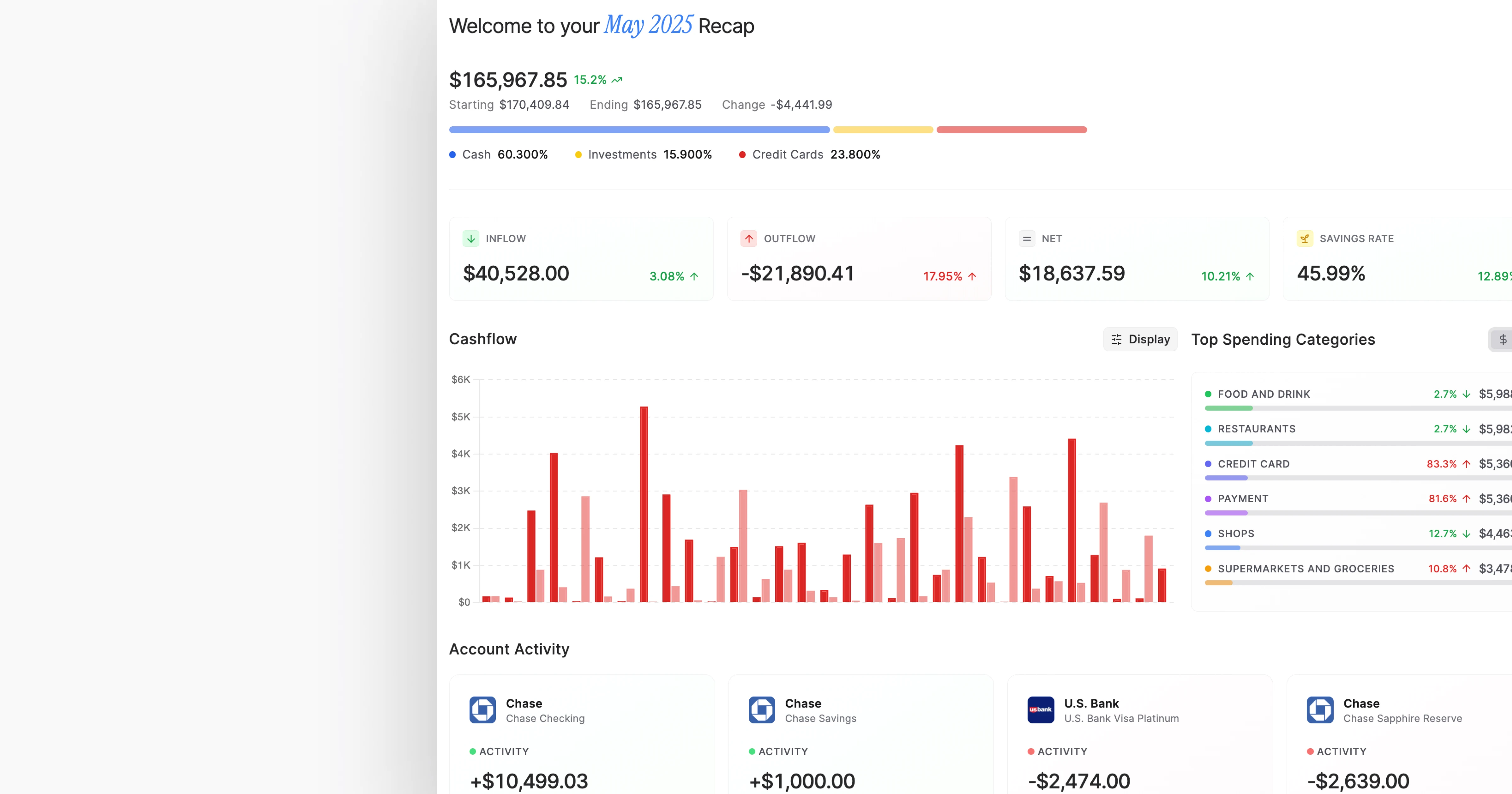

Today, I’m excited to launch Recaps — a comprehensive monthly financial summary that helps you step back and understand your financial patterns over time. While Balance’s daily insights provide tactical awareness, Recaps gives you the strategic perspective needed to make informed financial decisions.

