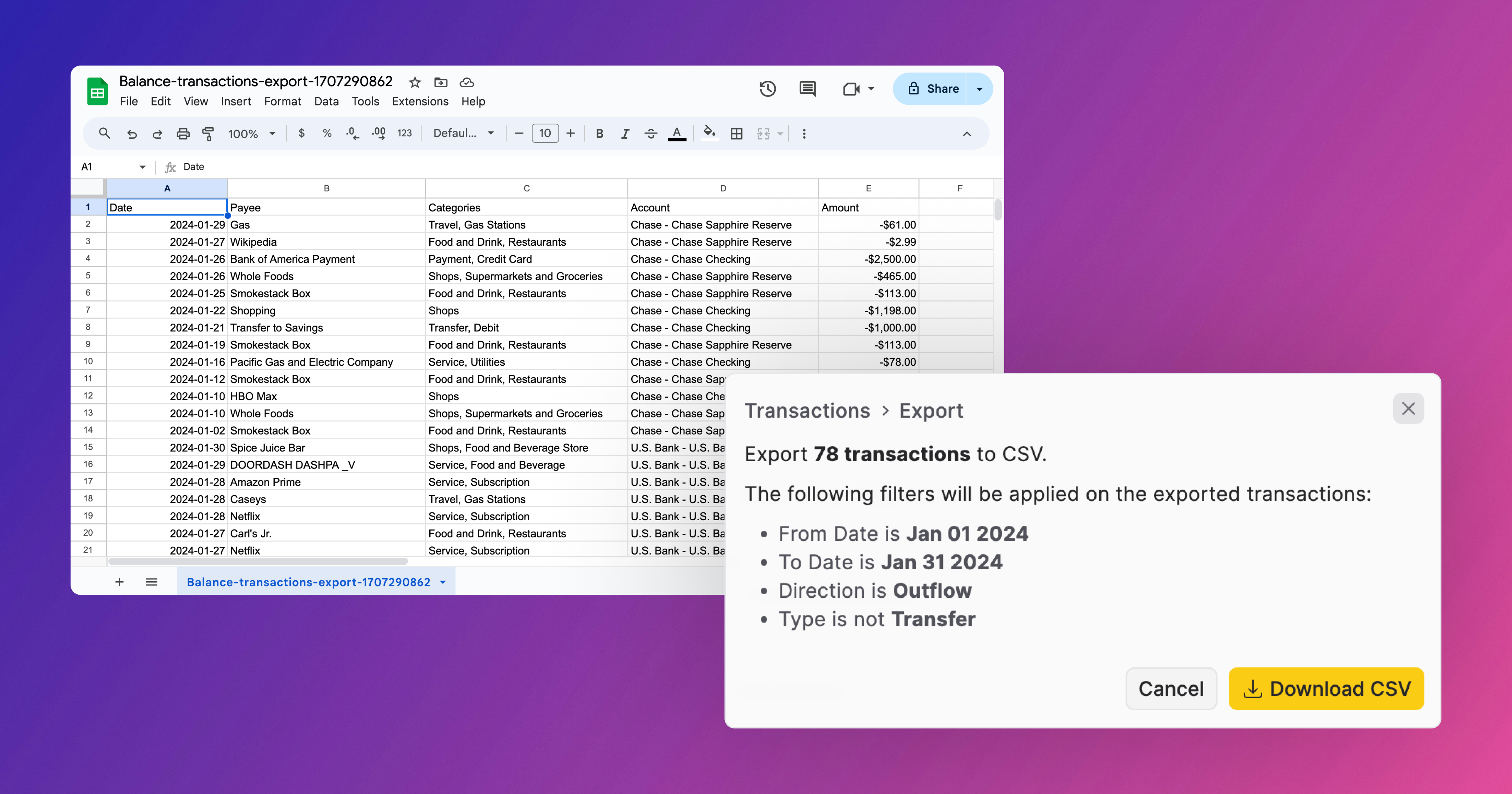

Transactions Export

Feb 06, 2024

Introducing Transactions Export. Tax season is almost upon us. If you need to send a list of transactions to your accountant, Balance can assist you. Navigate to the Transactions page, apply filters to narrow down the results (e.g., Category: Business, Account: Business Account, Direction: Outflow), and select Export Transactions from the transaction options dropdown. Balance will generate a CSV file containing the list of transactions that you can share with your accountant.

Optionally, you can export these transactions to Google Sheets or Microsoft Excel to run your own simulations.

Until next time!

