Beautiful personal finance app that you'll enjoy using

One place for all your finances. See your complete financial picture and make confident decisions about your money.

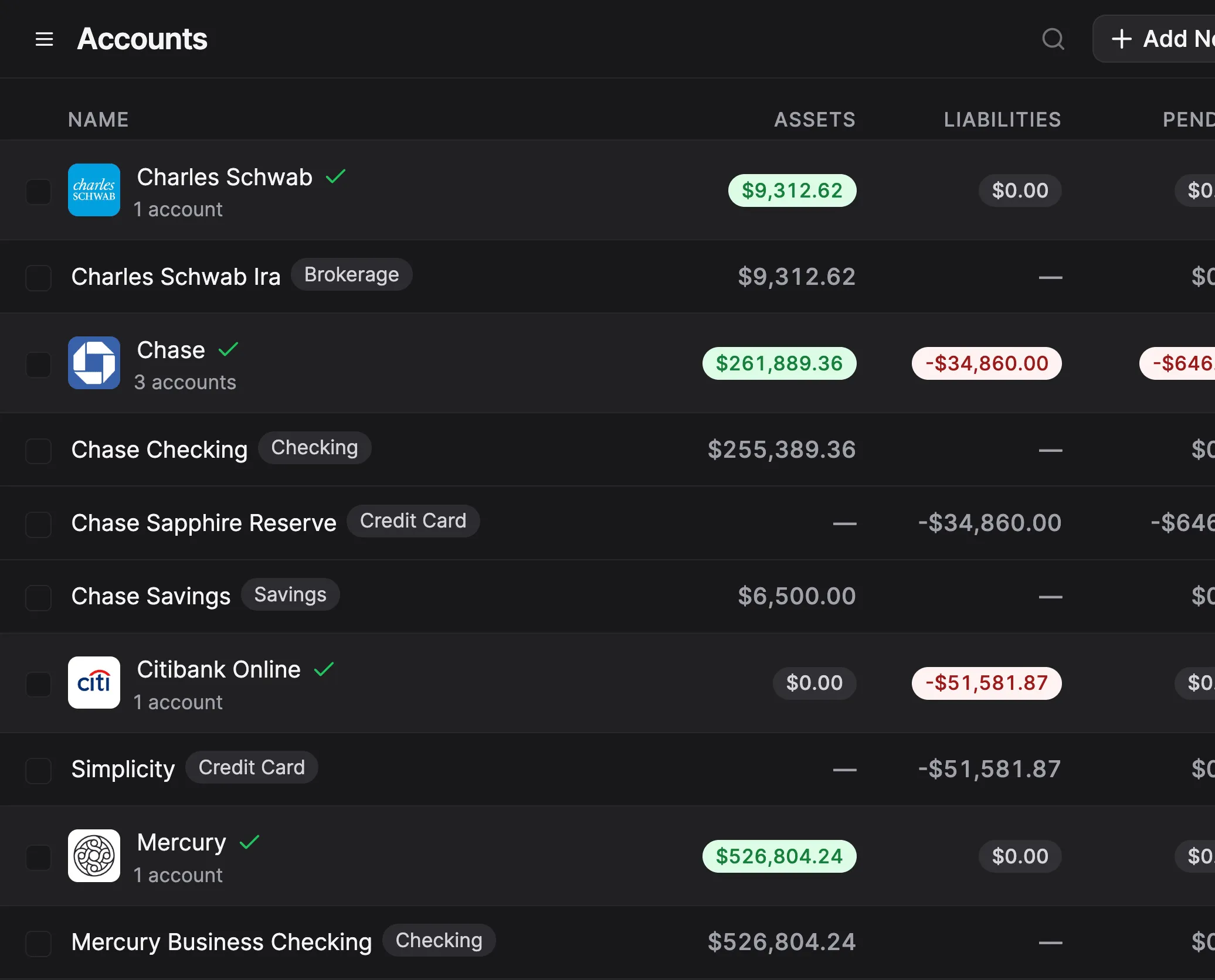

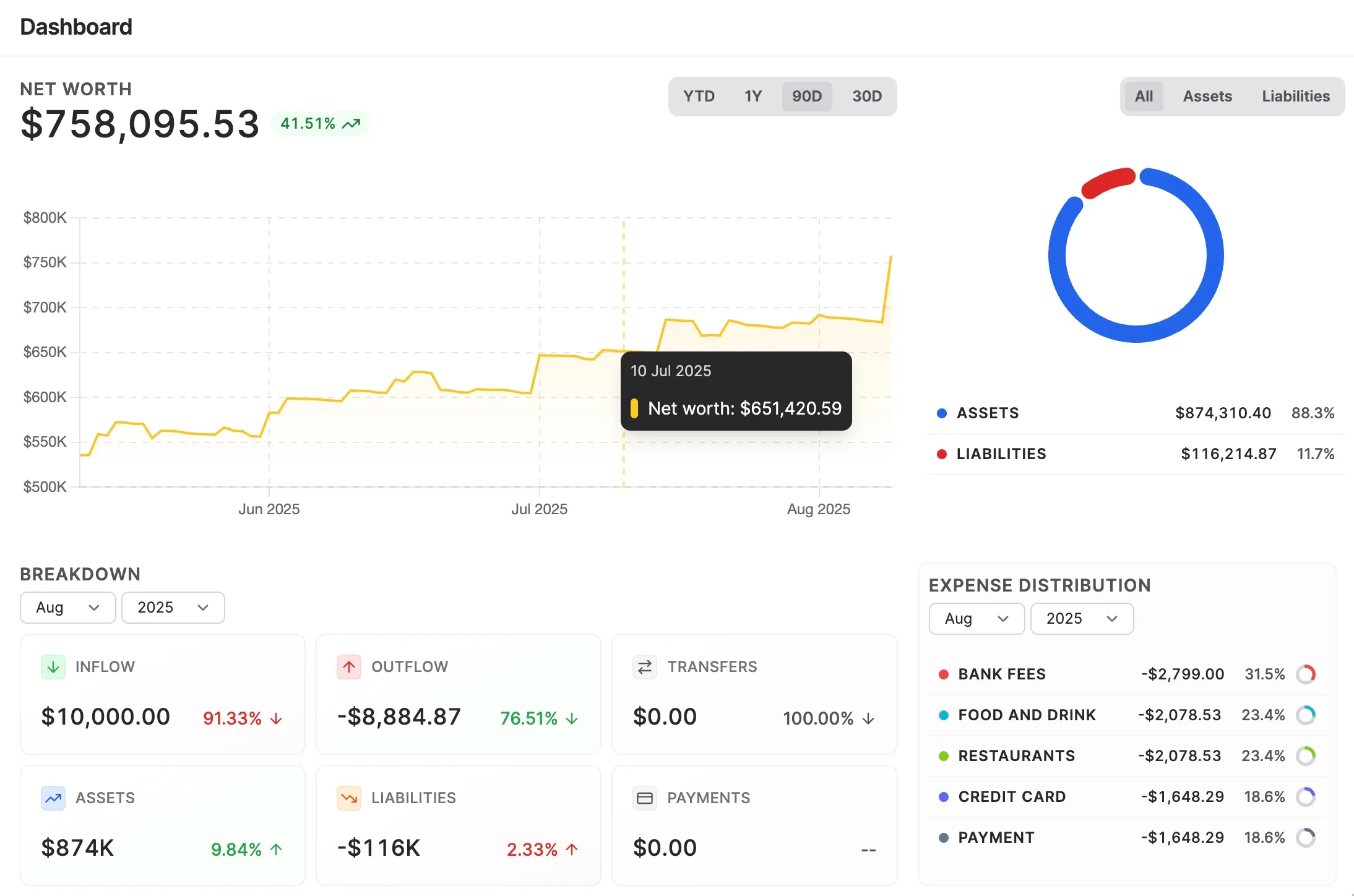

All your financial data in one place

