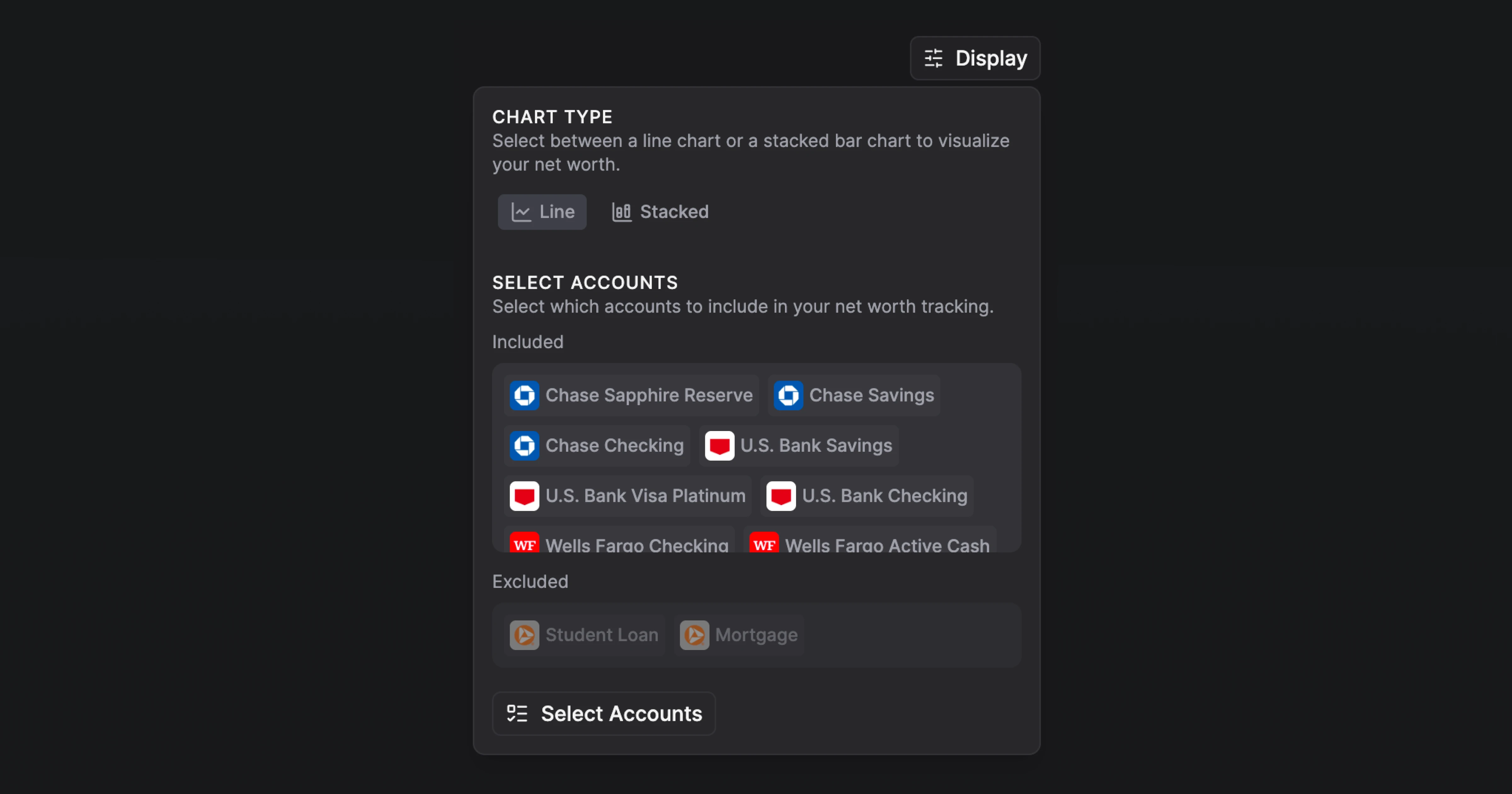

You can now choose which accounts to include in your net worth calculations. This gives you more control over how you track your financial position.

Maybe you want to exclude your mortgage from net worth tracking to focus on liquid assets. Or perhaps you have a business account that you’d rather keep separate from your personal net worth. Some people exclude investment accounts they’re not actively managing, or joint accounts they share with family members.

Whatever your situation, you can customize which accounts count toward your net worth. This makes your net worth number more meaningful to you and helps you track the financial metrics that actually matter for your goals.