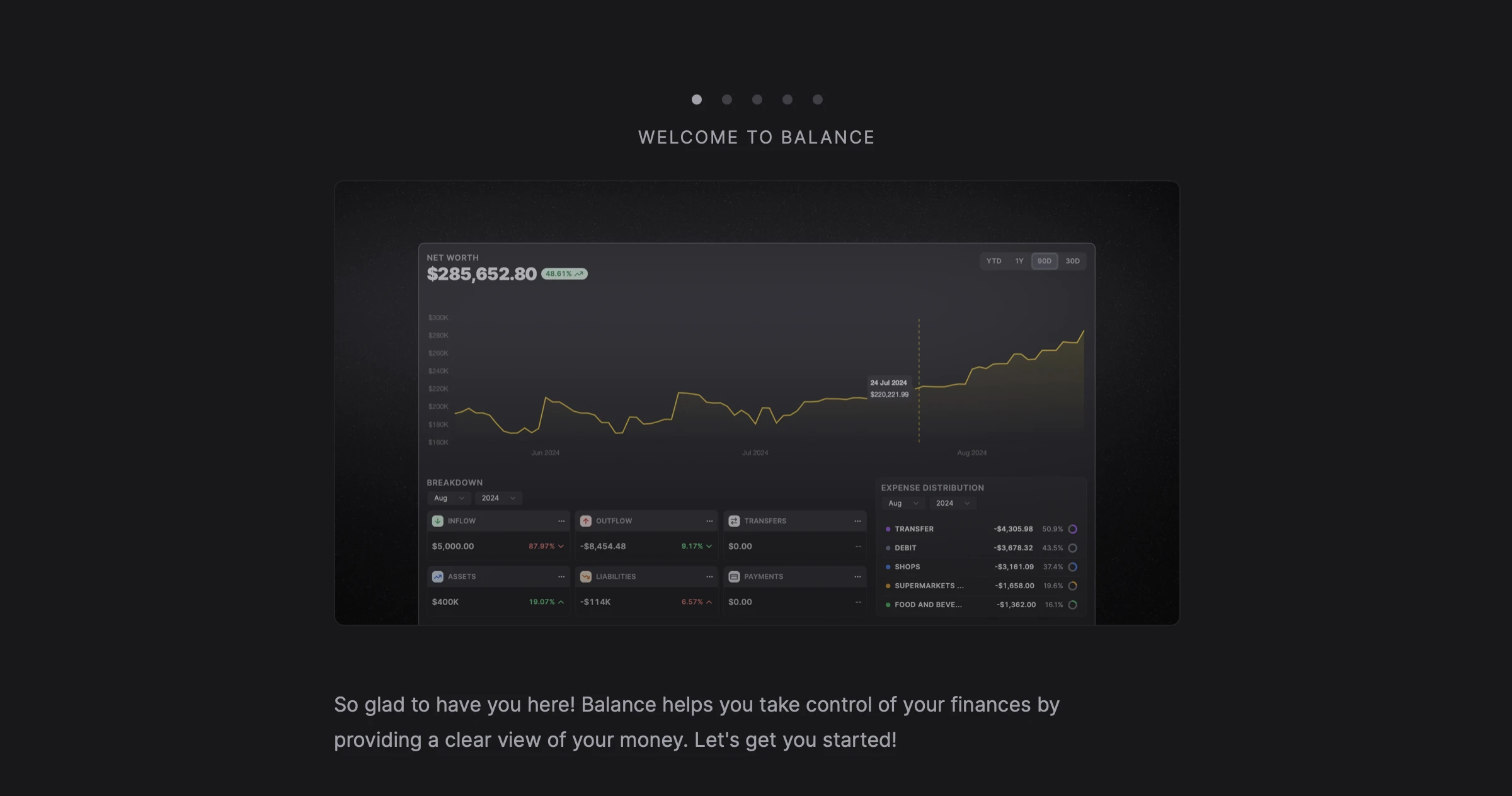

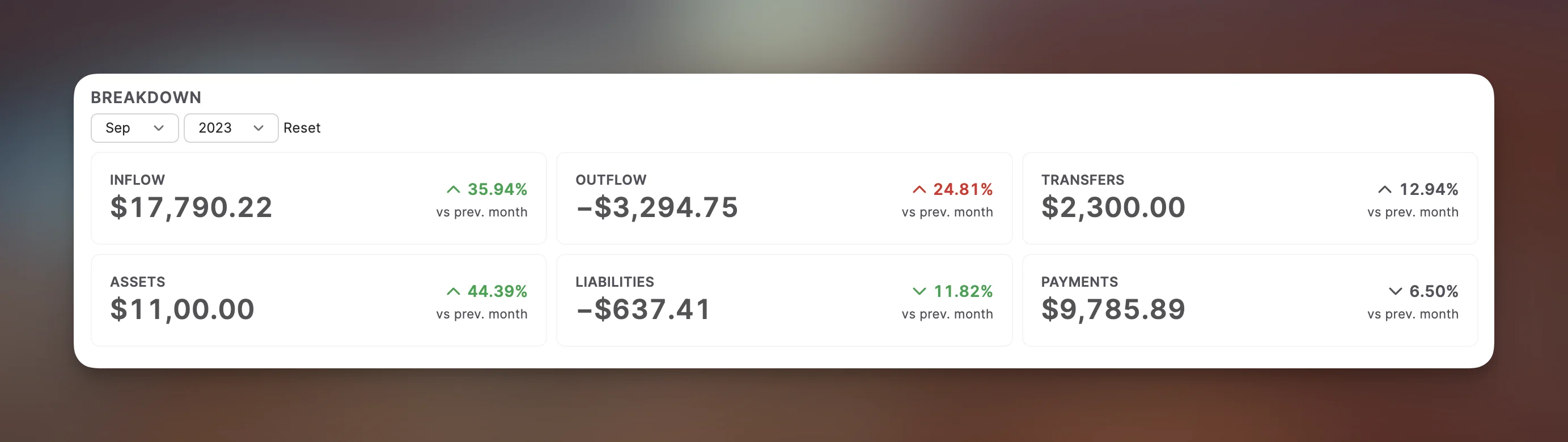

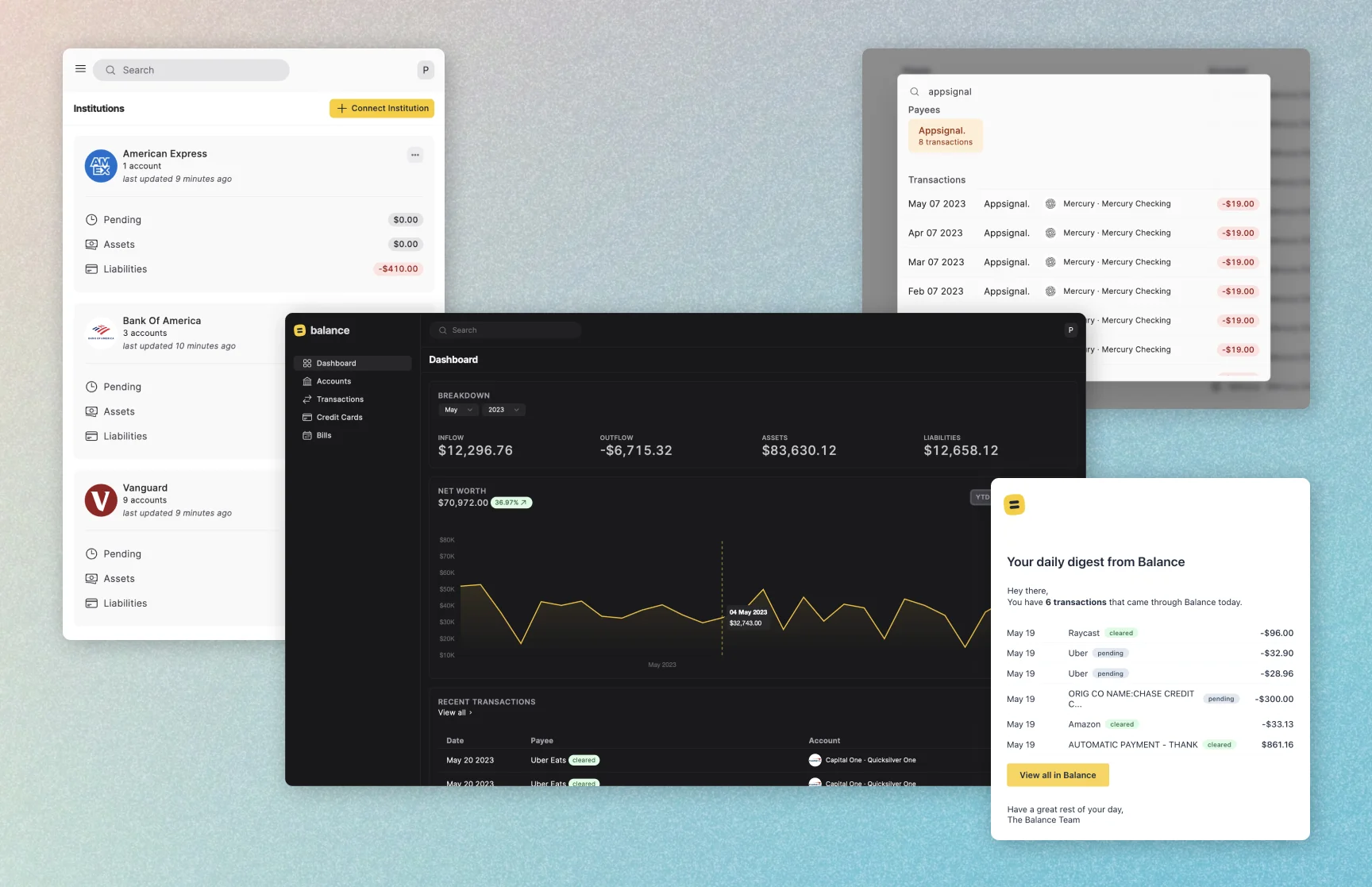

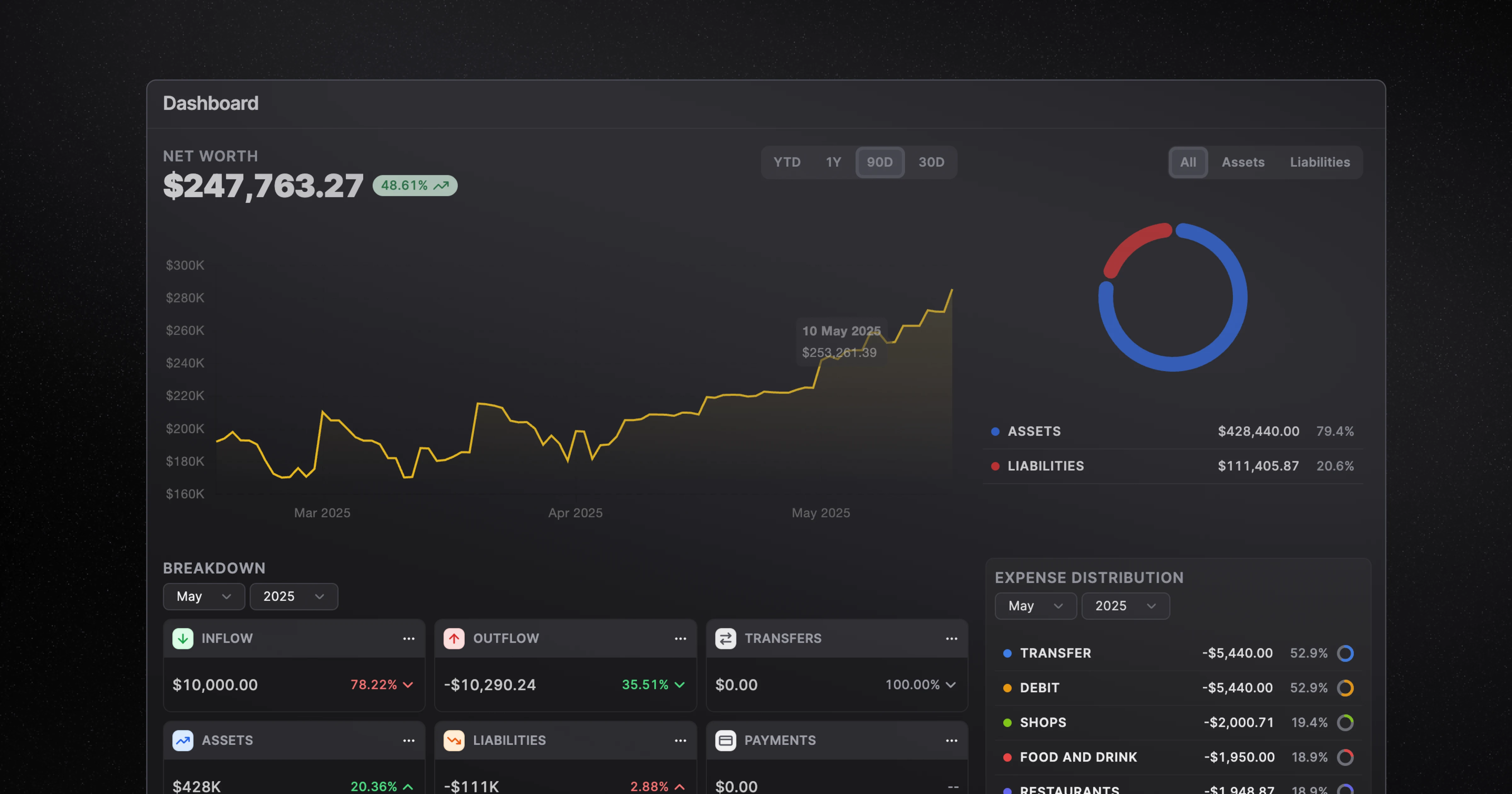

Monthly Financial Overview

Get a complete picture of your financial health with automatically generated monthly summaries. Each recap includes your net worth progression, spending breakdowns, account activity, and transaction highlights — all in one comprehensive view.