-

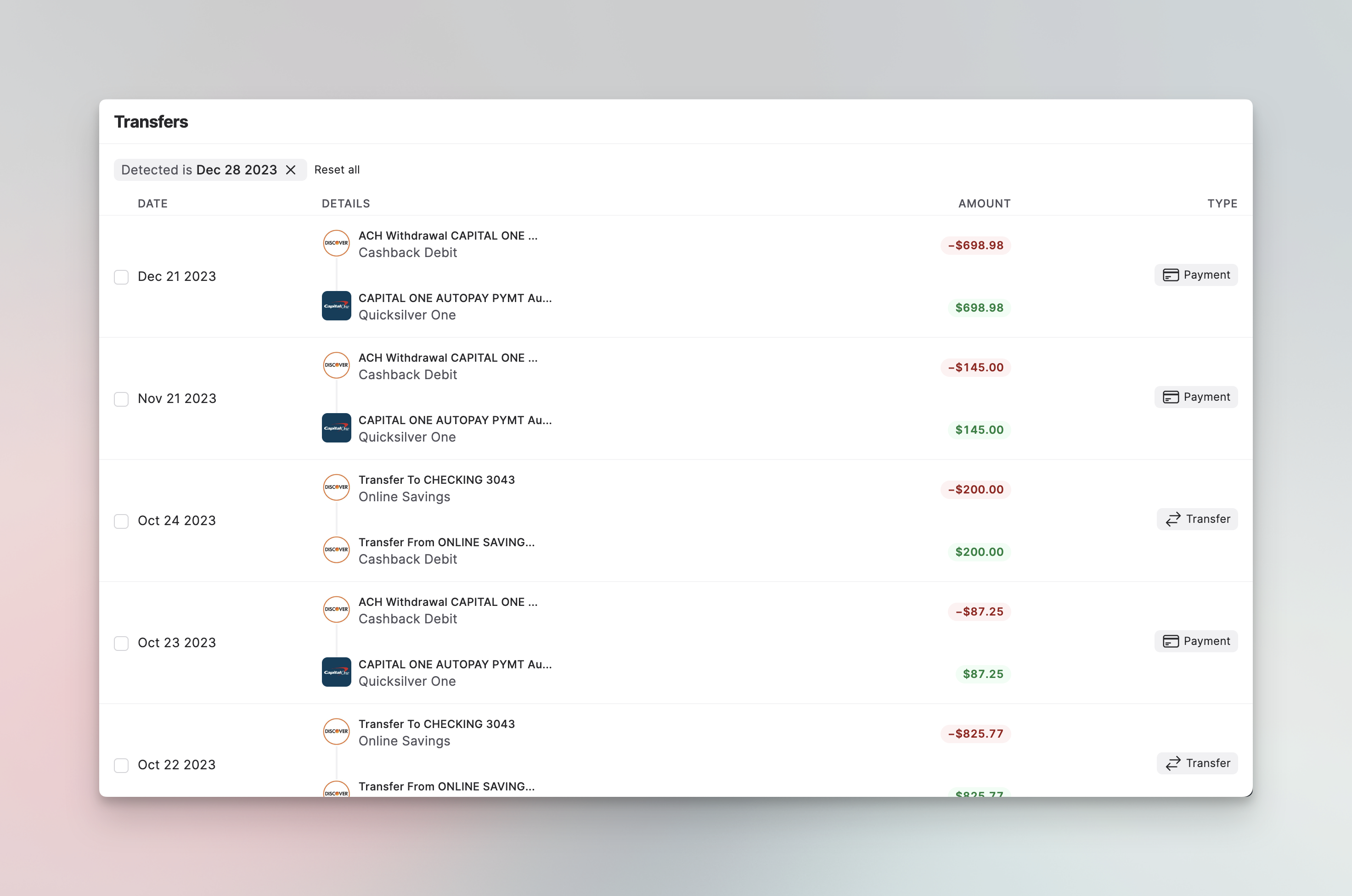

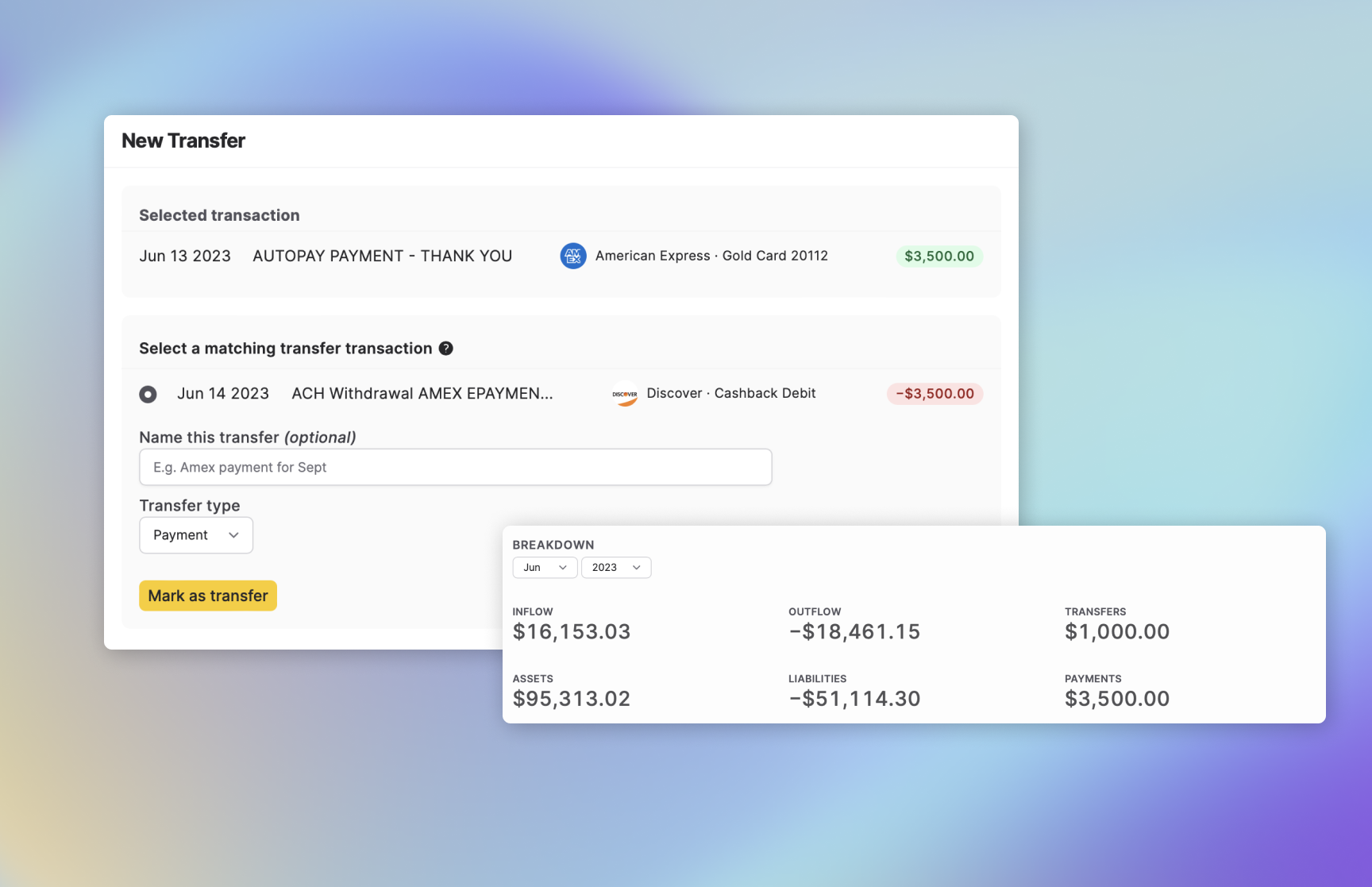

Payment and Transfer Detection

Dec 28, 2023

Introducing Payment and Transfer Detection. To ensure accurate calculation of breakdown values, it is important to correctly classify payments and transfers. Previously, this process was manual, and there was a risk of missing out on marking transactions as transfers or payments. From now on, Balance will automatically detect your payments and transfers and create them for you.

The transfer matching criteria are as follows:

- Both transfer transactions are cleared and not pending from the merchant.

- Transactions are of the same amount but opposite in polarity.

- Both transactions occur within 7 days of each other.

Balance also detects the type of transfer.

- Payment, if money is moved into a Liability account like a credit card or a loan account.

- Transfer, if the money was moved to a Depository account like checking, savings, etc.

Note that some detected transfers may be invalid and false positives. In such cases, you can delete them, and Balance will not recreate them again. The daily digest email will include a link to all detected transfers for the day.

