Hey there! I’m thrilled to show you the first look at Balance! While Balance is still in its early stages of development, its goal is to help you gain an in-depth understanding of your finances.

Here’s what’s included in the first release.

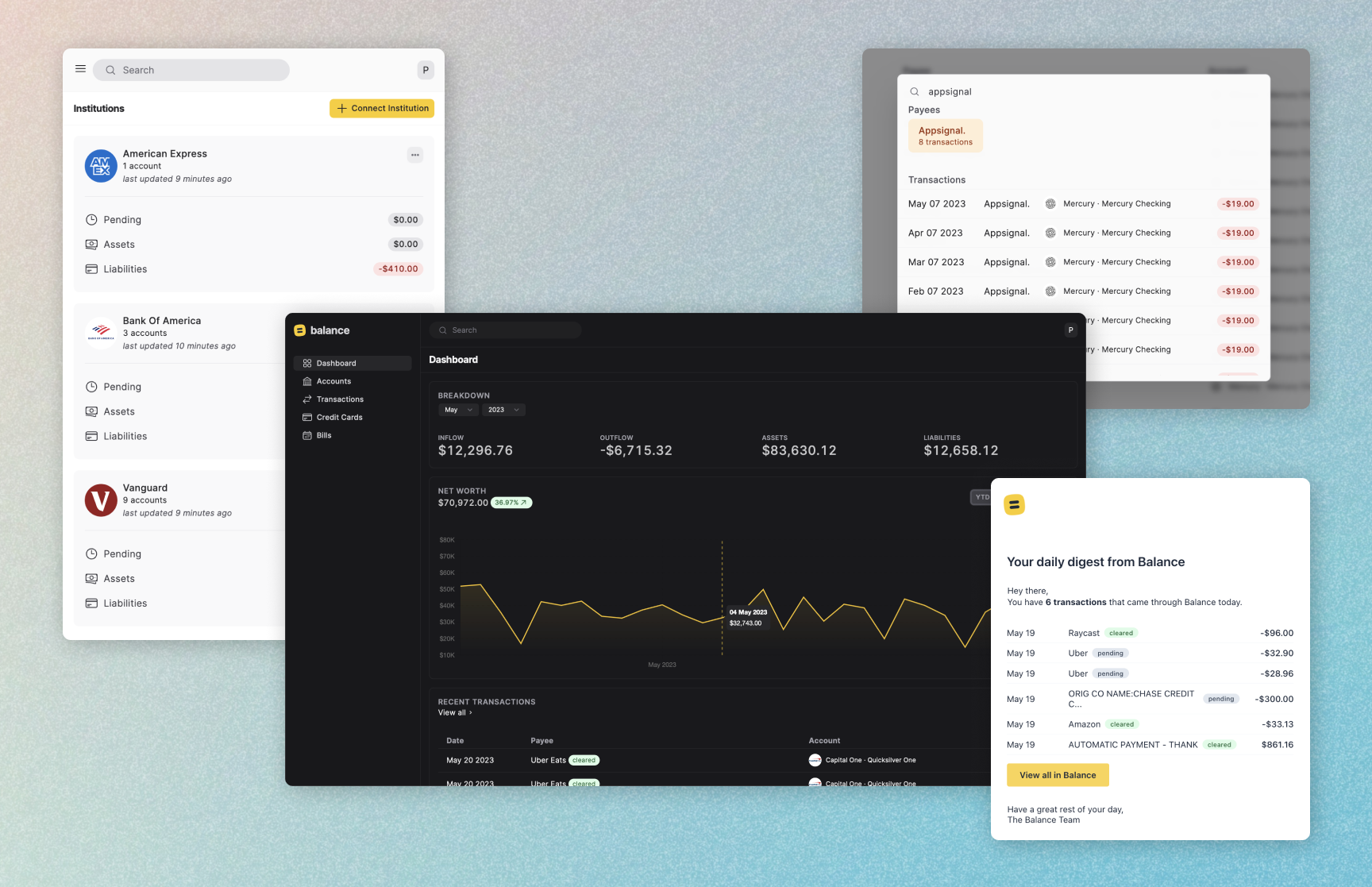

Connect your financial institutions

Having all your financial data in one place is essential to taking control of your money. Balance allows you to connect your bank accounts directly inside the app. This syncs your transactions and balances from these institutions and makes finding answers about your finances easier. Balance currently works with over 10,000 US institutions through Plaid.

Review your dashboard

The dashboard gives you a bird’s eye view of your financial health. The “Breakdown” section shows your Income, Expense, Assets, and Liabilities for a given month. The “Net Worth” graph shows your financial trend. “Recent Transactions” display the 10 most recent transactions, giving you an insight into how and where your money flows.

Search through transactions

Balance’s search feature makes locating transactions easy and understanding what happened. You no longer have to log in to multiple bank accounts or sift through numerous statements.

Daily digests

Balance sends you a daily digest of all the transactions synced to Balance. This helps you keep track of unexpected expenses, fees, or other fraudulent charges.

Curious about security? Read the Security Overview to understand how your data is protected at Balance.

If any of this intrigues you, get on the early-access list to receive an invite when Balance is ready.

Until next time ✌