Connect accounts, track transactions, monitor investments—all in one elegant interface. Get the complete picture of your financial health at a glance.

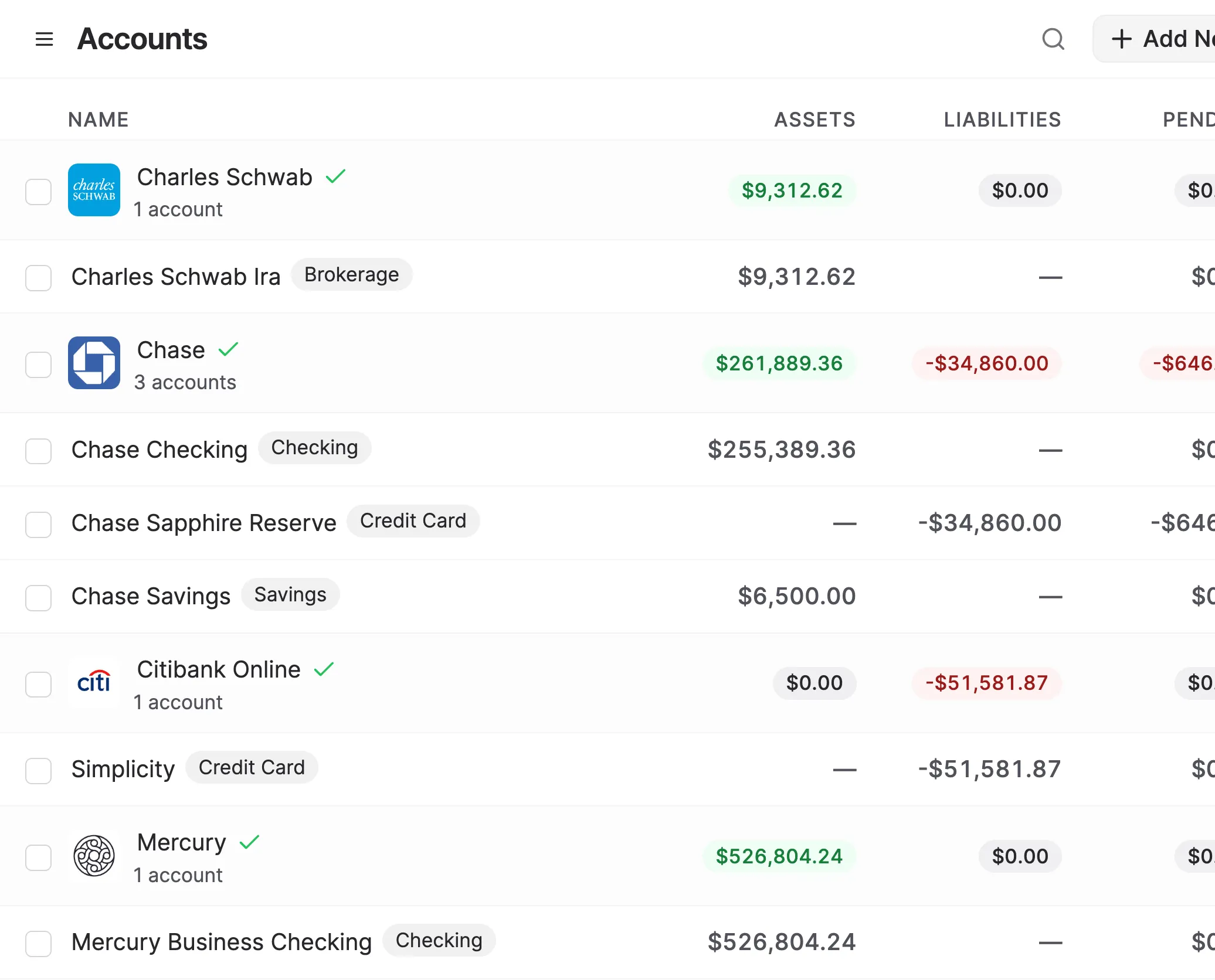

Accounts

Securely connect to over 12,000 financial institutions. View everything in one unified dashboard. Monitor all your accounts without switching between different apps.

