Balance is an AI-powered personal finance app built to show your entire financial life in one place. In 2025, the focus was to make money easier to understand, easier to explore, and easier to act on without cumbersome spreadsheets, manual repetitive tasks, or guesswork.

This year focused on modeling systems that organize your data, reveal patterns, and make everyday decisions easier. Here’s a look at what that made possible.

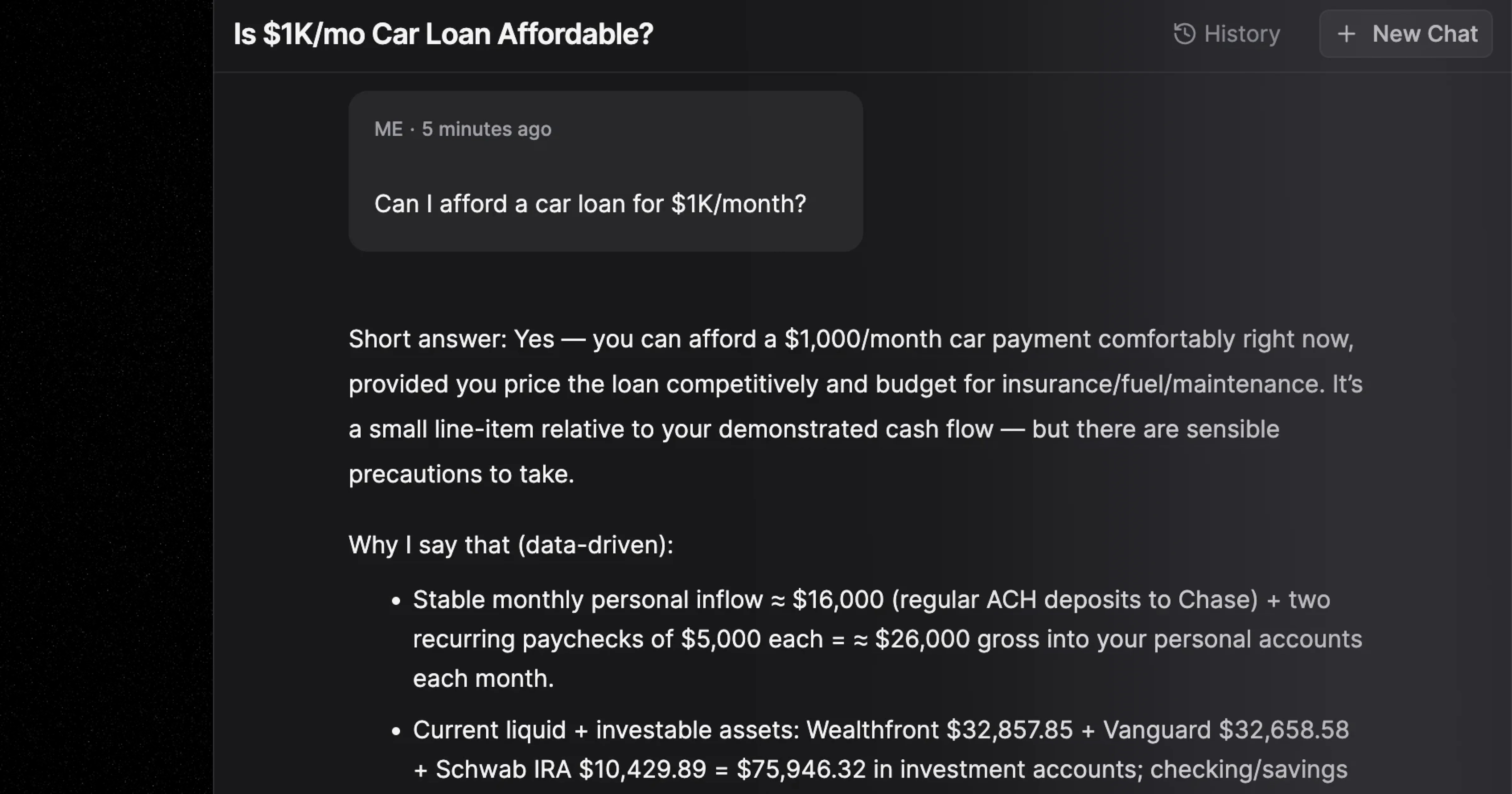

AI Became the Interface to Your Finances

AI is no longer just a feature inside Balance. It’s the foundation.

With faster, more capable models, AI now sits directly between you and your financial data, making it possible to explore your money in natural language and get immediate, meaningful answers.

Get personal with AI chat

With AI chat, you can ask questions like:

- “What were my largest transactions over $500?”

- “Which expenses from my New York trip were business-related?”

- “Do I have the financial runway to quit my job in the next 3 months?”