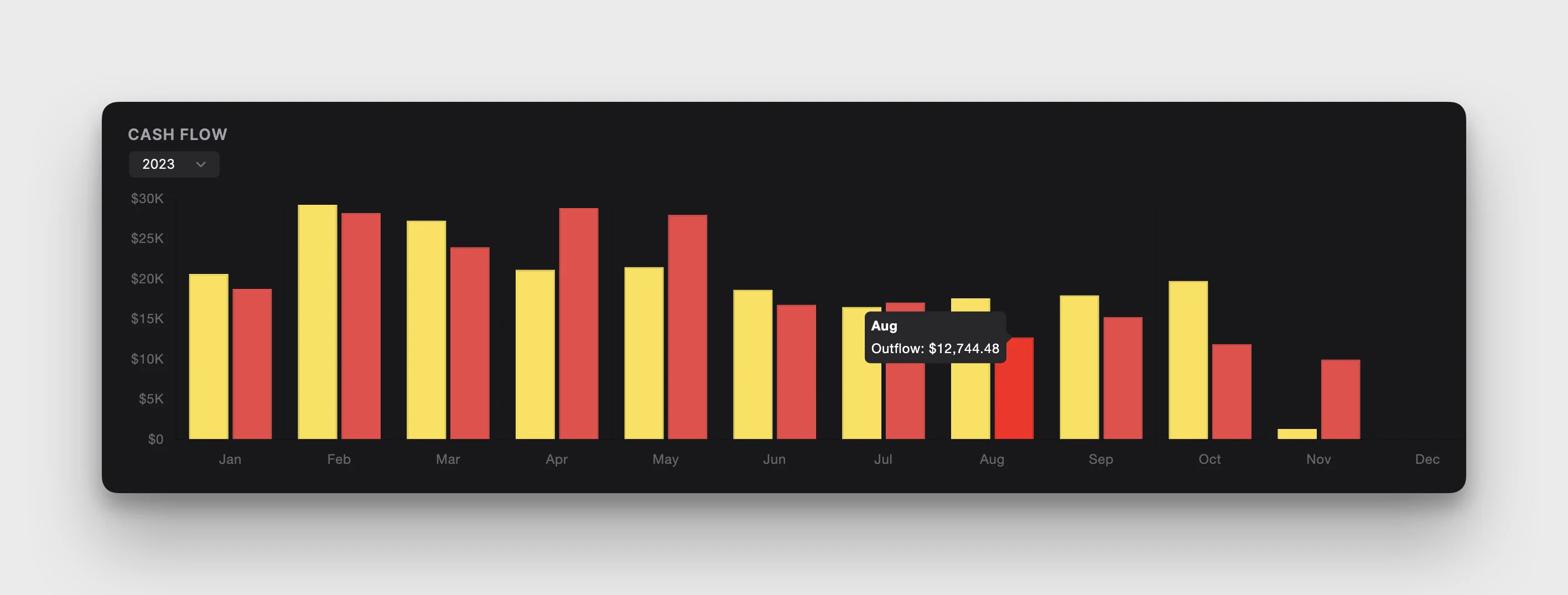

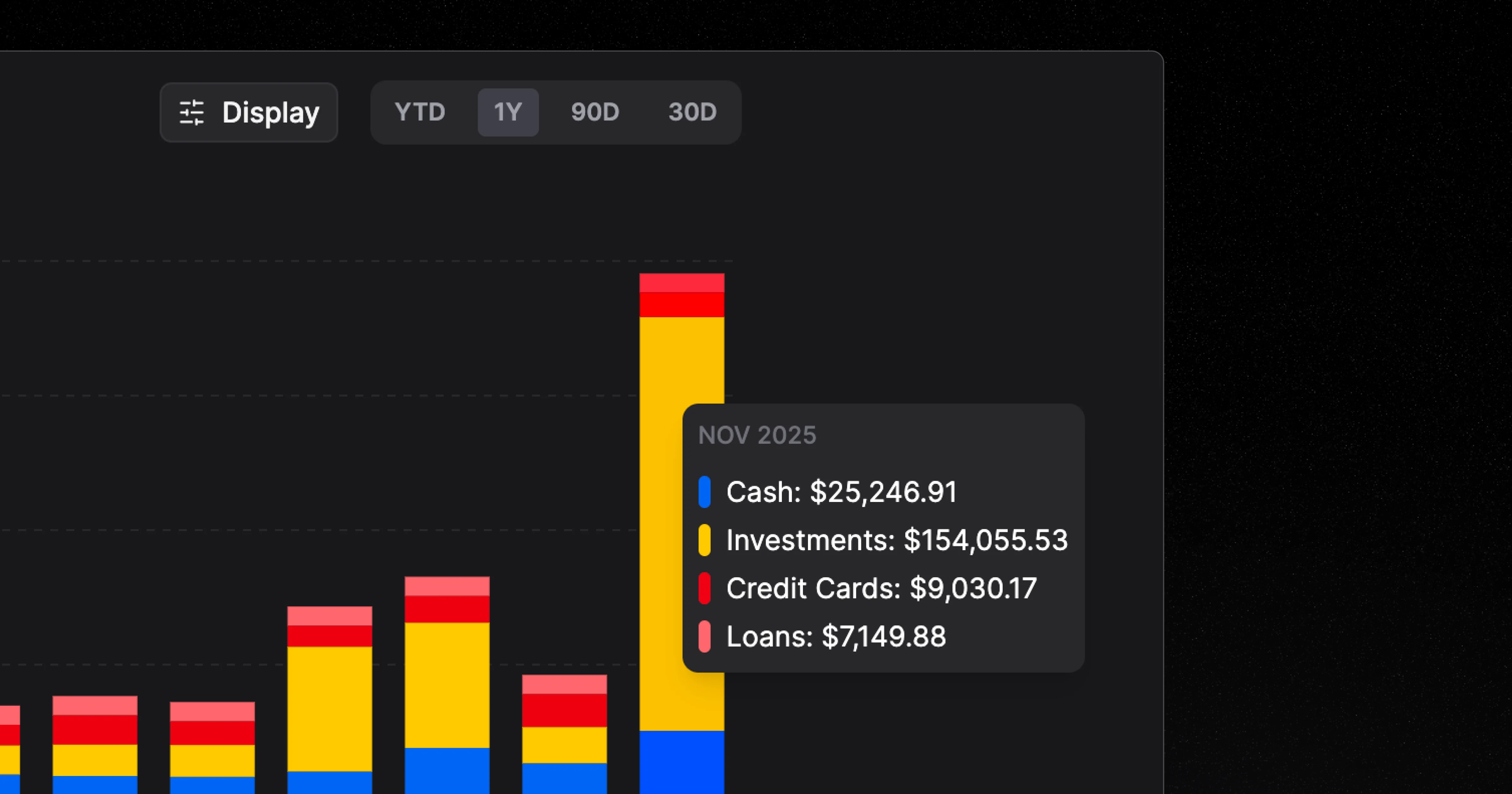

Interactive Cashflow Analysis

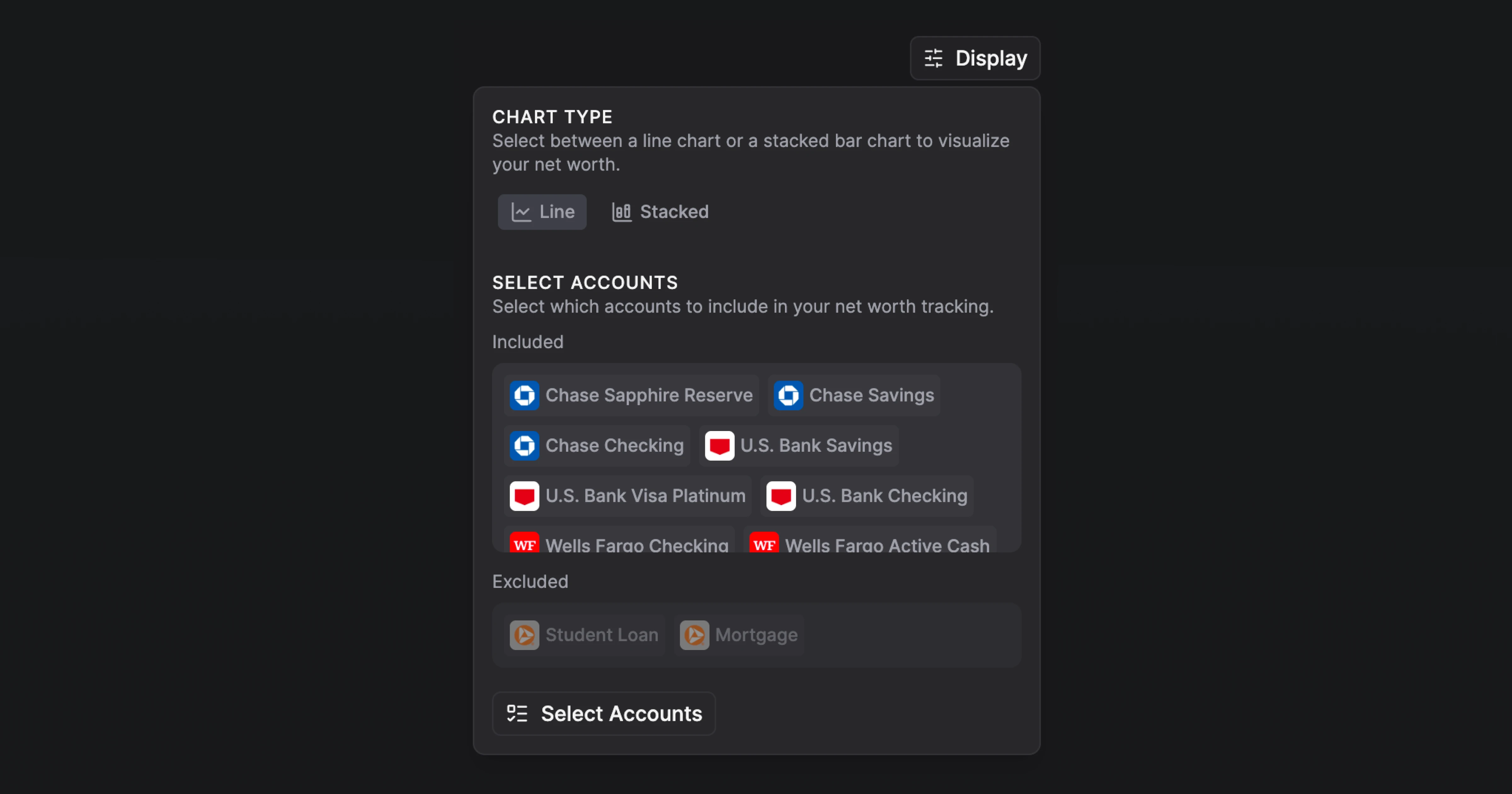

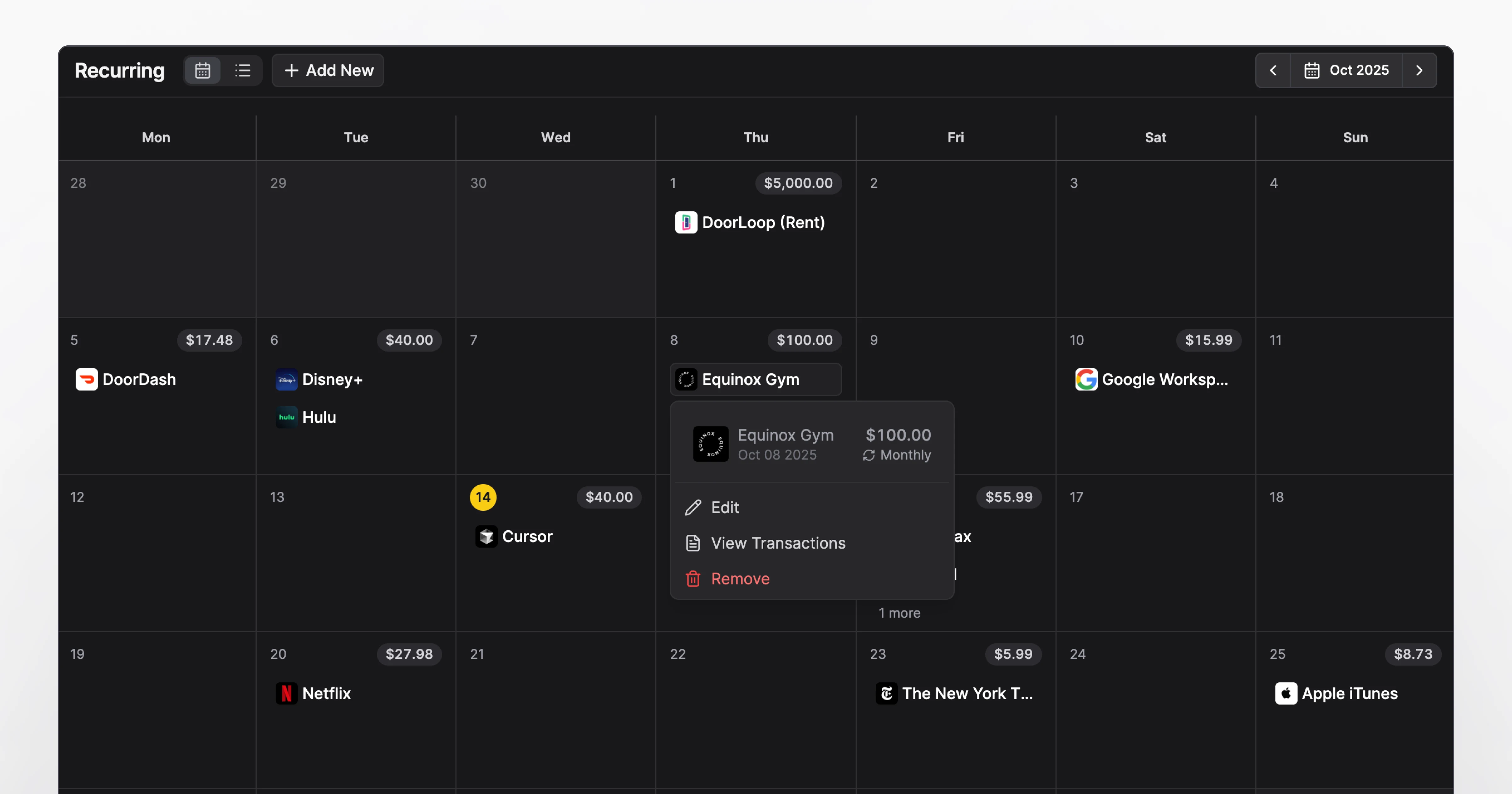

Visualize your income and expenses with customizable charts. Switch between line and bar graphs, toggle between inflow and outflow views, and compare current month performance against previous periods. Choose between daily transactions or cumulative trends to see your money movement exactly how you want.