Learn more

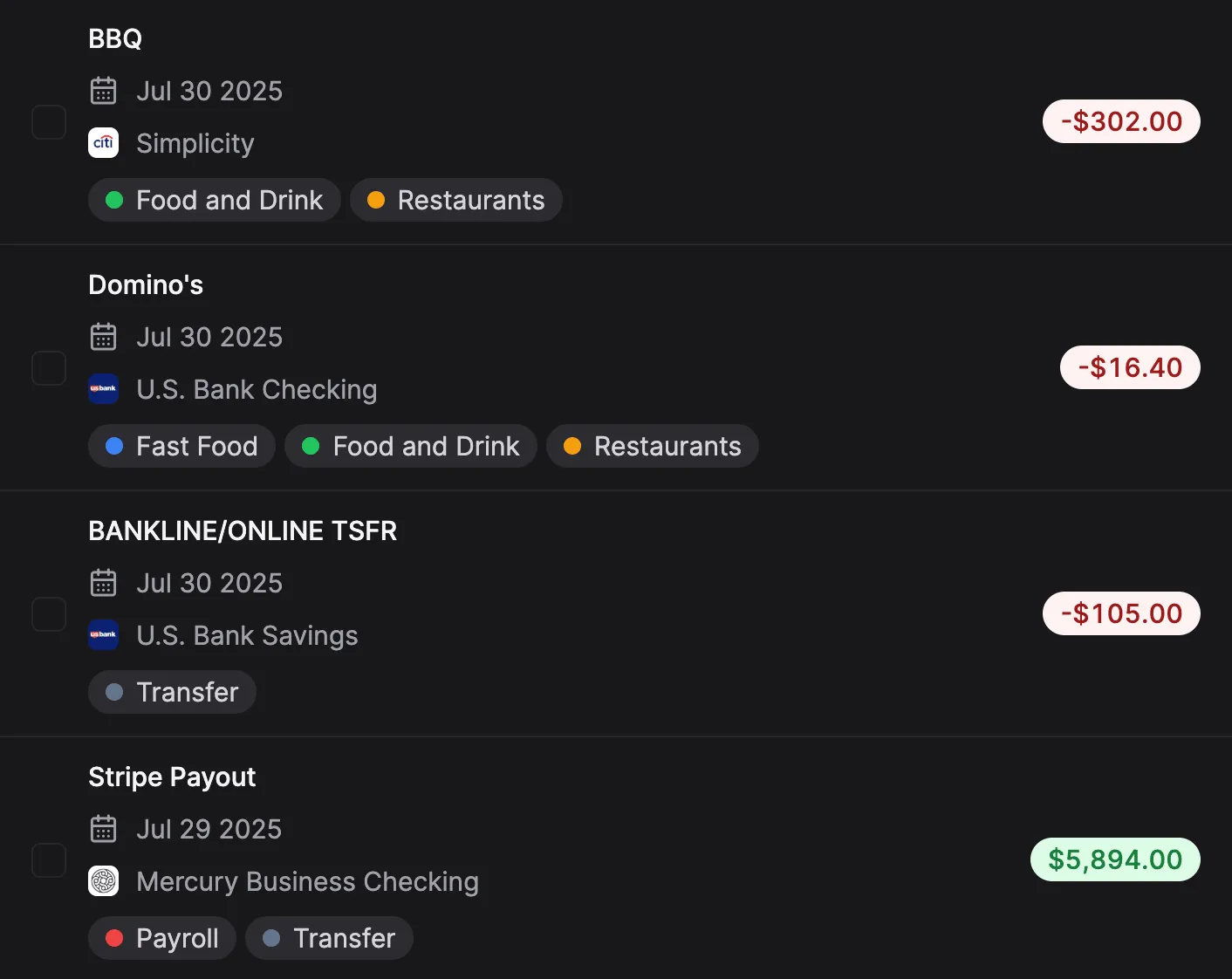

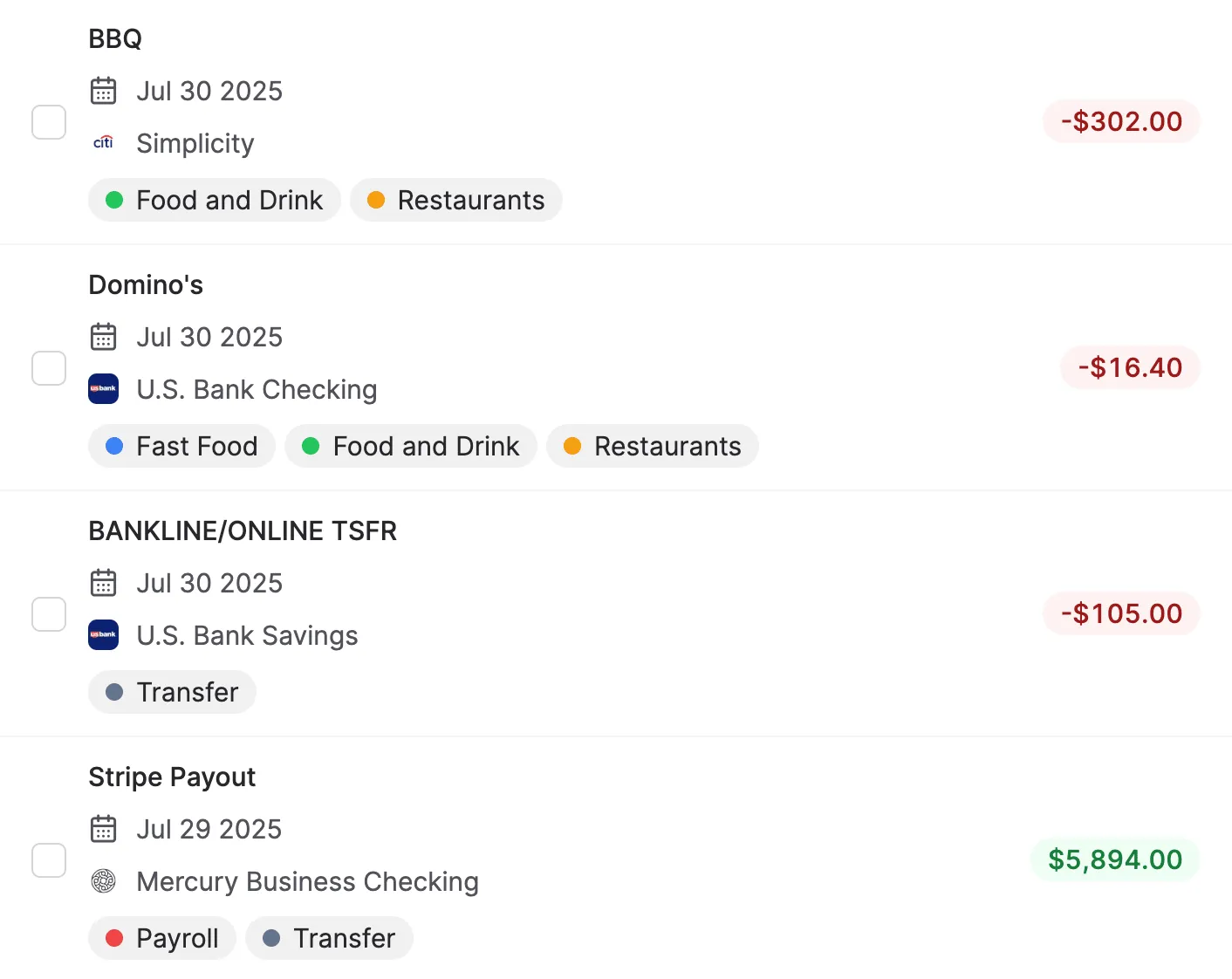

Transactions

Transactions automatically categorized and searchable using plain English. Query your spending patterns and get insights from your historical spending.

Learn more

Investments

Track your investment portfolio with real-time market