-

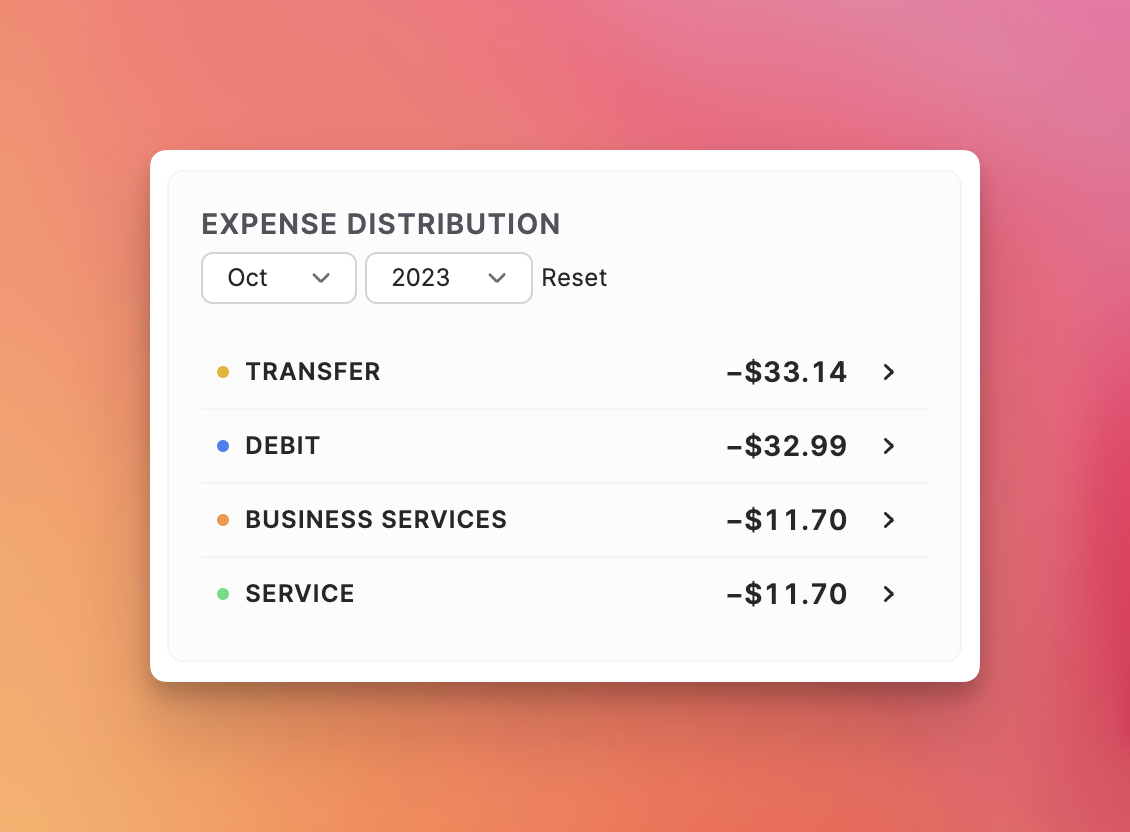

Expense Distribution

Dec 02, 2023

Introducing a new dashboard widget: Expense Distribution. Expense Distribution shows how your transactions are distributed across different categories. The categories are ordered based on highest expenses. Clicking on a category will show you the transactions for those categories so you can dig in even deeper. This will give you a sense of where your money is being spent.