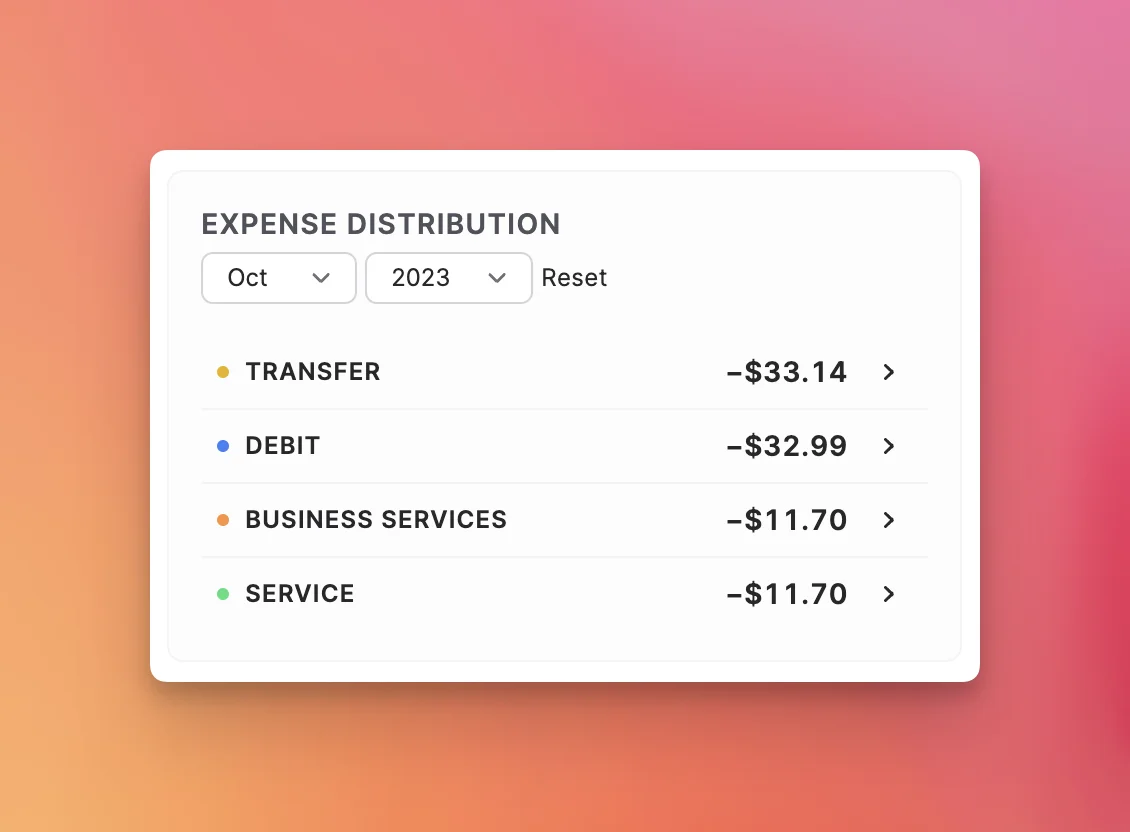

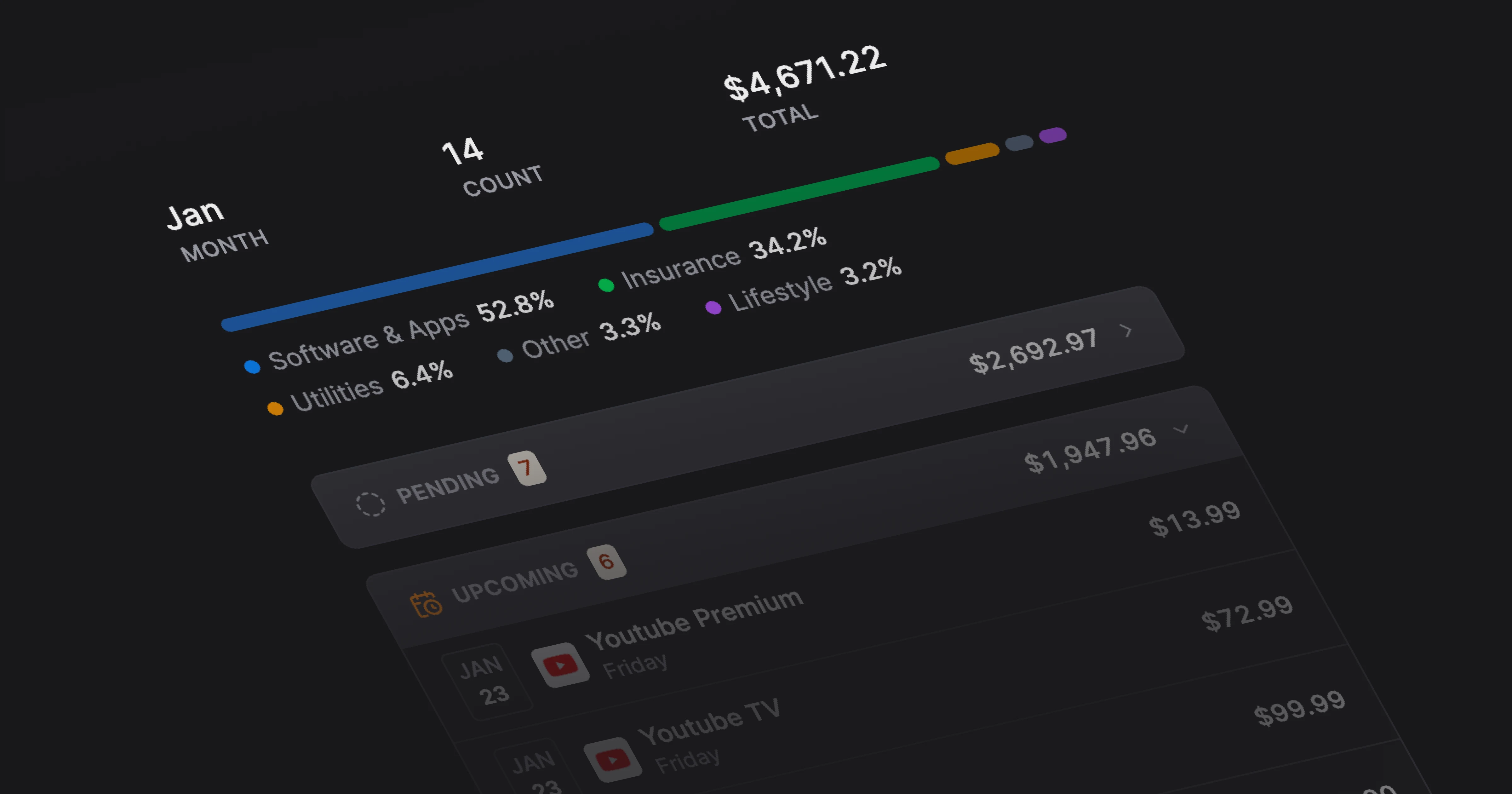

Smart Category Insights

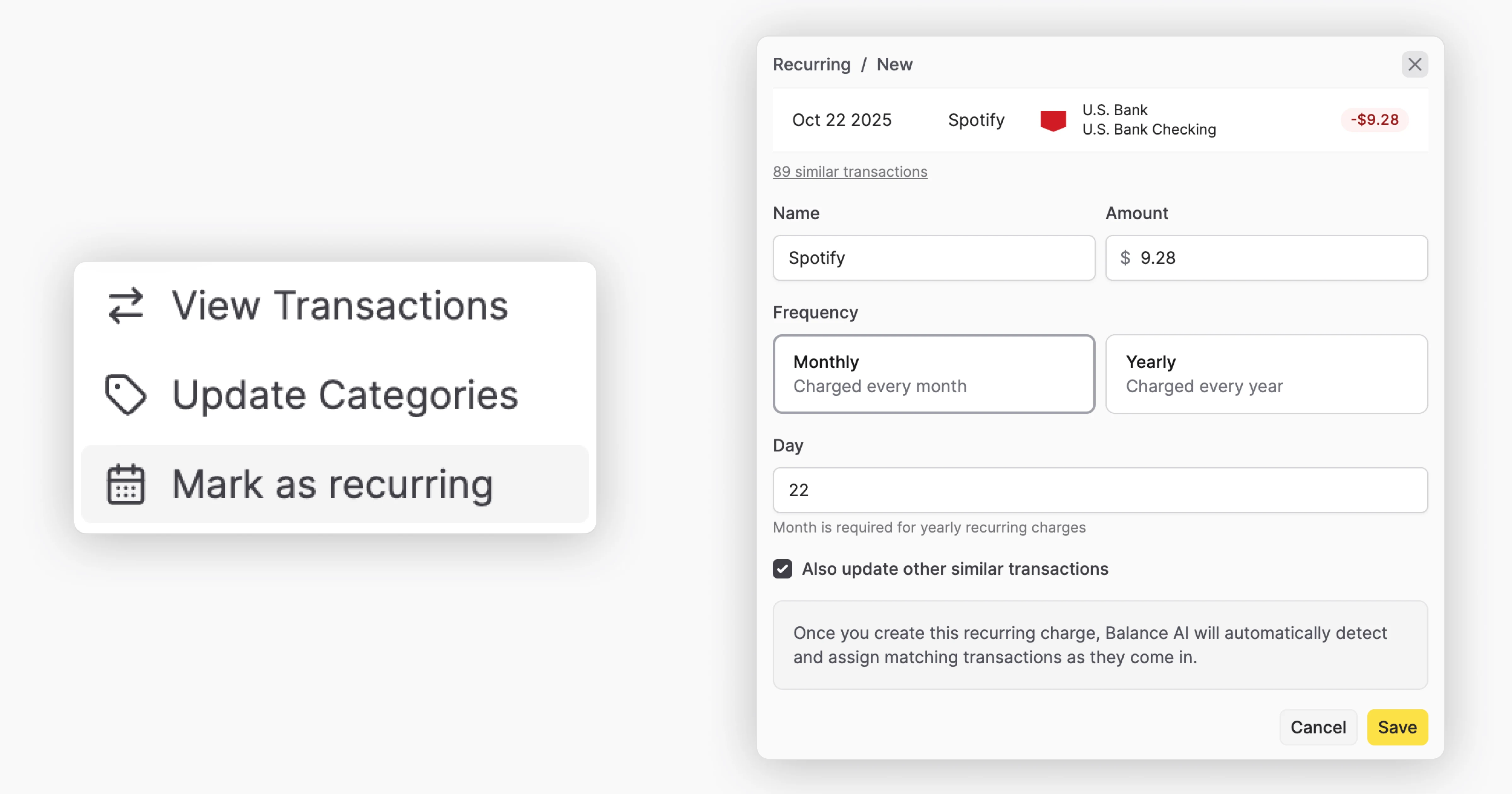

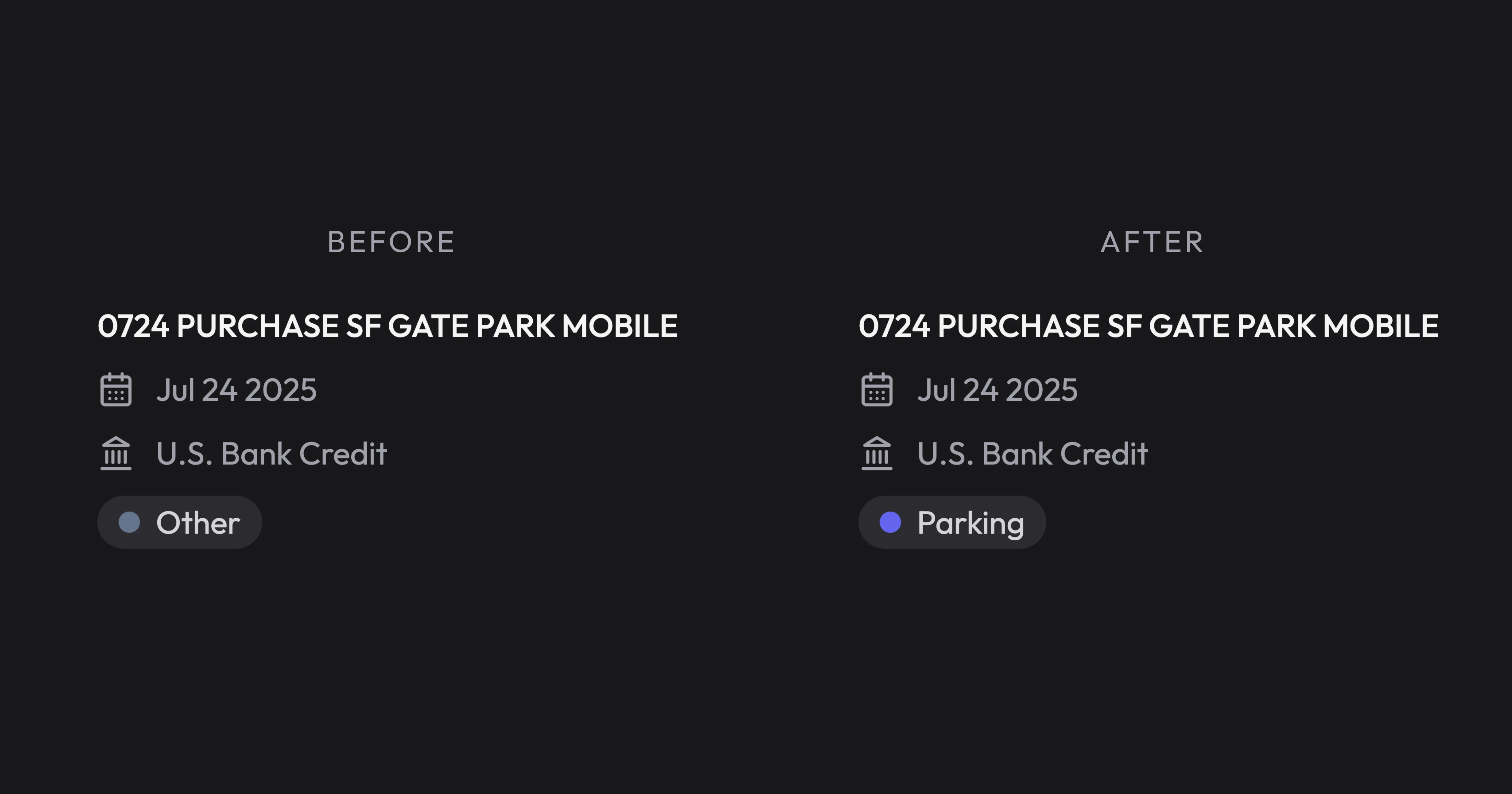

Understand your spending patterns with visual category breakdowns and trend analysis. Each category displays month-over-month changes with toggles to view percentage or dollar amounts, plus click-through access to detailed transaction histories for deeper insights.