data and performance analytics. Compare against benchmarks and analyze trends to make informed investment decisions.

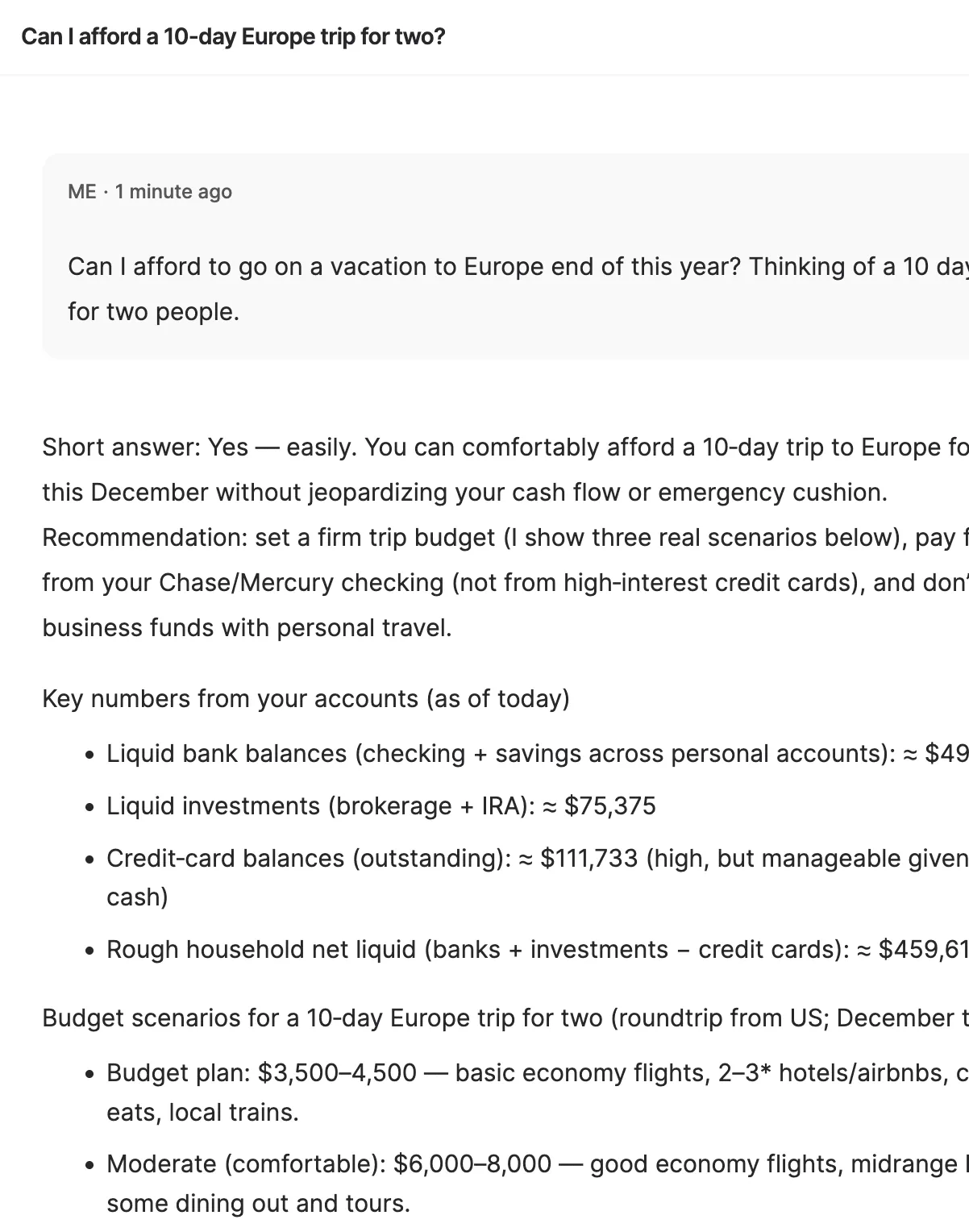

AI-powered financial advisor

Get answers about your money with Balance AI. Ask questions, understand patterns, explore possibilities. Get deep and personal about your money.