Balance understands the intent, identifies the relevant data, and returns clear results. This turns your financial data into something you can interact with, not just review.

Smarter categorization, less noise

Transaction categorization improved significantly this year. Instead of categorizing unclear charges into the infamous “Other” category, Balance uses multiple signals to categorize transactions more accurately and consistently.

The result is cleaner dashboards, more accurate metrics, and a financial picture that reflects reality.

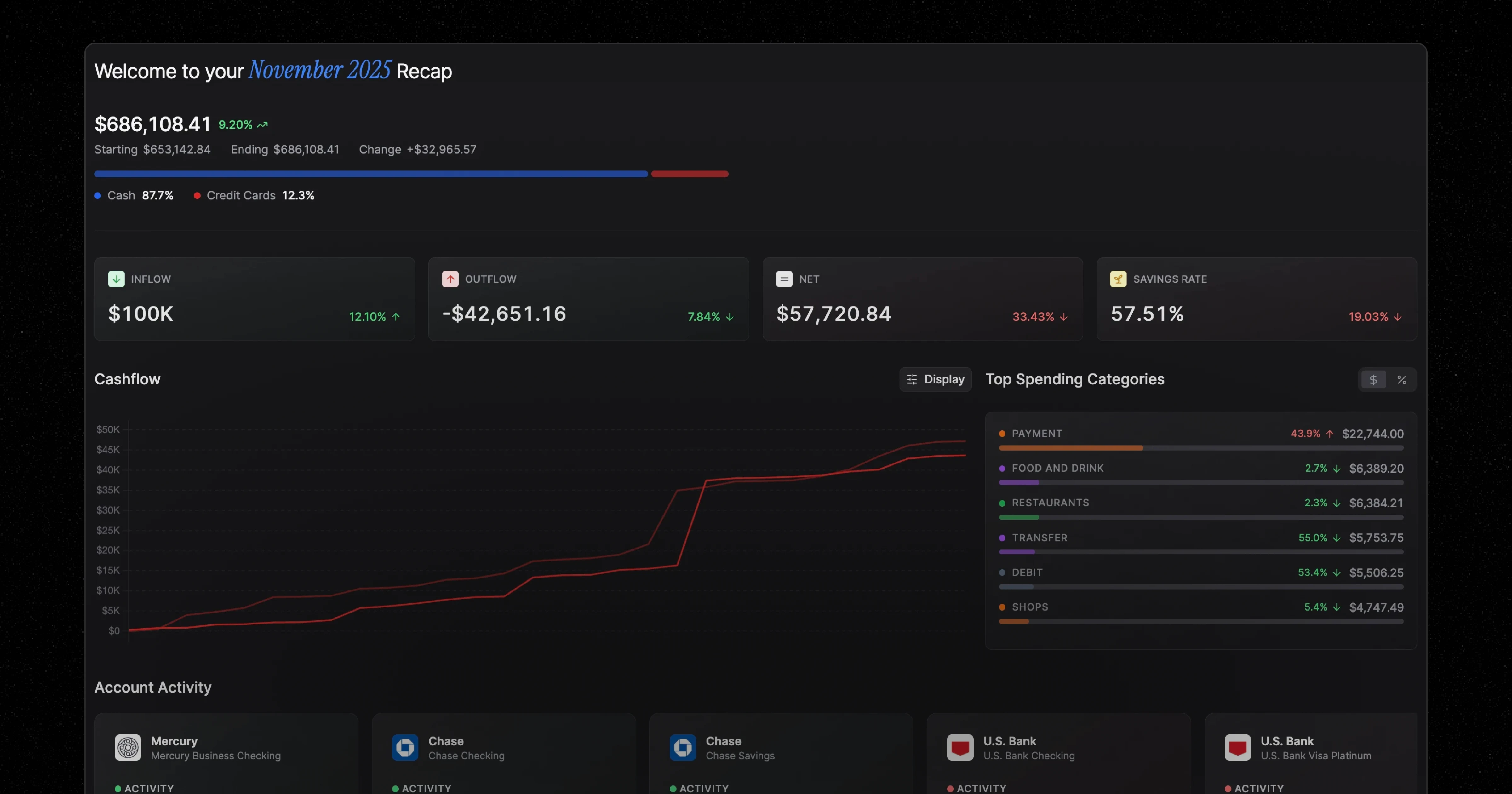

Financial Progress with Recaps

One of the most meaningful additions this year was Recaps, a monthly summary designed to show progress.

Each recap brings together:

- Net worth changes

- Income and spending

- Category breakdowns

- Transfers and payments

- Account activity

All in one place.

This gives you a 30,000-foot view of your finances while still allowing you to drill into details when something stands out. Over time, Recaps create a clear financial narrative you can actually follow month to month.