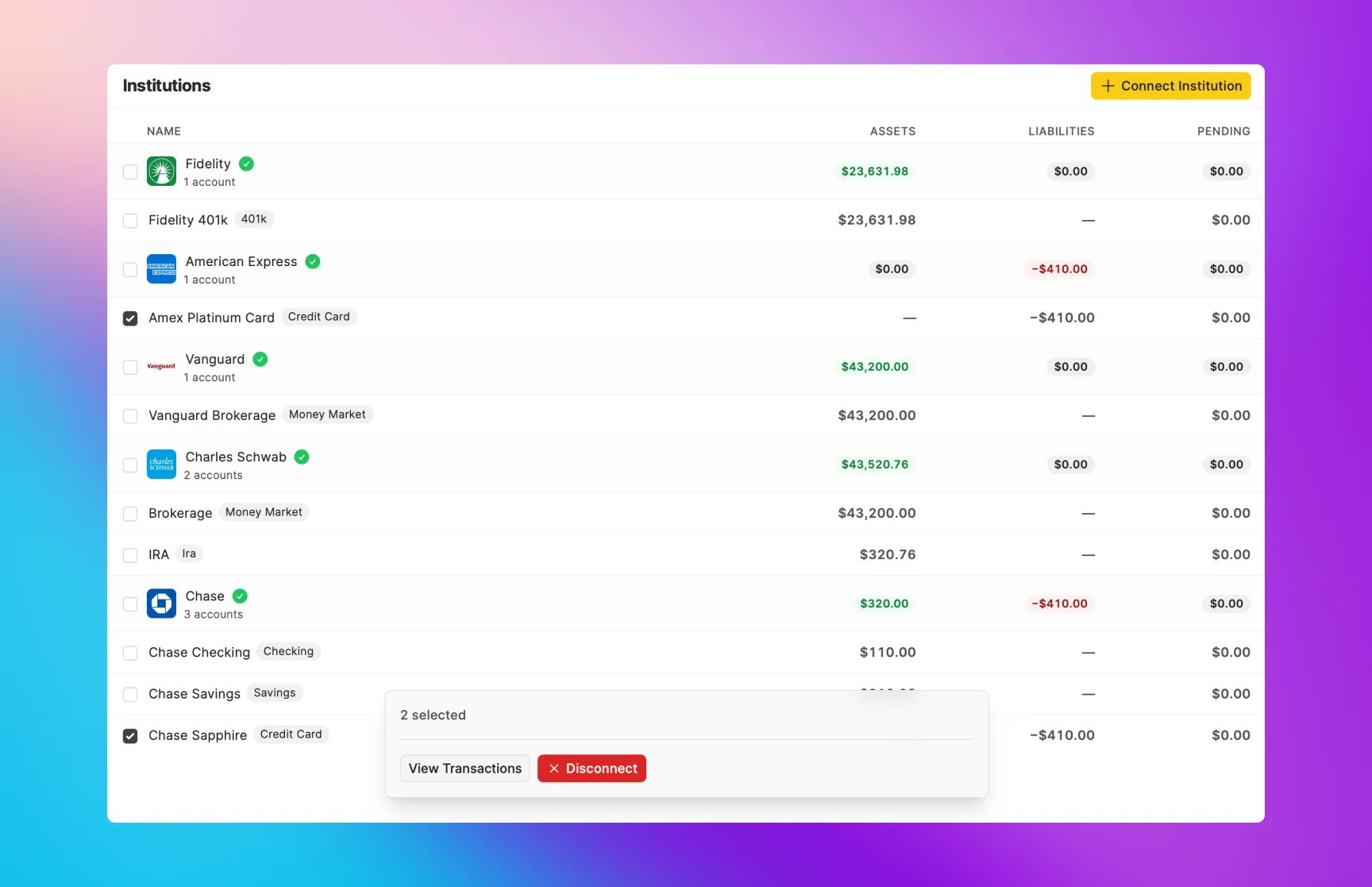

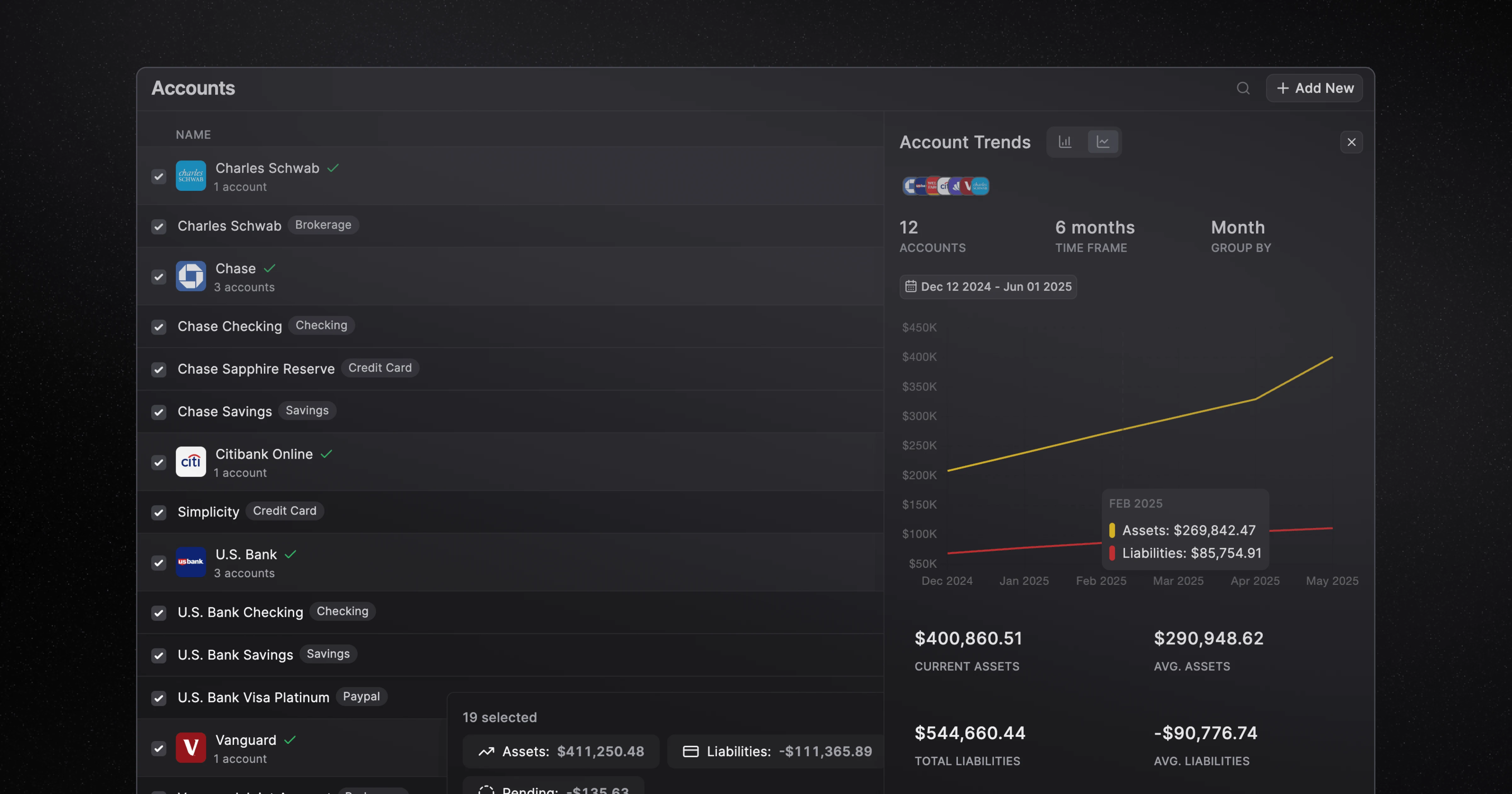

Account Activity Summary

Track money movement in all your accounts. See which accounts had the most activity during the month, with starting and ending balances plus change percentages. Perfect for tracking investment performance and understanding how money flows through your accounts.