-

Affordability Analysis

Turn financial goals and big purchases into actionable plans with realistic timelines and multiple pathways to make them achievable.

-

Spending Optimization

Uncover spending patterns, eliminate subscription creep, and identify hidden opportunities to improve efficiency and maximize your budget.

-

Decision Modeling

Evaluate options with powerful scenario planning to make confident financial choices at every stage.

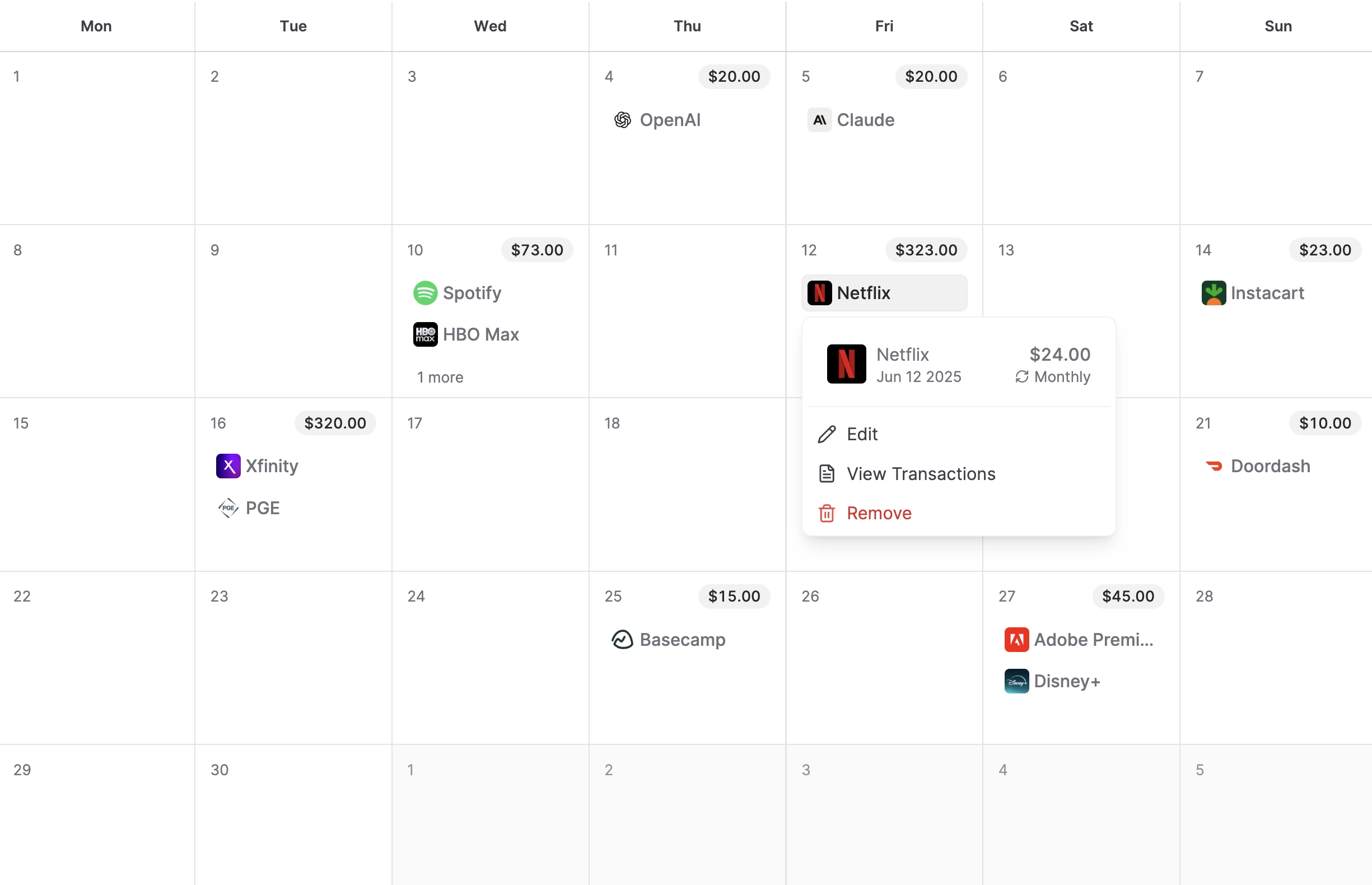

Never get caught off guard

Keep tabs on subscriptions, bills, and other recurring expenses. Balance automatically detects recurring charges using AI, so you can see what's coming, plan ahead, and never be surprised by another charge again.