-

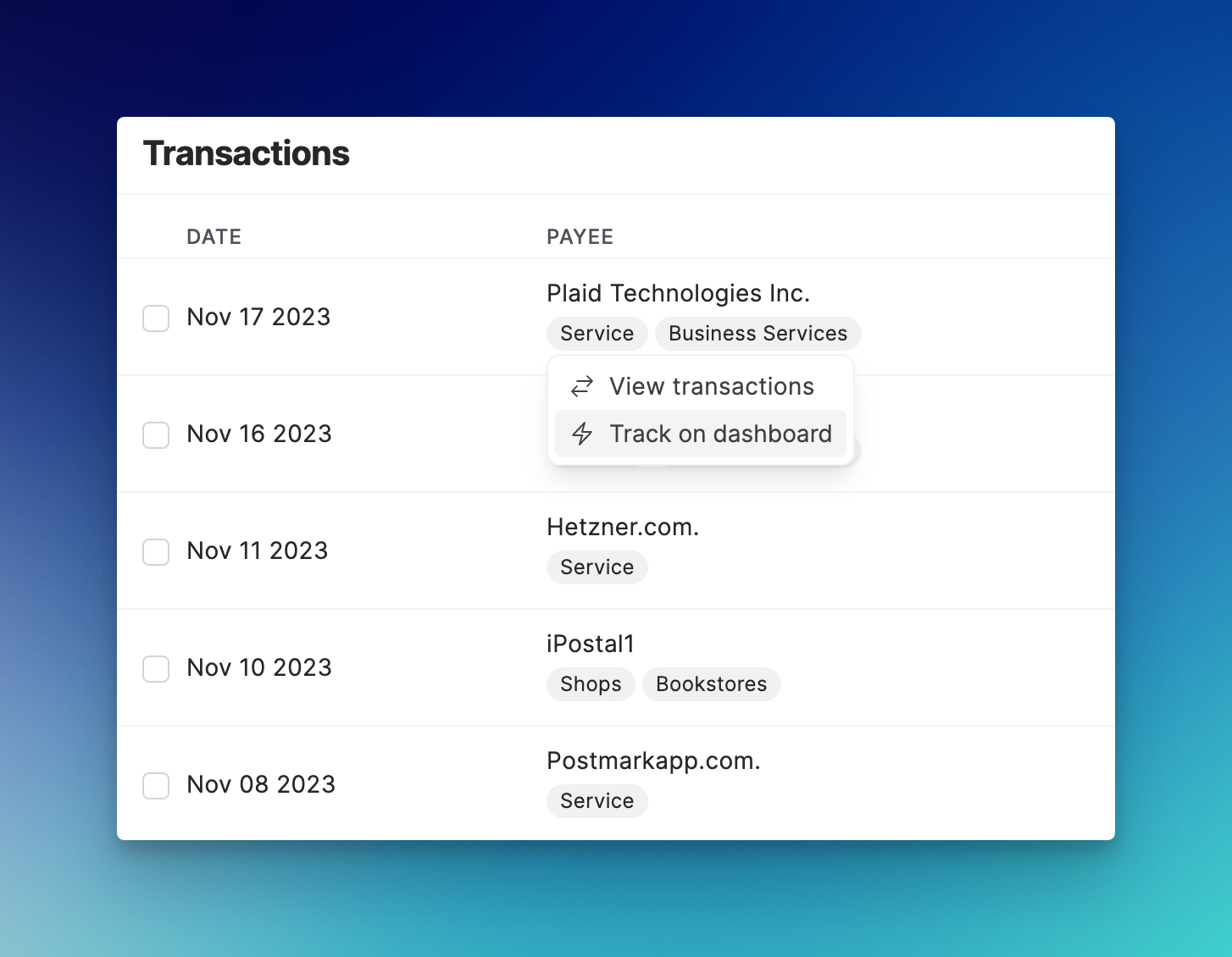

Tracking Categories

Nov 18, 2023

Track transaction categories on your Balance dashboard. By tracking categories on your dashboard, you can actively analyze your spending habits, identify areas where you can save money, and make more effective financial choices.

To track a category, click on the category name on a transaction and select “Track on dashboard”.

Check out this video for more information:

-

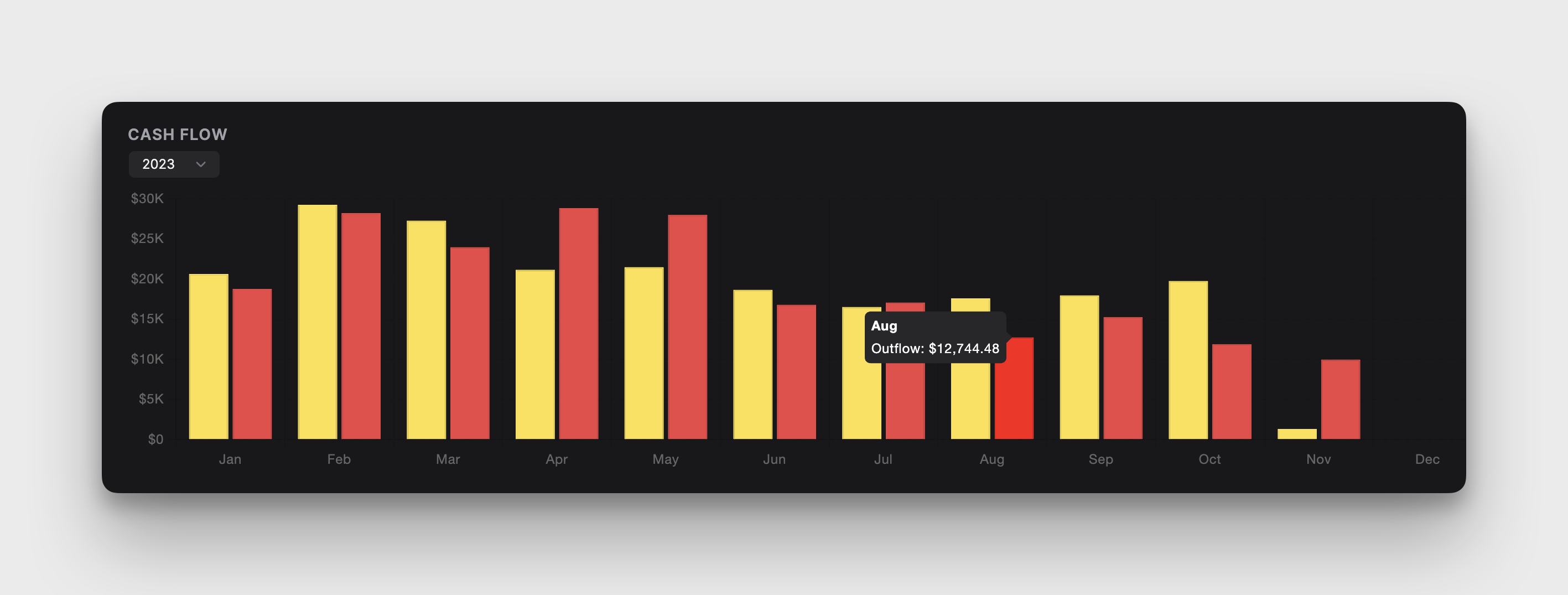

Visualize cash flow

Nov 12, 2023

Visualize your cash flow using the new Cash Flow chart. This chart shows the difference between your inflow and outflow each month. Categorize your transactions as Transfers or Payments to ensure accurate representation.