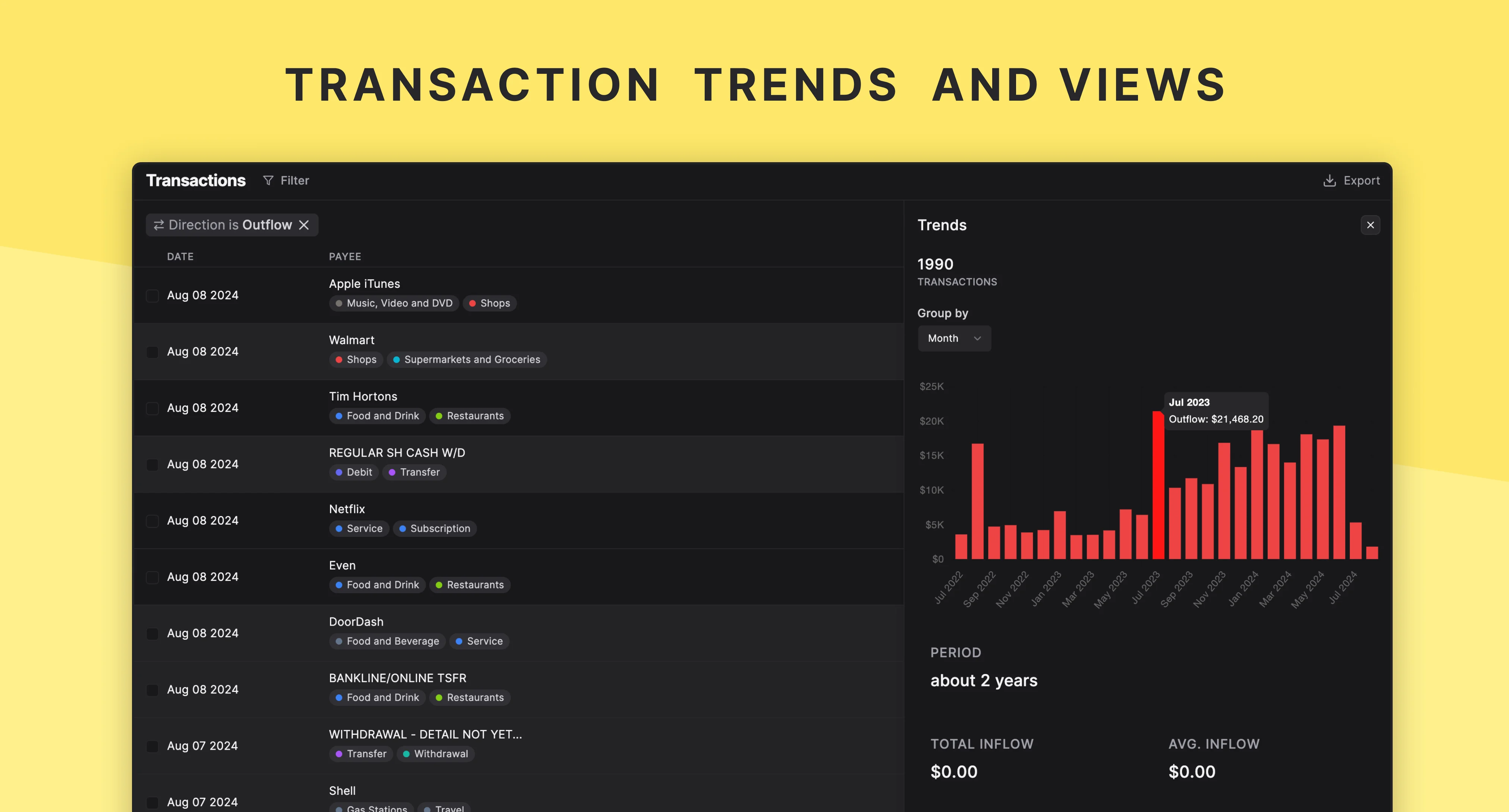

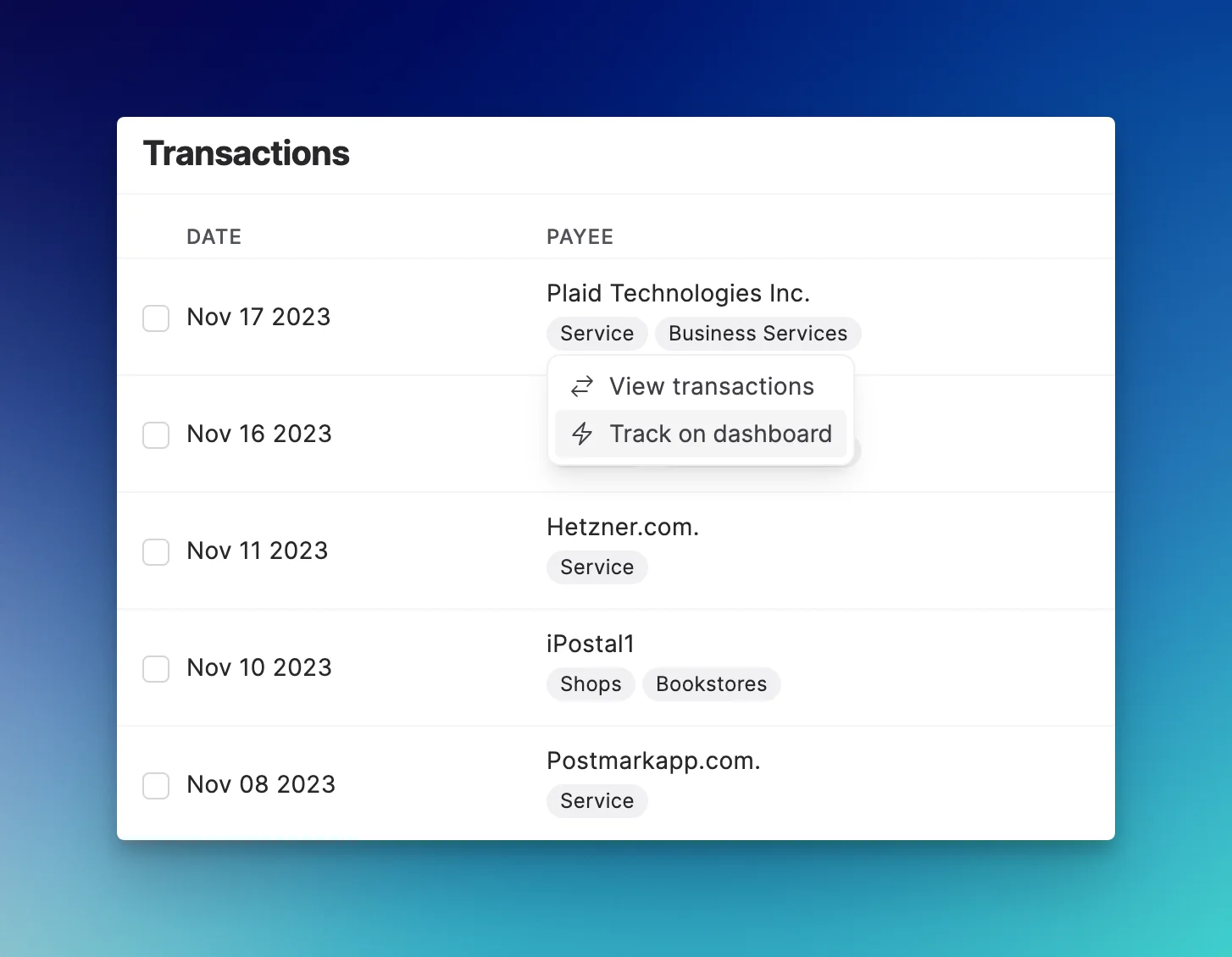

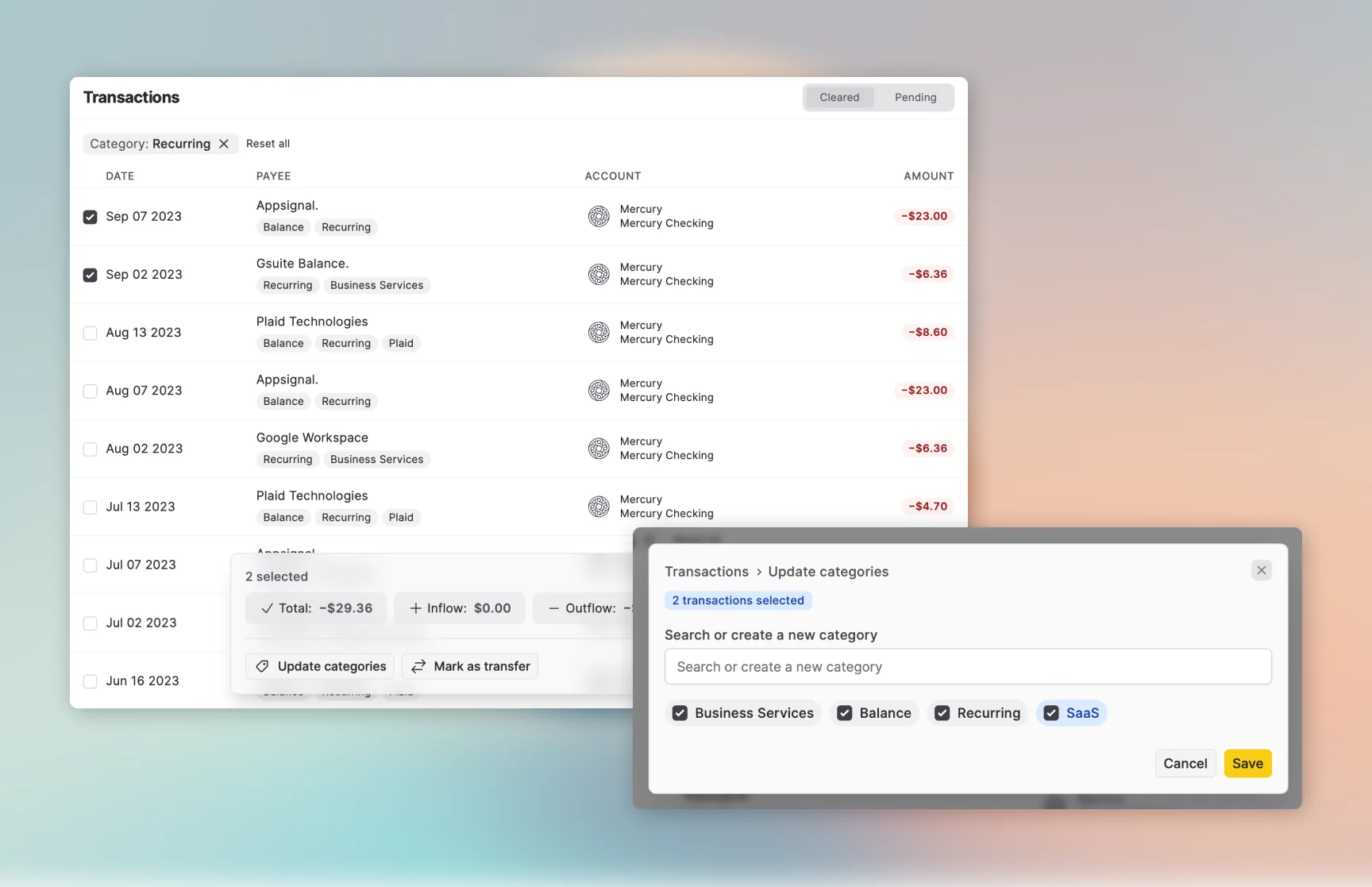

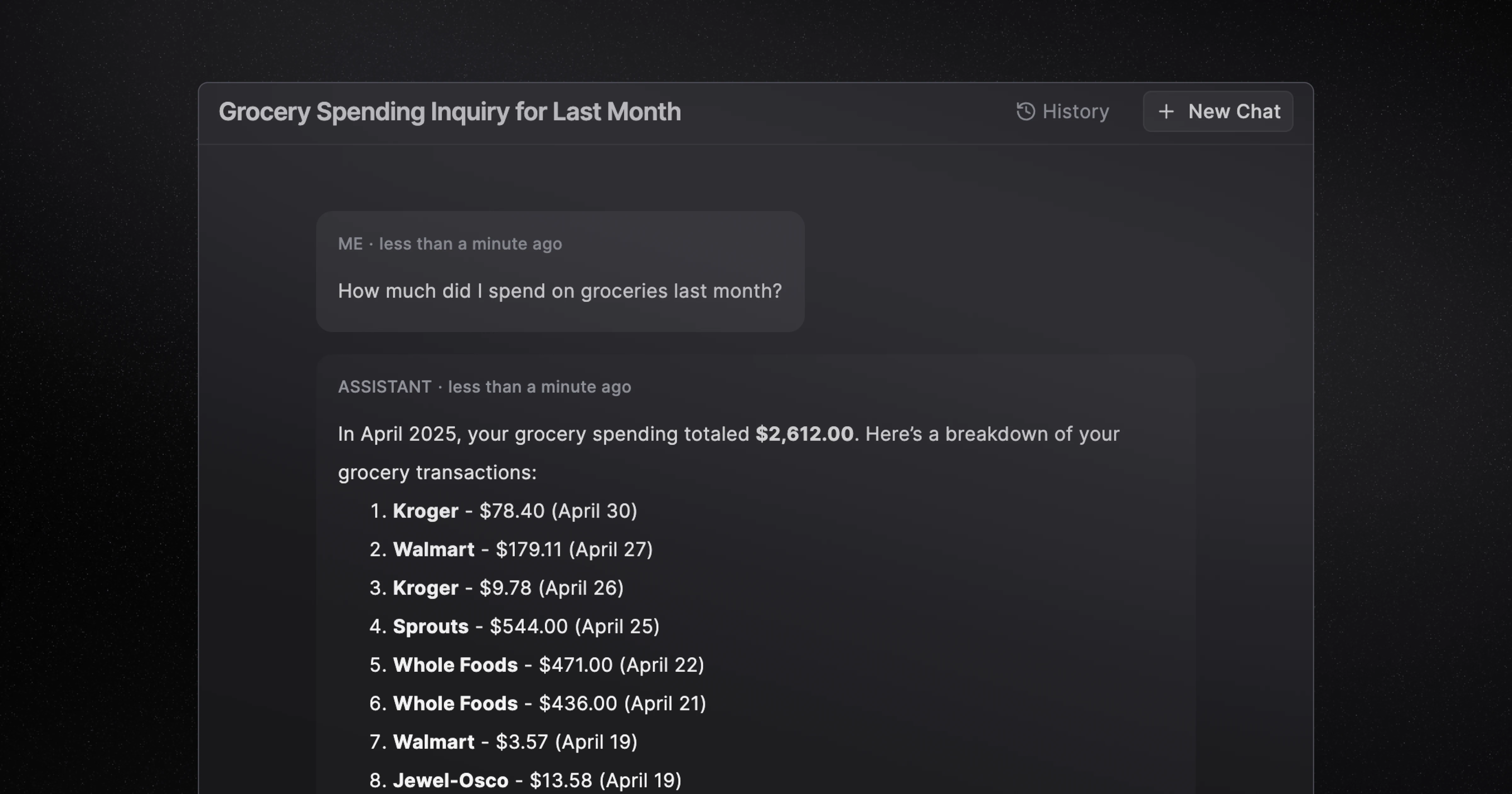

Transaction Highlights

Review your largest transactions to identify the major financial events that shaped your month. Spot outliers and unexpected expenses at a quick glance without digging through your entire transaction history.