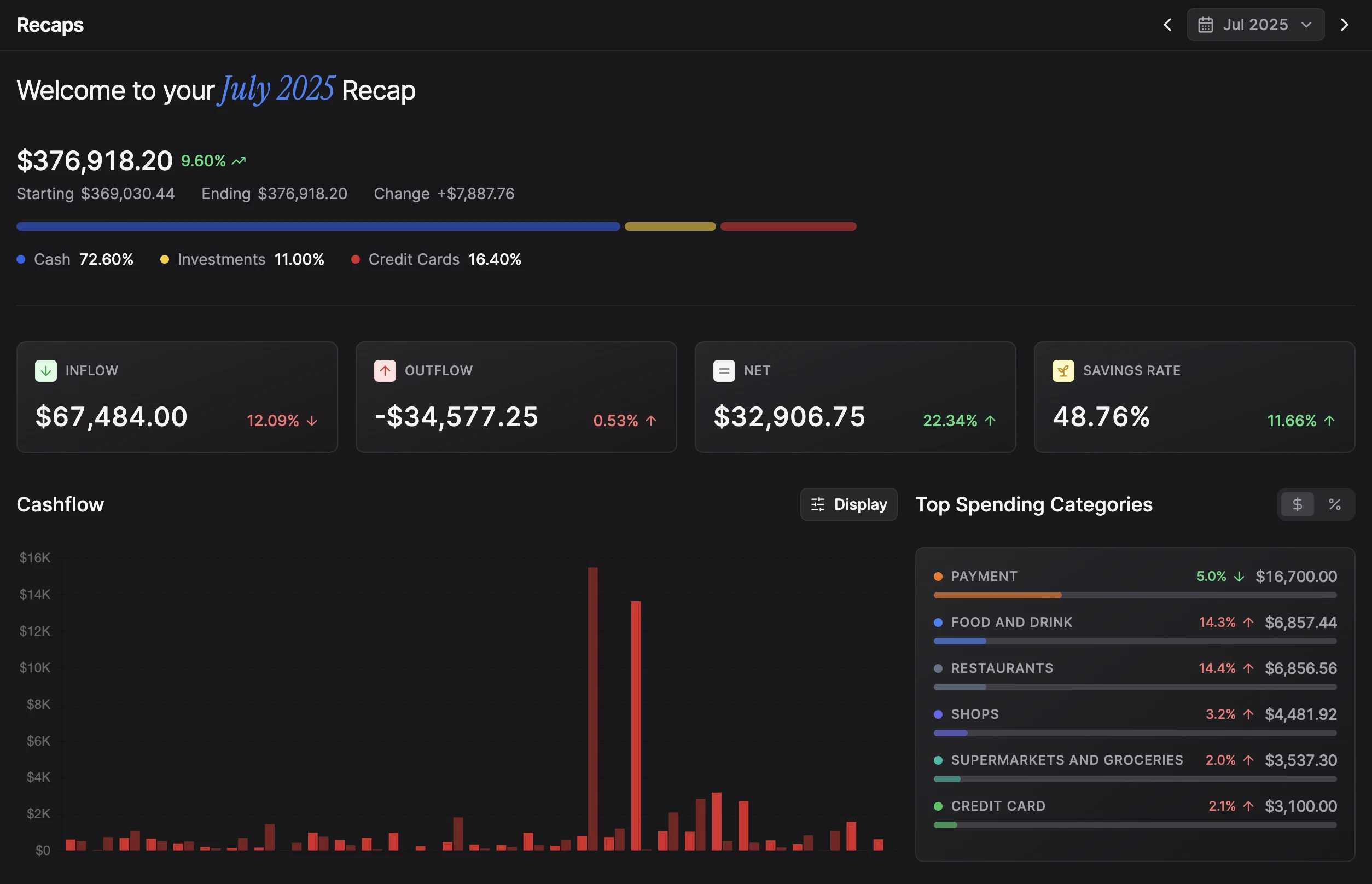

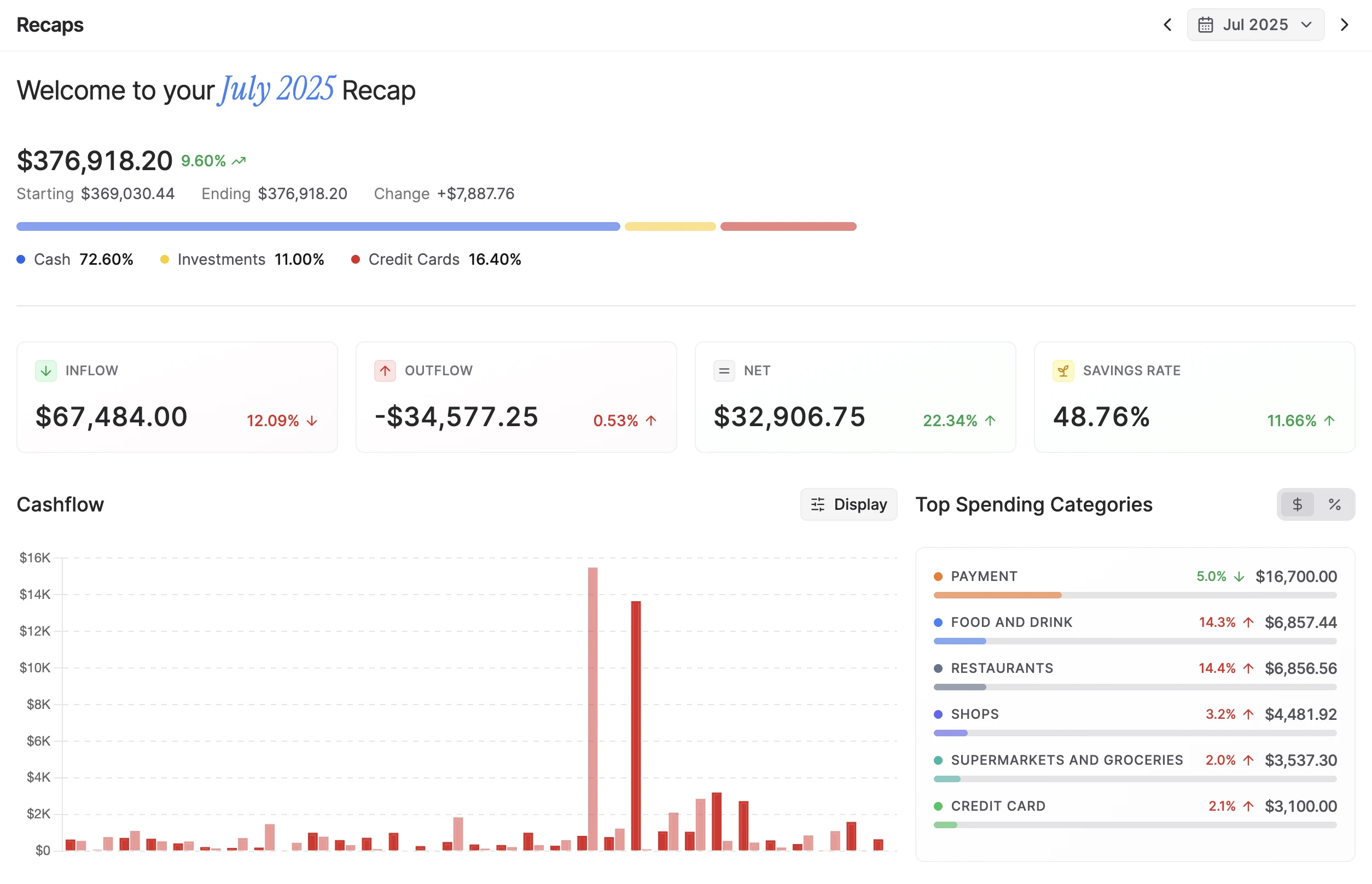

Look back with Recaps

Zoom out of the daily to see the bigger picture. Recaps show you a clear financial view of your month. Track net worth changes, see cash flow trends, understand money movements across all your accounts, and more.