-

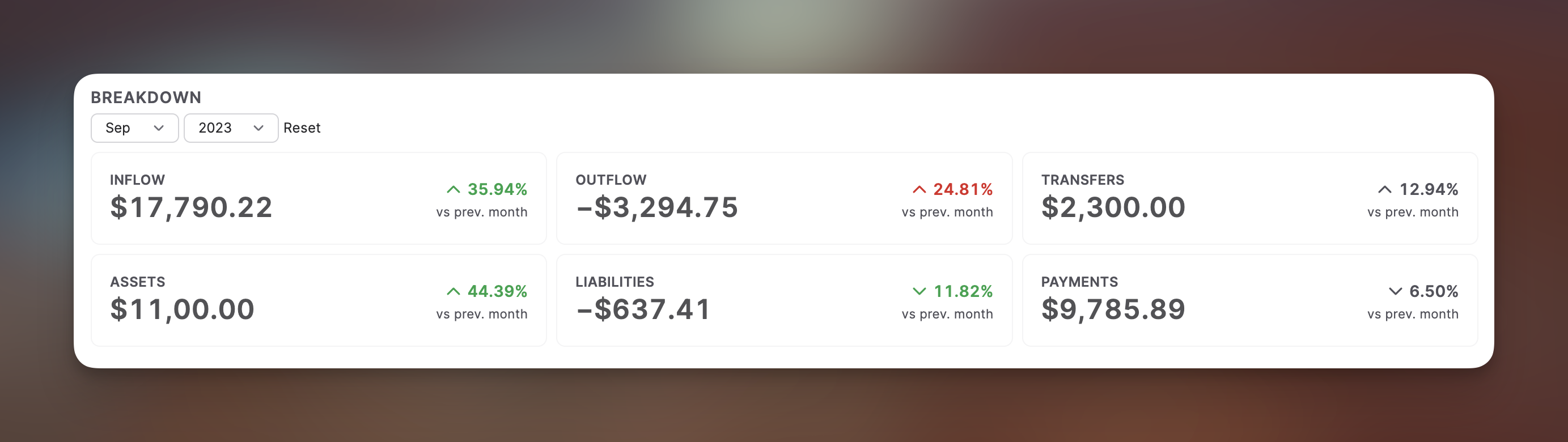

Breakdown Changes

Oct 10, 2023

You can now see the differences in your breakdowns compared to the previous month. These differences will be shown as percentages and amounts.

Here’s a quick summary of how it works:

- The change indicator for Inflow and Assets will be green if the current month’s amount is higher than the previous month’s amount, indicating an increase in your Inflow and Assets.

- The change indicator for Outflow and Liabilities will be red if the current month’s amount is higher than the previous month’s amount. This indicates an increase in your expenses or debt.

- The change indicator for Transfers and Payments will remain gray.