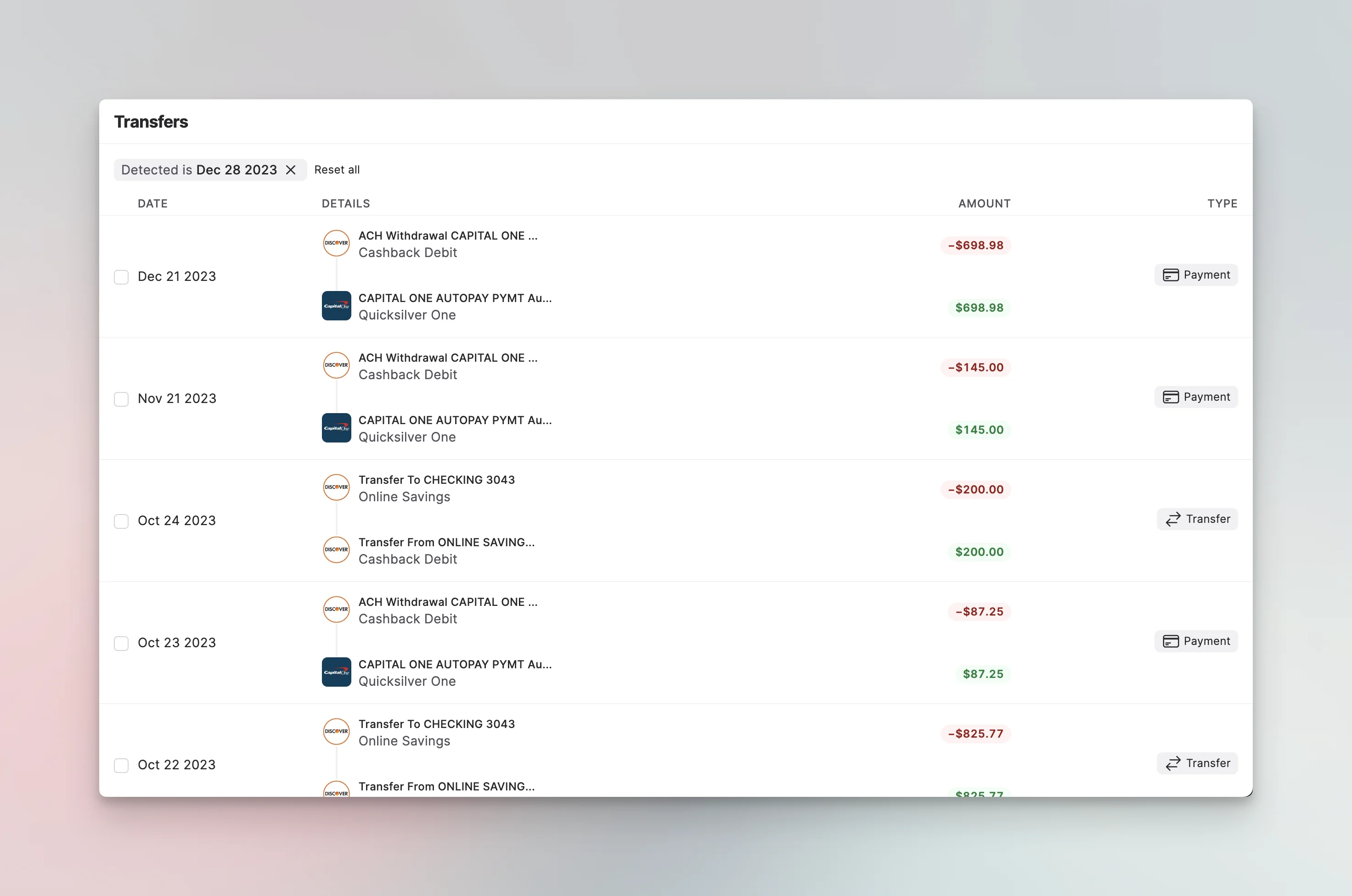

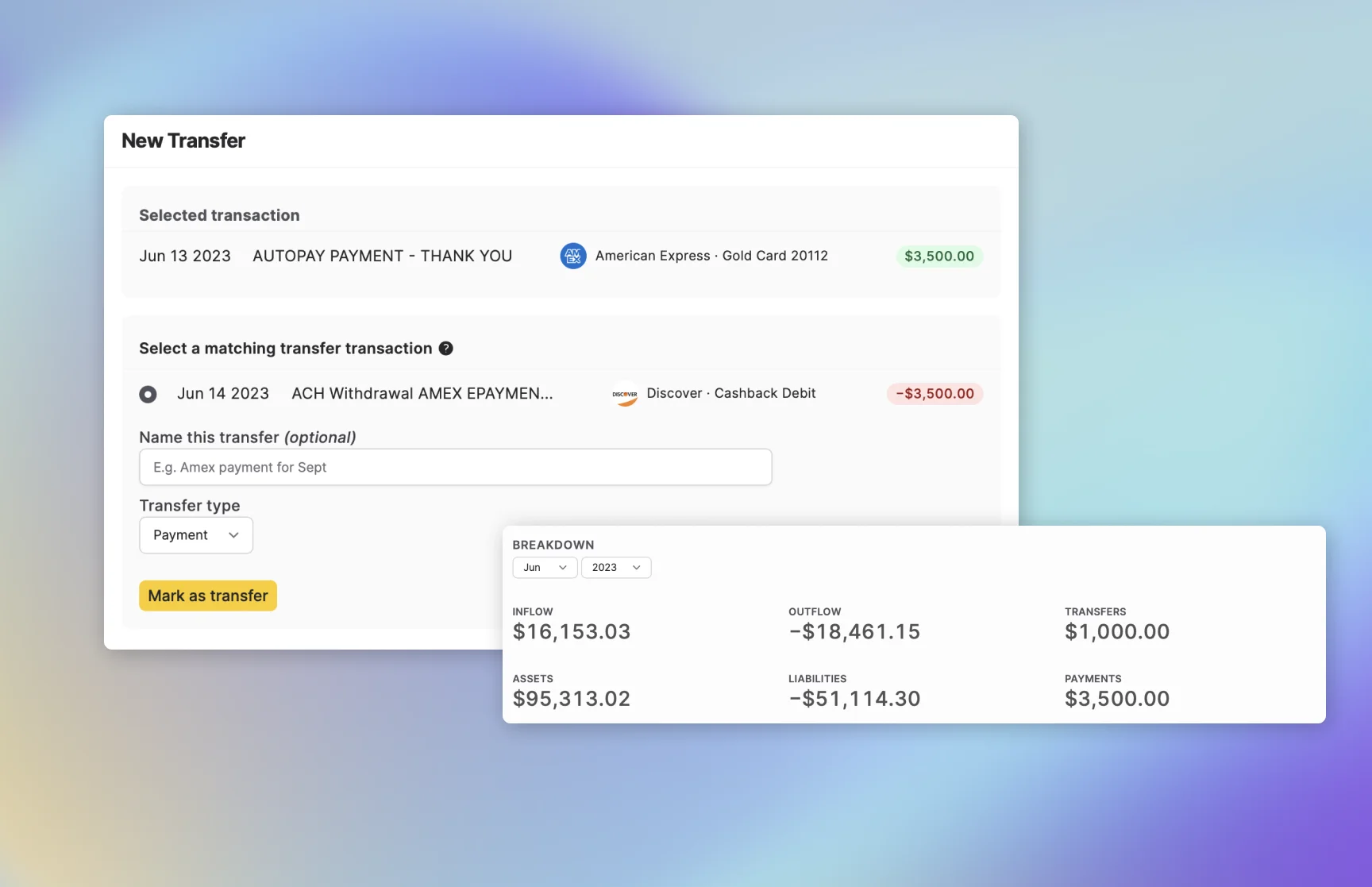

Transfer Summaries

See account transfers and credit card payments in one unified view. Compare changes from previous months to understand credit card usage or saving patterns.

Recaps are available for the past 6 months, with new monthly summaries generated automatically going forward.

Available to Plus subscribers.