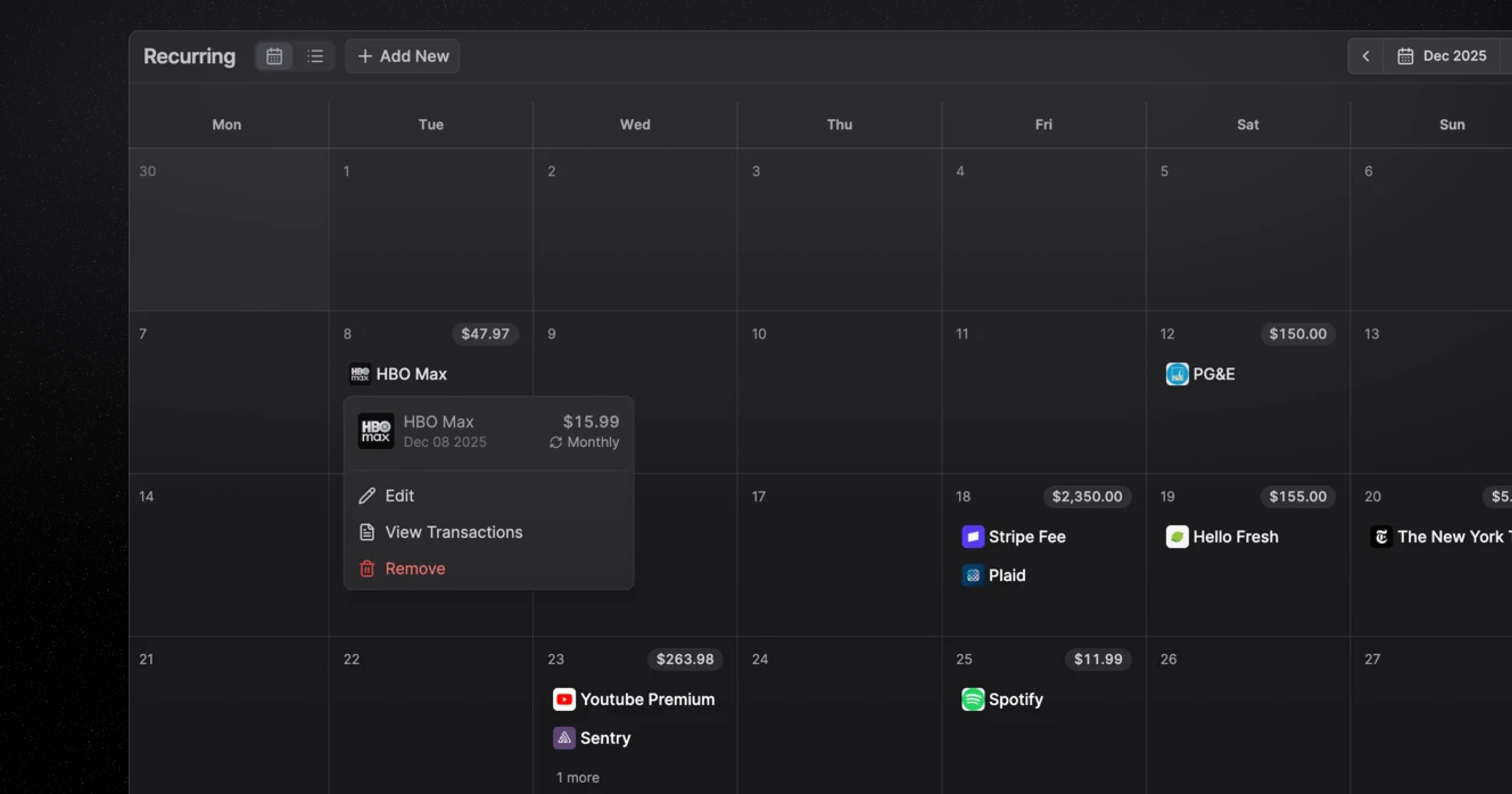

Foundations for Forecasting with Recurring Charges

Recurring spending shapes long-term financial health. Balance can now identify and track recurring charges automatically.

Using AI, the system:

- Detects monthly and annual recurring charges from your transaction history

- Identifies new recurring charges as they appear

- Automatically associates transactions to a recurring charge

- Displays recurring charges in calendar and list views for easier planning

This makes spending more predictable and gives you time to act. Cancel subscriptions, adjust budgets, or plan ahead instead of reacting after the fact.

There’s a lot more that shipped this year, feel free to explore the changelog.

Balance is built for people who want clarity without complexity and insight without constant effort. Some great things are already lined up for 2026. Stay tuned. But until then, happy holidays!