-

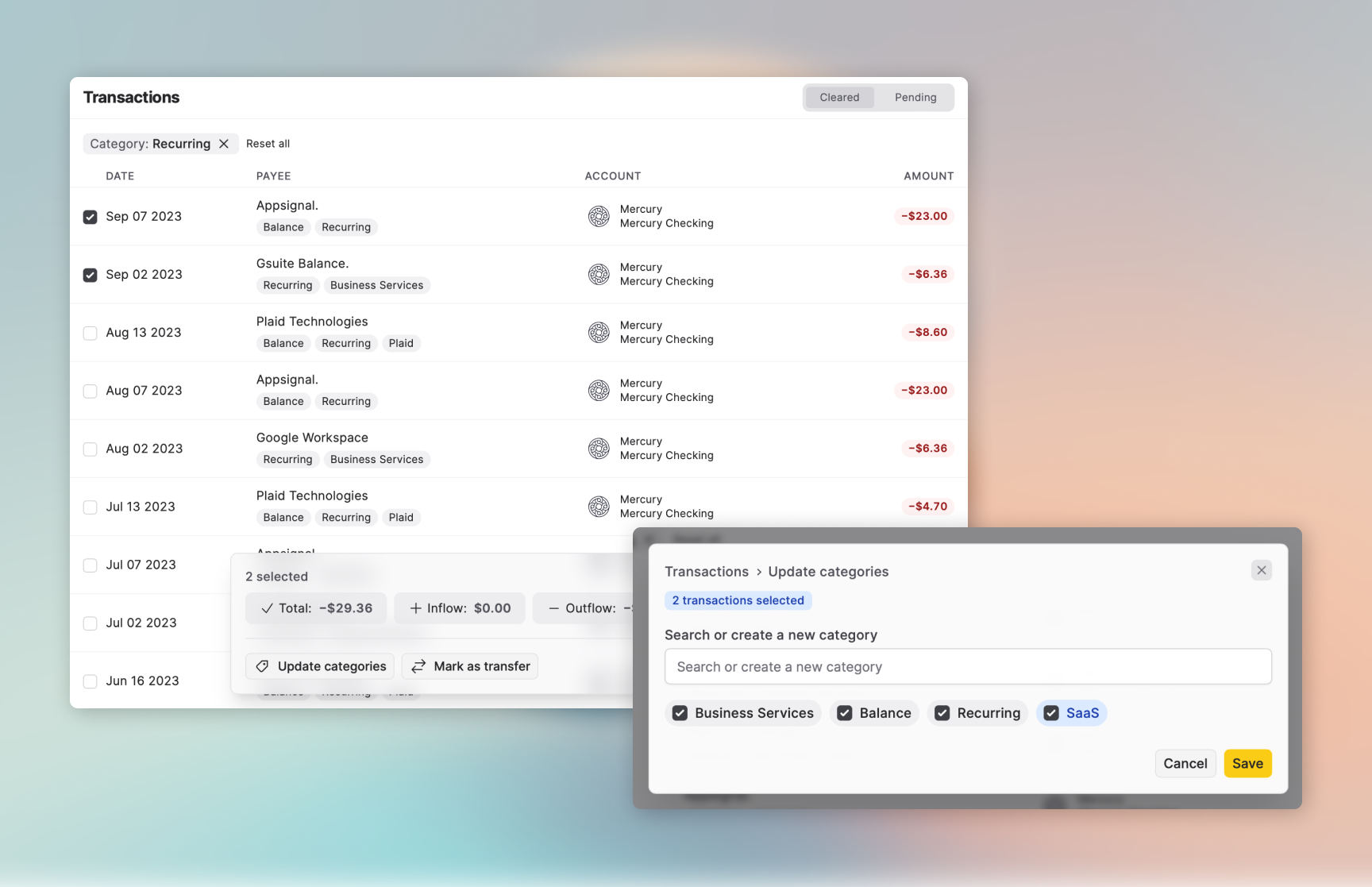

Transaction Categories

Sep 10, 2023

Introducing transaction categories! Now you can view the categories associated with a transaction. Balance will automatically fetch categories from the financial data aggregator. However, you also have the flexibility to modify or add new categories.

This release also introduces the ability to select multiple transactions by holding down the Shift key. Alternatively, you can select all transactions on the page by using Cmd + A / Ctrl + A. This allows you to quickly assign categories to multiple transactions at once.

Unlike other tools, Balance lets you assign multiple categories to a transaction. Think of categories as “tags” that provide context. For instance, you can tag a transaction as “Business Expense” and “Office Supplies”. This enables you to easily see all transactions categorized as business expenses and also provides a breakdown of categories within your business expenses.

Other improvements in this release

- Clicking on a category will filter transactions by that category.

- Improved the mobile layout for transactions.

- The experience of marking transactions as transfers has been enhanced. Instead of being directed to a new page to select a transfer, you can now mark the transaction as a transfer in a pop-up dialog that appears when you click “Mark as transfer.”

- Better and consistent logos for institutions.