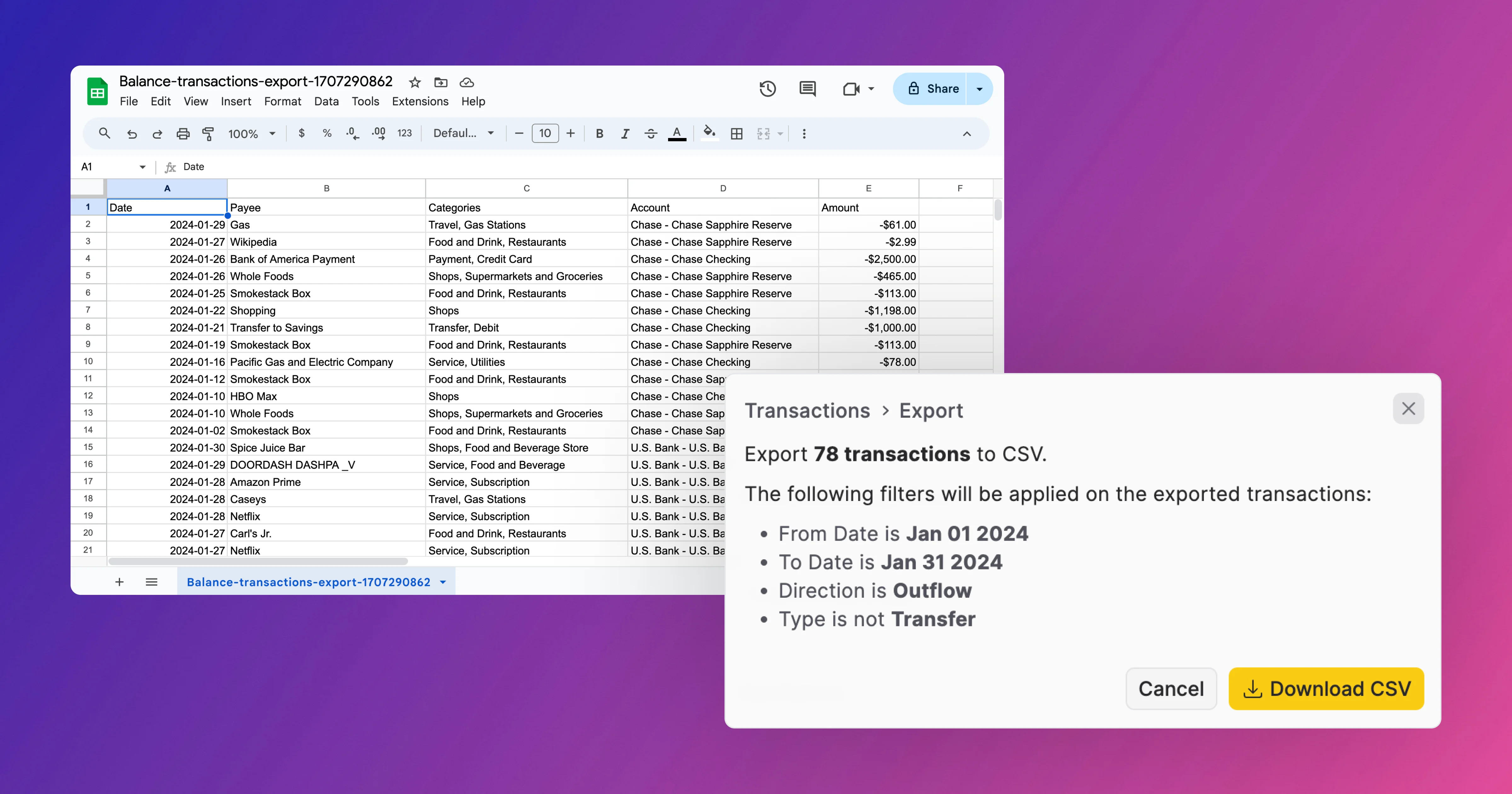

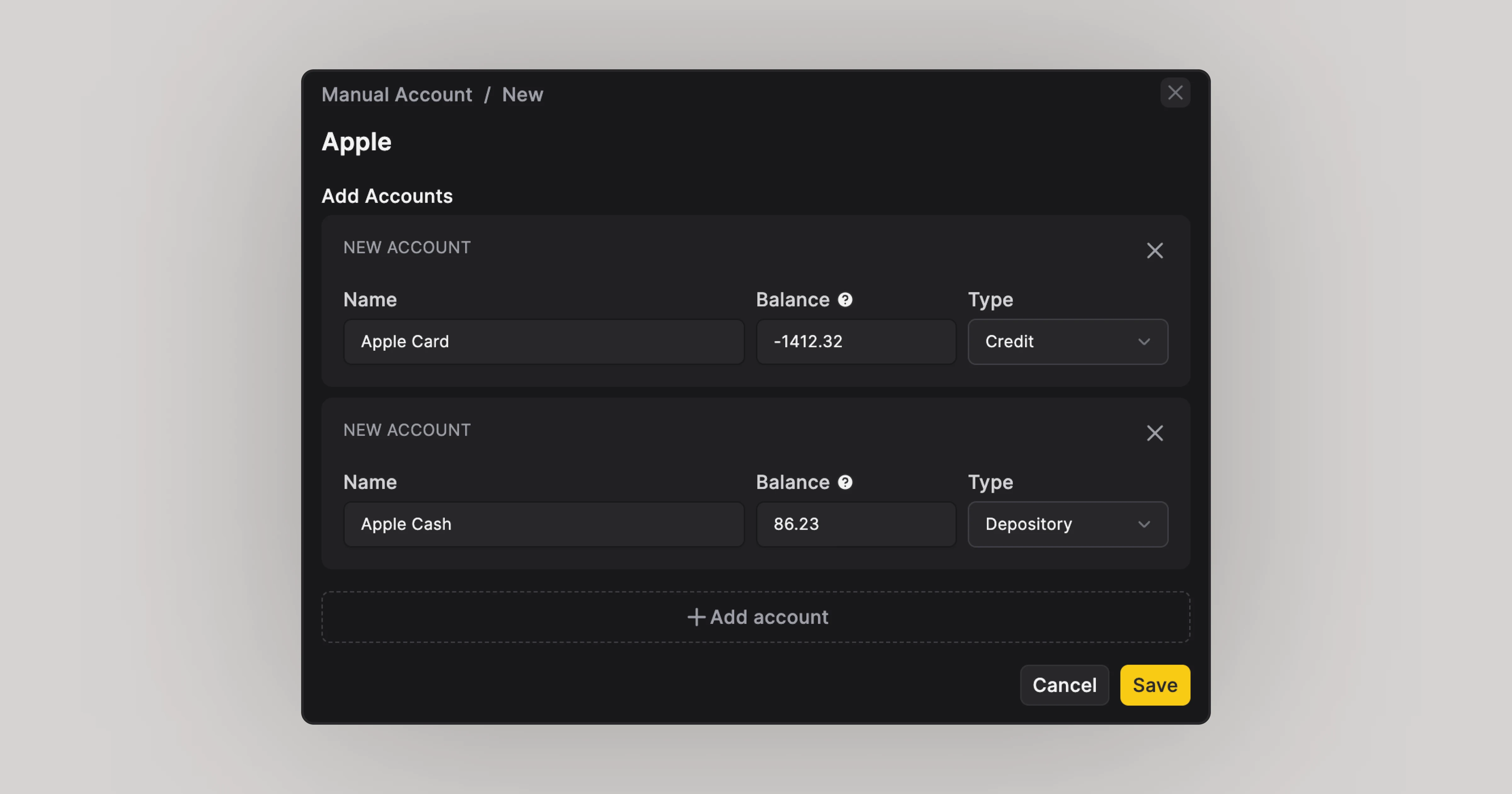

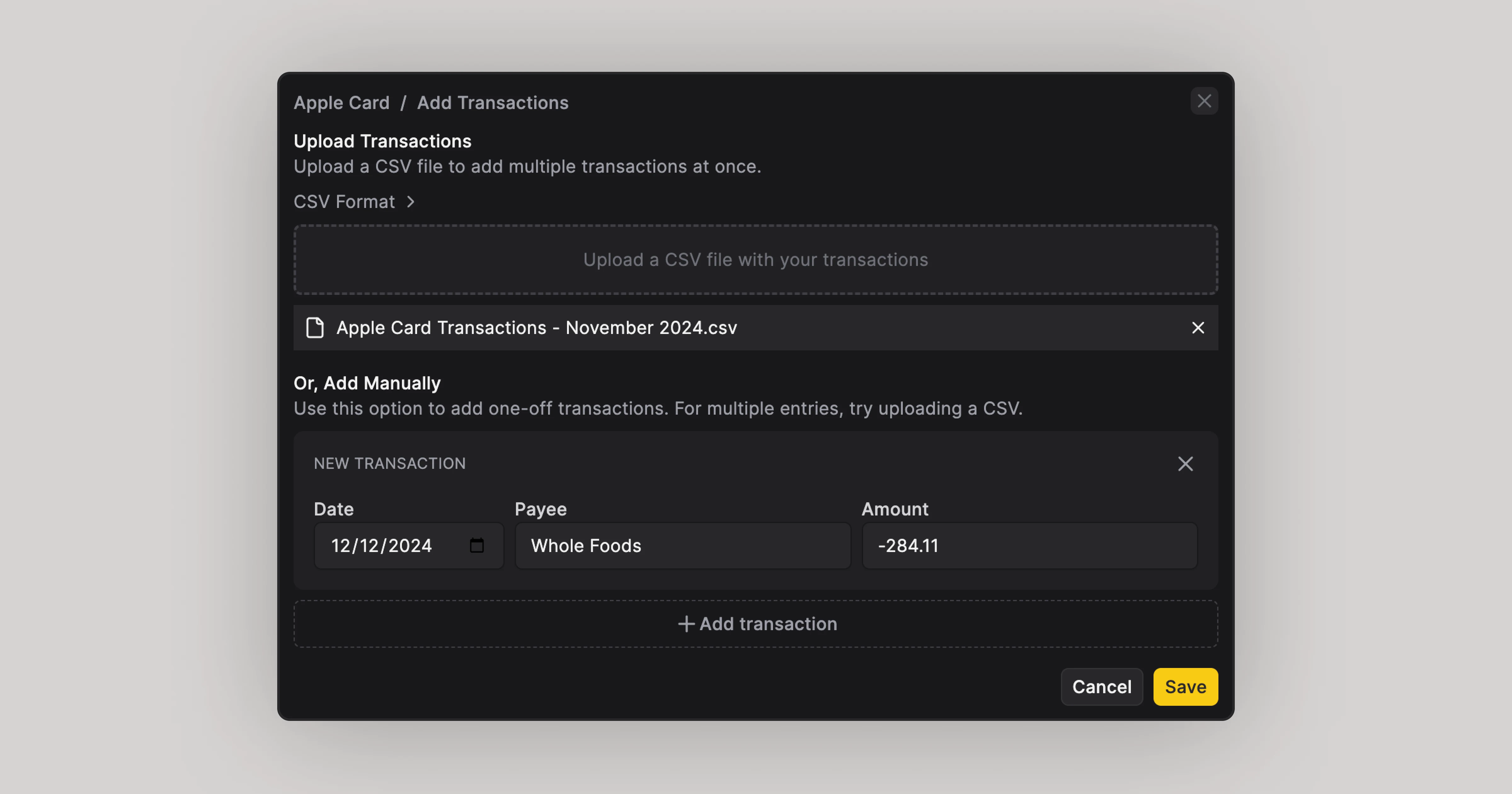

For manual accounts, you'll have full control over your transactional data. You can import transactions in bulk by uploading a CSV or add them individually as you go—right in the app. Manual accounts and transactions seamlessly integrate with your existing financial data, including net worth calculations and financial analytics, giving you a more holistic view of your finances.

For manual accounts, you'll have full control over your transactional data. You can import transactions in bulk by uploading a CSV or add them individually as you go—right in the app. Manual accounts and transactions seamlessly integrate with your existing financial data, including net worth calculations and financial analytics, giving you a more holistic view of your finances.