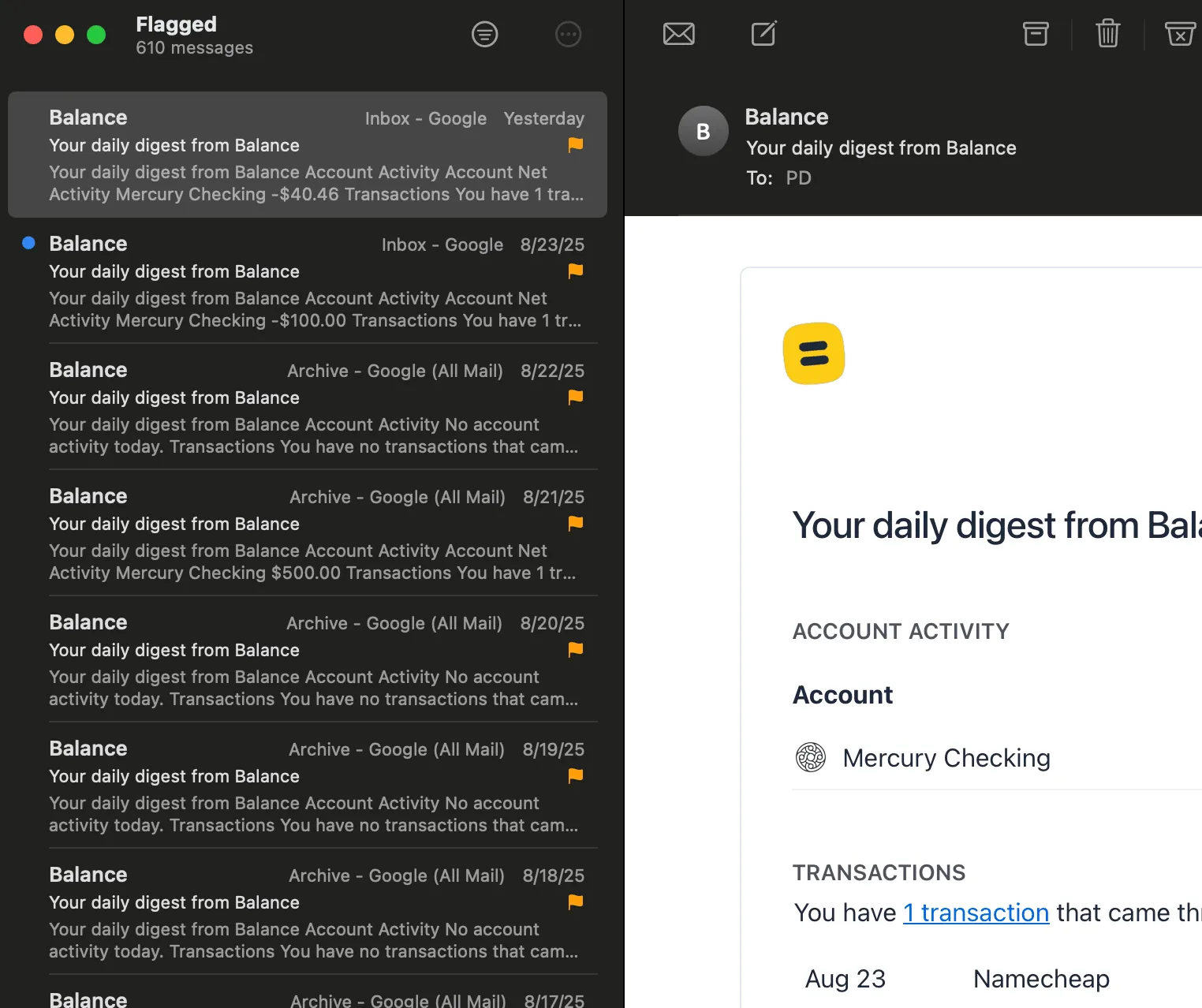

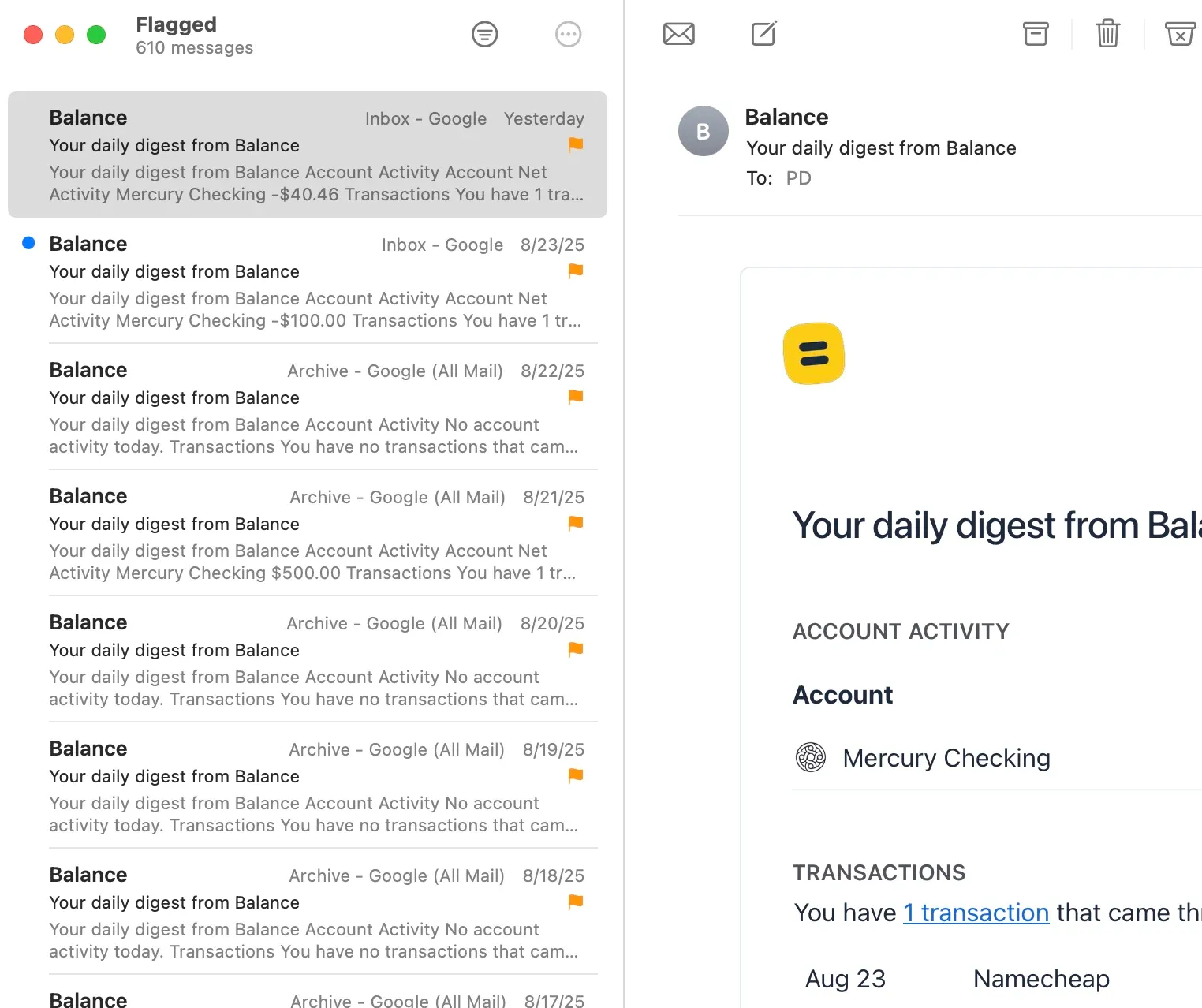

Stay informed, not overwhelmed

Get the right information at the right time. Smart notifications and insights that help you make better financial decisions.

Daily Digest

Receive an email every evening with a summary of your transactions and account activities.

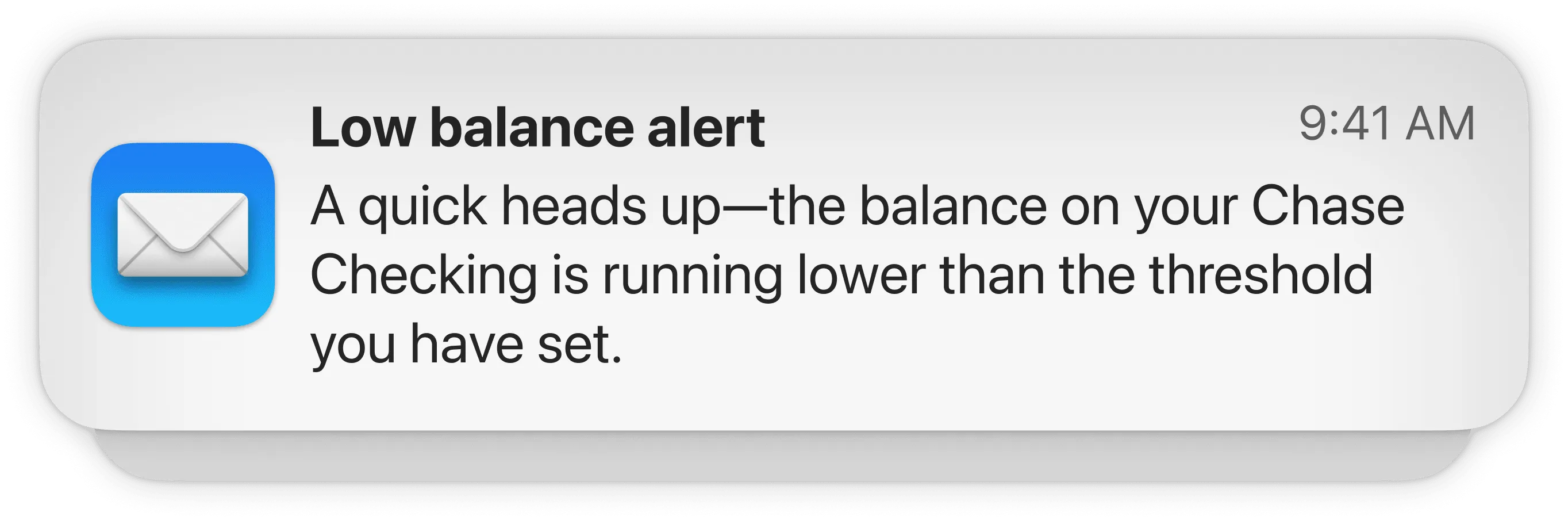

Low Balance Alerts

Receive alerts when your account balance falls below a certain amount. Avoid surprise charges or overdraft fees.

Track Categories

Track categories on your dashboard. Actively analyze your spending habits, identify areas where you're going over budget, and make better financial decisions.

-

Restaurants

-$1,123.62

22.26% -

Groceries

-$173.02

50.76% -

Subscriptions

-$167.02

0.76% -

Gas

-$563.92

32.76% -

Utilities

-$667.34

21.76% -

Entertainment

-$234.56

15.43%

Secure by default

Your finances are private. That's why Balance is designed to keep personal finance truly personal.

Data Encryption

Sensitive data is encrypted using industry-standard protocols.

Secure Authentication

Strong password requirements and breach detection protect your account.

Privacy Protection

Your data is confidential and never sold to third-party services or vendors.