-

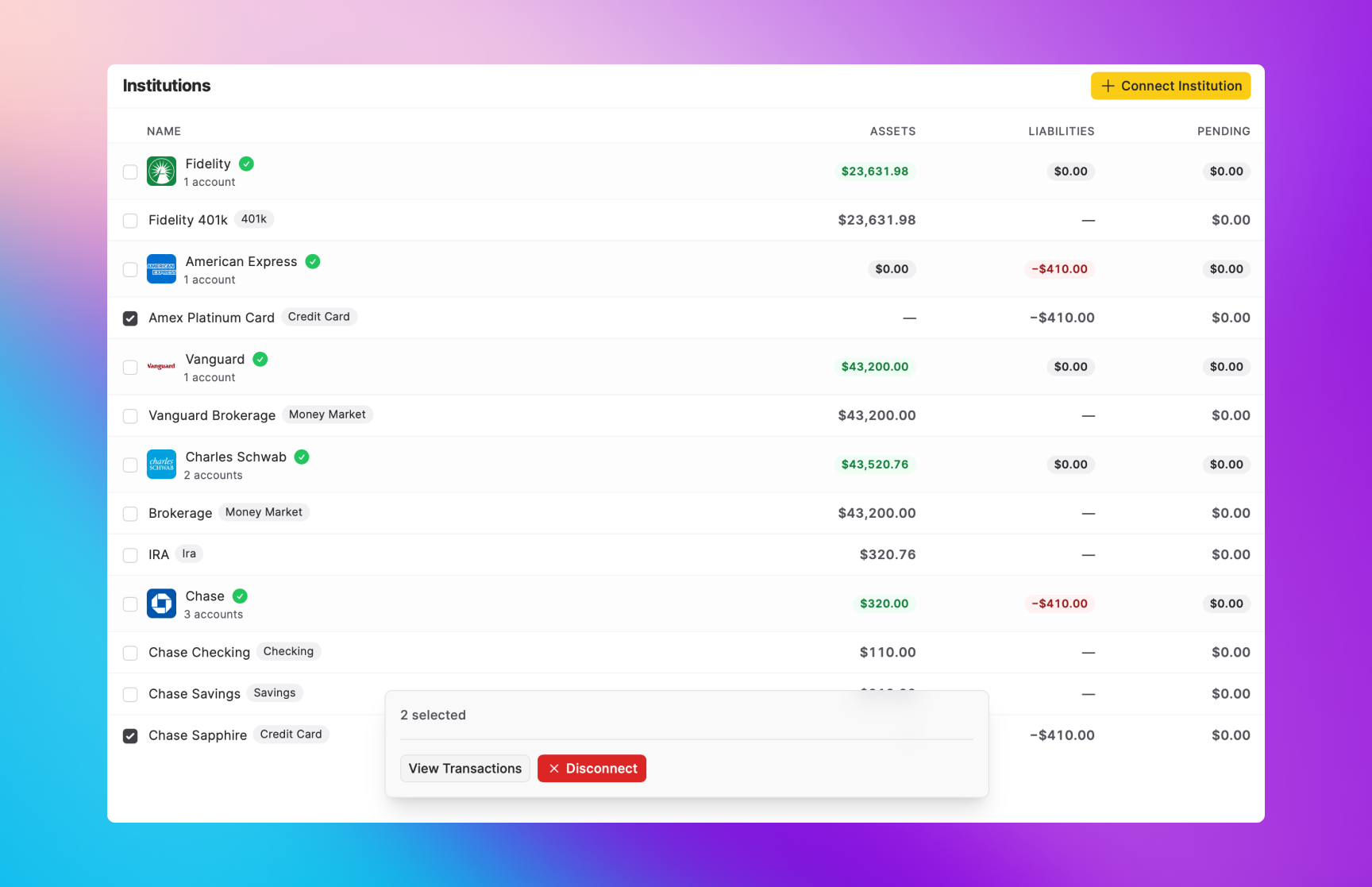

Institutions Redesign

Aug 06, 2023

The institutions page has a new design giving you a complete view of all your accounts in one place. The new design is also consistent with the rest of the app and allows you to perform bulk actions on institutions and their accounts. With the multi-selection feature, you can conveniently filter transactions from different accounts based on your specific requirements.

Another improvement in this release is the ability to rename your accounts. Simply click on the institution or account name and select the option to change the display name. The new name you choose will be updated across the app, including the transactions page. This feature is especially handy when you have multiple accounts connected from the same institution, such as yourself and your partner.

These features also lay the foundation of what’s coming up next, which is filtering. Being able to filter your financial data is immensely powerful and provides you with accurate insights. Stay tuned for more updates!

That’s all for now. I hope you enjoy this release.

-

Tracking Payments and Transfers

Jun 17, 2023

Capture payments and transfers to keep track of your money movement. Select a transaction and click “Mark as Transfer”. Balance will show you potential payment/transfer matches. After selecting the matching transaction, the two will be linked. Additionally, you can choose a transfer type of Payment (e.g. for credit card or loan payments) or Transfer (e.g. for moving money between accounts).

Payments and Transfers will appear on your dashboard in the Breakdown section. Tracking your transfers and payments helps you understand how much of your monthly spending goes towards debt payments.

-

Introducing Balance

May 20, 2023

Hey there! I’m thrilled to show you the first look at Balance! While Balance is still in its early stages of development, its goal is to help you gain an in-depth understanding of your finances.

Here’s what’s included in the first release.

Connect your financial institutions

Having all your financial data in one place is essential to taking control of your money. Balance allows you to connect your bank accounts directly inside the app. This syncs your transactions and balances from these institutions and makes finding answers about your finances easier. Balance currently works with over 10,000 US institutions through Plaid.Review your dashboard

The dashboard gives you a bird’s eye view of your financial health. The “Breakdown” section shows your Income, Expense, Assets, and Liabilities for a given month. The “Net Worth” graph shows your financial trend. “Recent Transactions” display the 10 most recent transactions, giving you an insight into how and where your money flows.Search through transactions

Balance’s search feature makes locating transactions easy and understanding what happened. You no longer have to log in to multiple bank accounts or sift through numerous statements.Daily digests

Balance sends you a daily digest of all the transactions synced to Balance. This helps you keep track of unexpected expenses, fees, or other fraudulent charges.Curious about security? Read the Security Overview to understand how your data is protected at Balance.

If any of this intrigues you, get on the early-access list to receive an invite when Balance is ready.

Until next time ✌